68 Trading Plan (07/11 – 14/11/2022) – Have We Found Bitcoin's Bottom?

Let’s dive into 68 Trading’s analysis of potential trading opportunities in the crypto market for the upcoming week.

Recap of Last Week’s Trades

Hello everyone, Coin68 Trading had a successful week, accurately predicting Bitcoin’s early-week correction and capturing the Altcoin wave during the latter half of the trading week.

Additionally, we successfully hit our targets for SOL, ETH, and GAL as outlined in last week's plan:

SOL Plan:

- SOL hit our entry zone at $30.30.

- It then surged to $36-$38, resulting in over 20% profit.

1D chart of SOL/USDT on Binance Futures as of 06/11/2022

ETH Plan:

- The details of ETH’s performance can be seen in the following chart.

This Week’s Trading Plan

Bitcoin (BTC) Analysis

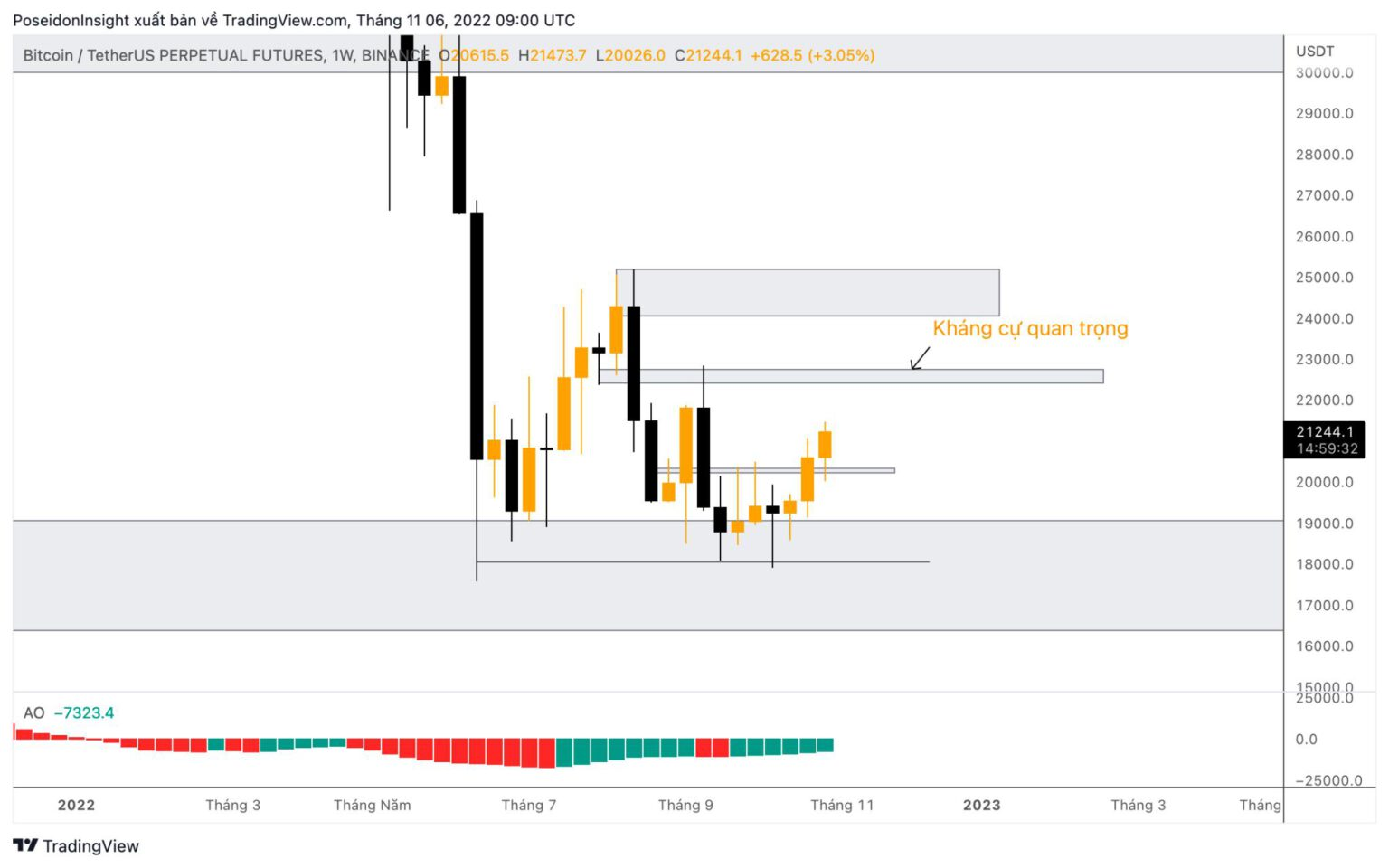

On the weekly timeframe, Bitcoin has formed three consecutive bullish candles, resembling the classic Japanese candlestick pattern "Three White Soldiers." With each successive candle opening and closing higher than the previous one, Bitcoin’s bullish momentum is becoming more evident. If Bitcoin closes this week at around $21,200, it will produce a weekly candle with a small upper wick, indicating weak selling pressure.

1W chart of BTC/USDT on Binance Futures as of 06/11/2022

With the larger timeframe showing a sideways trend (monthly chart) and clear bullish momentum, we can anticipate Bitcoin might advance to the next resistance zone around $22,700.

The daily chart is currently challenging, as Bitcoin is approaching a strong demand zone between $21,600 and $22,600. Therefore, I will limit long positions in BTC and altcoins correlated with BTC movements this week. There might be a shorting opportunity if the price enters this demand zone and exhibits additional divergence.

1D chart of BTC/USDT on Binance Futures as of 06/11/2022

The 4-hour chart has started showing initial divergence signals (using the AO indicator). I expect there might be one more pump to sweep liquidity in the demand zone before entering a short position.

Of course, if this short trade succeeds, it doesn’t necessarily mean a sharp decline for BTC, as we are still in a market sideways cycle.

4H chart of BTC/USDT on Binance Futures as of 06/11/2022

Personally, it’s too early to declare this as Bitcoin's bottom and anticipate a new cycle.

BTC Dominance (BTC.D)

