$880 Million Crypto Liquidated as Bitcoin Returns to ATH - ETF BTC Volume Sets Record $10 Billion

The cryptocurrency market experienced 12 hours of intense volatility after Bitcoin surged back to $69,000 for the first time in 2 years.

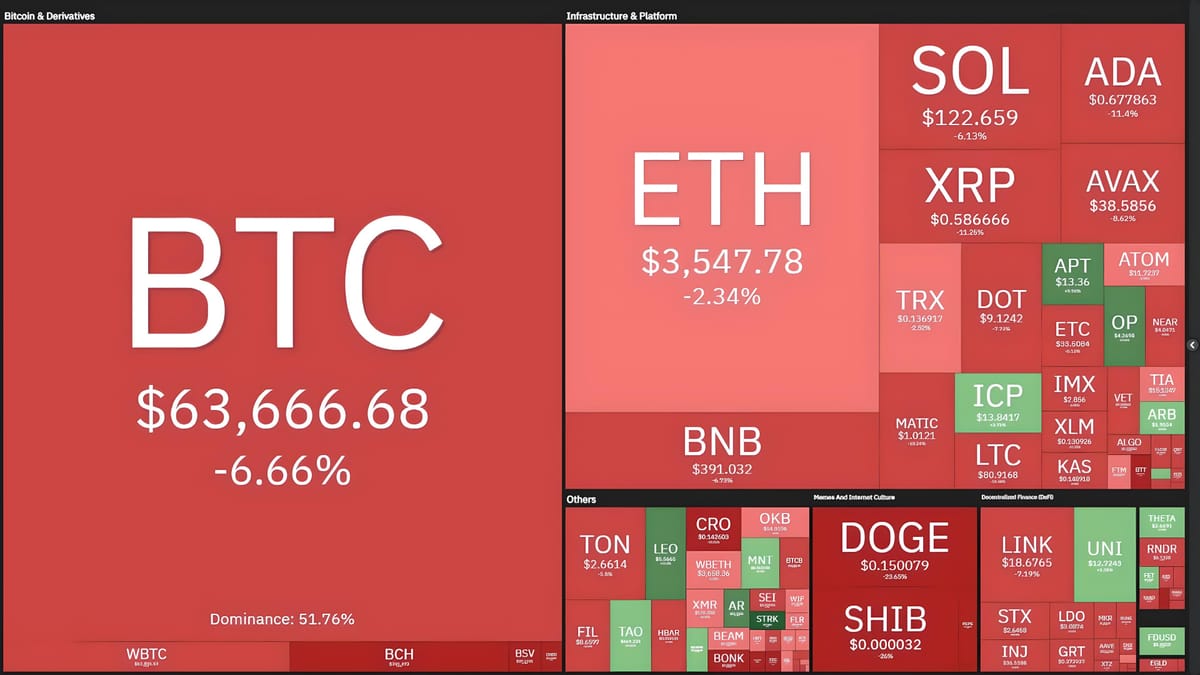

Volatility of top cryptocurrency coins at 09:30 AM on March 6, 2024

As reported by Coin68, Bitcoin (BTC) reached its ATH of $69,000 on the evening of March 5th for the first time since November 2021. However, profit-taking waves immediately pushed BTC down by over $5,500 in just one hour.

CryptoQuant shows that 1,000 Bitcoins (worth approximately $69 million) were transferred to Coinbase after the bitcoin reached a peak of $69,000 before falling to $62,000. These addresses are more than a decade old and are associated with Bitcoin miners, potentially triggering…

— Wu Blockchain (@WuBlockchain) March 6, 2024

According to CryptoQuant, shortly after hitting $69,000, a 10-year-old address holding 1,000 BTC, reportedly belonging to a miner, transferred funds to Coinbase. This move indicates that a portion of investors decided to take profits at the current peak.

By early morning on March 6th, selling pressure persisted, briefly dropping BTC to $59,000, a support level previously touched during the February 28th dump.

Chart: 1-hour BTC/USDT pair on Binance at 09:30 AM on March 6, 2024

The BTC/EUR pair on Coinbase even experienced a flash crash to €48,500, causing concern among European investors.

Euros wicked BTC all the way down to $48K EUR ($52K USD) on Coinbase. pic.twitter.com/NVbQk9UvjT

— K A L E O (@CryptoKaleo) March 5, 2024

The dump occurred against the backdrop of Bitcoin ETFs - the primary driving force behind BTC for the past six months - recording another successful trading day with volumes exceeding $10 billion.

MILESTONE: the ten Bitcoin ETFs did $10b in volume today, smashing prev record set last Wed.. Volatility and volume go hand in hand with ETFs so not totally surprised. That said these are bananas numbers for ETfs under 2mo old. $IBIT, $FBTC, $BITB, $ARKB all w record days. pic.twitter.com/rIdbhoYifV

— Eric Balchunas (@EricBalchunas) March 5, 2024

Other altcoins are also currently undergoing corrections of 5-9% from their prices 24 hours ago, while some memecoins have seen double-digit declines.

Chart: 1-hour ETH/USDT pair on Binance at 09:35 AM on March 6, 2024

The rapid market reversal has significantly impacted investor positions. Derivatives market statistics show that over the past 12 hours, more than $880 million in derivative contracts were liquidated, with BTC accounting for a quarter of that amount. Long positions made up 84% of these liquidations.

Total value of liquidated derivative contracts across the market in the past 24 hours reached $1.15 billion, the highest since August 2023.

Liquidation data from the derivatives market, screenshot from CoinGlass at 09:35 AM on March 6, 2024