68 Trading Plan (12/05 – 12/11/2022): Stay Cautious with Macro News

In last week’s analysis, we anticipated a more active trading week, and indeed, we saw several take-profit actions. Let’s review the trades from the past week and plan our trading strategy for the upcoming week.

Review of Last Week's Trades

Last week, I set up a scalping plan for BTC, a spot buying plan for DOGE, and CELO. All three plans were successful.

BTC

Plan from Last Week:

Outcome:

BTC closely followed the initial plan, executing a fake dump that cleared liquidity around 16,000 USD before bouncing up by 1,000 USD.

DOGE

Last week, DOGE experienced a strong uptrend, so I planned to buy spot DOGE when the price retraced to support.

Plan from Last Week:

Outcome:

DOGE hit the entry point and surged. Traders who followed this plan achieved a profit of 15-17%.

CELO

Similarly, CELO had a strong uptrend last week, so I planned to buy when the price retraced to support.

Plan from Last Week:

Outcome:

Like DOGE, CELO also experienced a strong rise, gaining 15-20% after the buy plan was executed.

Join the 68 Trading community for more high-quality trade setups!

Trading Plan for This Week

Bitcoin (BTC) Analysis

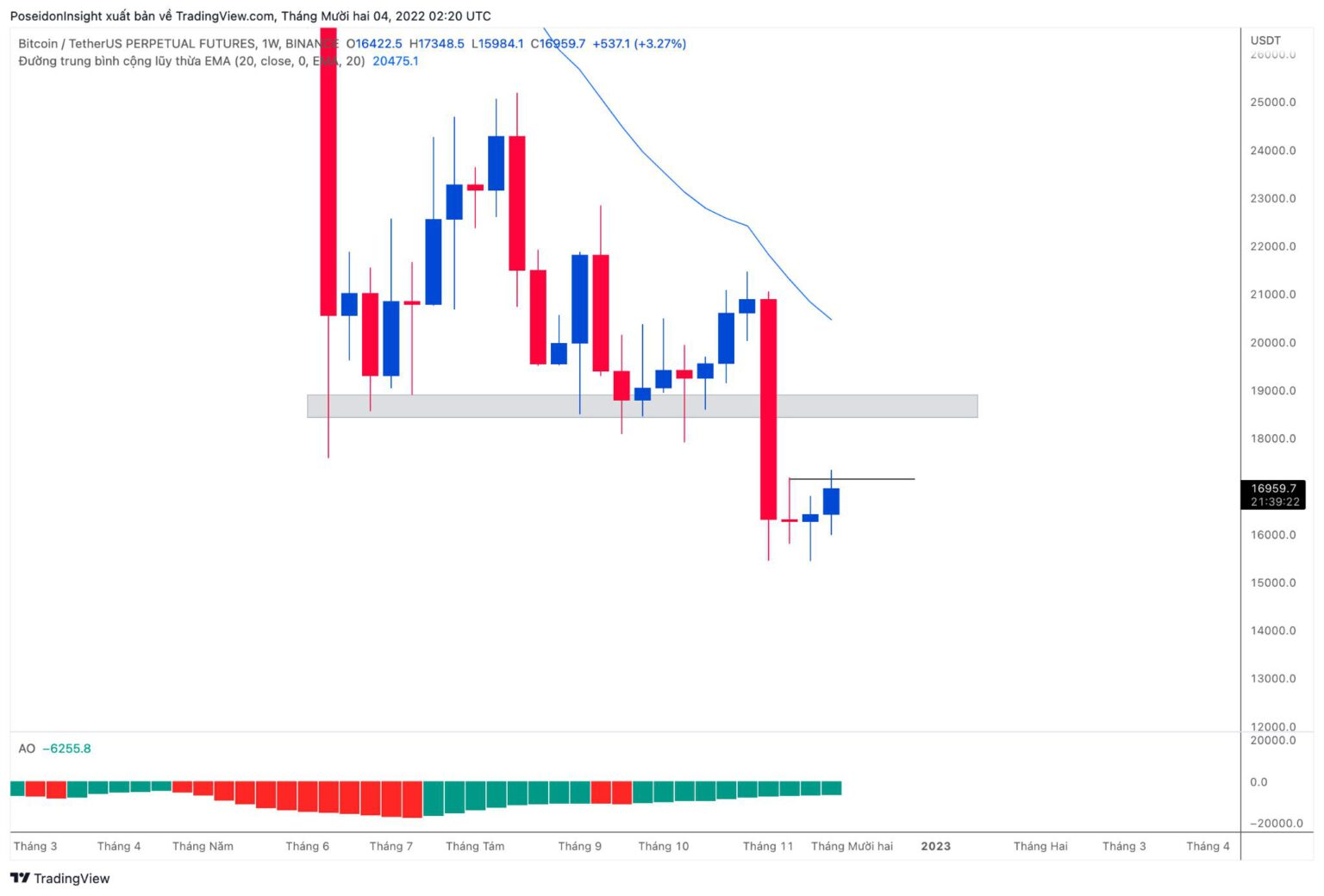

Weekly Chart (BTC/USDT on Binance Futures) as of 12/04/2022

This week, BTC has bounced after consistently forming a bottom at 15,400 USD. However, the weekly candle still closes below 17,100 USD. While the candle shows buying pressure, it is not significant (small body, total length equals that of the previous week, with balanced wicks). If the weekly candle closes below 17,100 USD, BTC remains within the sideways range of 15,400 – 17,100 USD.

Daily Chart (BTC/USDT on Binance Futures) as of 12/04/2022

On the daily chart, a bullish pattern has formed with two consecutive green candles. However, the price is still struggling to break the resistance at 17,100 USD. A good buying zone is at 16,200 USD (highlighted in gray).

For those looking to scalp, I suggest the following 4-hour plan:

4-Hour Chart (BTC/USDT on Binance Futures) as of 12/04/2022

Wait for a breakout above the 17,100 USD resistance, then long and take profit at 17,700 – 17,900 USD. The price is expected to clear liquidity at the 17,900 – 18,000 USD resistance zone. You can short (high-risk) when the price reaches this zone or wait for a structural breakdown before entering a short to 16,200 USD.