As mentioned last week, BTC.D remains favorable for Altcoins as it continues to slightly dump. This week, BTC.D might see a short-term recovery, so consider limiting long positions in altcoins (except for those with strong signals).

Bitcoin Dominance chart as of 06/11/2022

Promising Altcoins

NEAR:

NEAR has broken out of its sideways range and is currently correcting. I hope NEAR will retrace to the $3.0 – $3.2 entry zone.

1D chart of NEAR/USDT on Binance Futures as of 06/11/2022

APT:

APT is experiencing a strong rebound. The scalping plan for APT is to wait for a short at the significant resistance zone around $8.5 – $8.6. This plan will activate only if the price rejects and forms strong bearish patterns. It will be invalid if the price breaks out above this zone.

1D chart of APT/USDT on Binance Futures as of 06/11/2022

LINK:

With Web 3.0 becoming a trend, many related tokens have surged, including Oracle systems like BAND and TRB. This week, I expect LINK to continue leading the Web 3.0 wave. My plan is to buy LINK at the support zone of $8 – $8.2

1D chart of LINK/USDT on Binance Futures as of 06/11/2022

Macro News

Last week, the FED announced a 0.75% rate hike. Another rate hike is expected in mid-December 2022. Additionally, FED Chair Jerome Powell acknowledged that rate hikes have not yet effectively reduced inflation, and further increases might be needed. Read Coin68’s detailed analysis of Powell's speech here.

Fortunately, this rate hike was anticipated, so the market response was not overly negative. However, if inflation remains unchecked in the long term, the FED might take more aggressive actions, leading to further market pain.

This week, there are several important news events:

- On November 9th at 22:30 (Vietnam time), the U.S. will release crude oil reserve data. As known, crude oil reserves impact oil prices and, consequently, inflation.

- On November 10th at 20:30, the U.S. will release October’s Consumer Price Index (CPI) and initial unemployment claims. CPI reflects inflation’s impact on living costs through a basket of goods, while initial unemployment claims indicate U.S. economic health and affect FED’s interest rate policy.

Conclusion

These are some trading plans from my perspective. I hope this provides additional insights for better trading decisions in the coming week. Don’t forget to join the 68 Trading group on Telegram for trading and discussions!