0xSifu Shorts CRV to Challenge Curve Finance Founder

The crypto community is buzzing once again with the latest showdown between Curve Finance founder Michael Egorov and 0xSifu, a prominent figure known for stirring drama in DeFi circles.

14/ * After my yesterday's tweet, Mich wrote in the tg group that he came to know that "someone" is using CRV from the Silo for shorting.

— DeFi Made Here (@DeFi_Made_Here) January 8, 2024

He increased utilization to make it very expensive and Sifu repaid a portion of the $CRV. https://t.co/YzuE8Pfg6i

Specifically, Curve Finance founder Michael Egorov revealed that "someone" has been borrowing CRV from Silo Finance and shorting the token.

On-chain data identifies the account in question as "sifu.eth." Quickly escalating the Utilization ratio (total borrowed assets / total deposited assets) with CRV, 0xSifu was forced to swiftly unwind their CRV borrowings due to exorbitant borrowing costs.

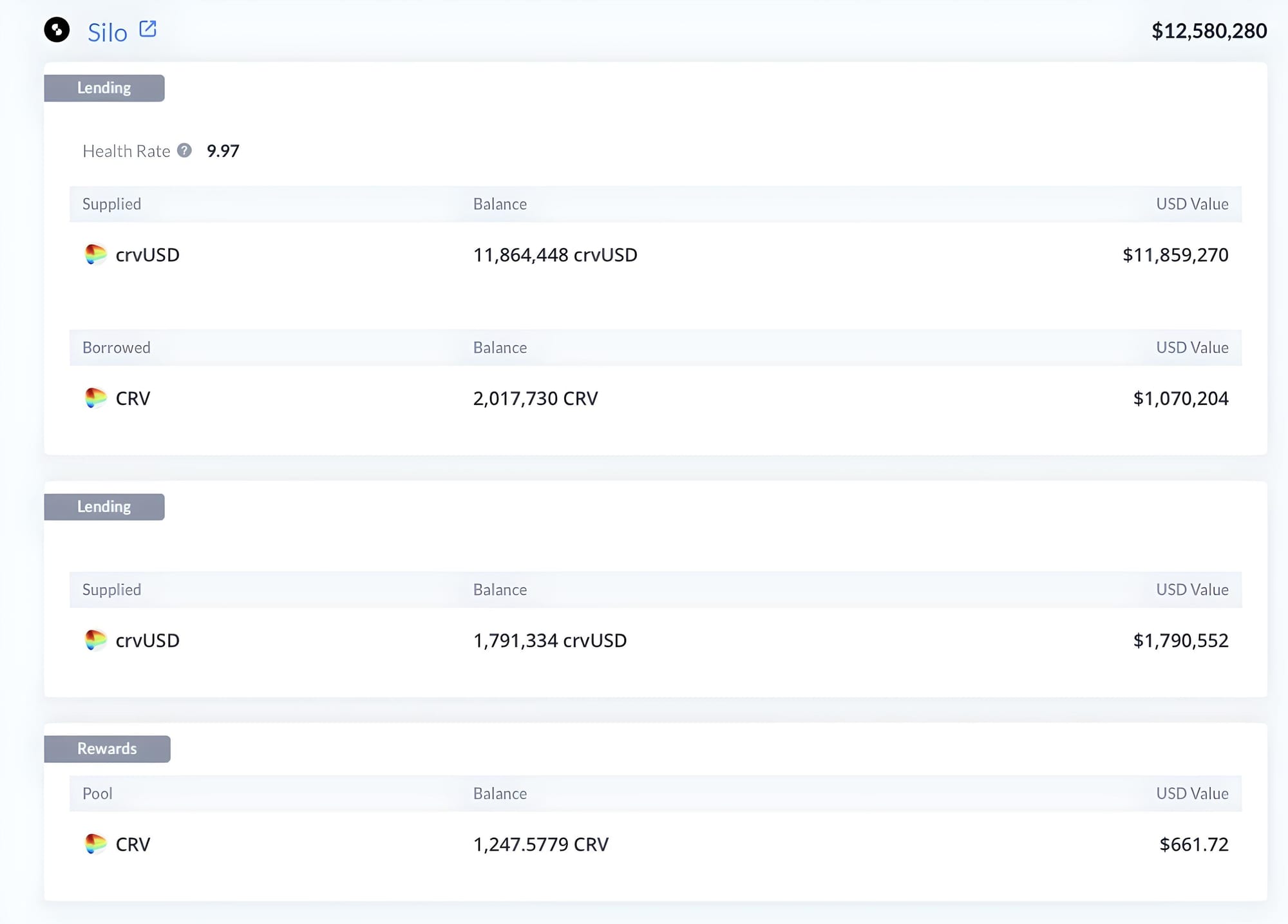

In retaliation, 0xSifu countered by depositing crvUSD via Silo, capitalizing on the high yield of this stablecoin and threatening to withdraw crvUSD to impose higher borrowing costs on Michael Egorov.

At the time of writing, 0xSifu has collateralized approximately $12 million in crvUSD stablecoin and borrowed around $1 million worth of CRV.

These actions by 0xSifu are not without basis, particularly following a series of dramas involving CRV collateralization and large stablecoin borrowings by the Curve Finance founder. During that time, his borrowing position was so significant that "there wasn't enough liquidity to liquidate" if the price of CRV plummeted.

A series of over-the-counter (OTC) deals were executed to help reduce leverage, with Egorov selling CRV tokens at prices below market value to investment funds in exchange for liquidity amounting to $92.6 million USDT.

10/ So Mich borrowed against $CRV again.

— DeFi Made Here (@DeFi_Made_Here) January 8, 2024

This time $75M which are distributed among

Silo: $46.5M (From his and assosiated wallets)

Fraxlend: $15.1M

Others: $13.4M pic.twitter.com/h5ayv6jzzv

However, as an ingrained habit, Michael Egorov swiftly transferred his borrowings to another platform, Silo Finance, which is the battleground where 0xSifu is executing their short position.

Earlier in November 2023, 0xSifu and their short ETH position also became the focal point of the market. However, the outcome of this position was "far from optimistic" after Ethereum's strong upward momentum.

Currently, the community remains agitated about the outcome of this bout, especially regarding the unlock timing of CRV tokens in OTC transactions, a detail that remains ambiguously undisclosed.