Weekly Trading Strategy:

- Long when price breaks out and successfully retests 17,100 USD.

- Short when price reaches 17,900 – 18,100 USD or wait for a return to this area and a structural breakdown.

- Short-term long at 16,200 USD.

BTC Dominance (BTC.D)

For BTC.D, I maintain the previous view, expecting a bounce at this support level. An increase in BTC.D could coincide with a Bitcoin dump. We might see an altcoin season if BTC.D creates a fake breakout and dumps back down.

Bitcoin Dominance Chart as of 12/04/2022

Altcoin Plans

AVAX

AVAX is climbing well, adhering to the trendline + EMA 20. I expect the price to retrace to around 13.27 USD for a long entry, with a stop loss at 12.826 USD. If the price continues to rise, I will look to short at the strong supply zone of 14.8 USD.

4-Hour Chart (AVAX/USDT on Binance Futures) as of 12/04/2022

OP

Last week, OP experienced a solid bull run. This week, I will wait for the price to retrace to the previous support zone (0.97) for a long entry.

4-Hour Chart (OP/USDT on Binance Futures) as of 12/04/2022

Macro News

This week, the market may be more volatile with several notable macroeconomic events:

- December 5, 2022: At 22:00 (Vietnam time), ISM will release the November Non-Manufacturing PMI. Higher-than-expected data is considered positive for USD, and vice versa.

- December 7, 2022: At 00:00 (Vietnam time), the EIA (U.S. Energy Information Administration) will release its Short-Term Energy Outlook. At 22:30 the same day, the U.S. will also release Crude Oil Inventories data.

- December 8, 2022: The U.S. will announce Initial Jobless Claims. Higher-than-expected data will be considered negative for USD, and vice versa.

- December 9, 2022: At 20:30, the U.S. will release the Producer Price Index (PPI), an important indicator for assessing inflation.

Be cautious this week as numerous news events might lead to sharp price movements. Additionally, analyze these developments to better anticipate the next Fed rate hike on December 13, 2022.

Conclusion

Above are some trading plans from my perspective. I hope they provide valuable insights for your trading next week. Don't forget to join the 68 Trading group on Telegram to trade and discuss with us!