Aptos (APT) Price Stabilizes After Initial "Floodgate" Trading Day

After a highly eventful listing day, Aptos (APT) has temporarily stabilized within the $7 to $8 range.

APT Trading Day Summary

The most notable event in the past 24 hours was undoubtedly the listing and launch of Aptos (APT), a blockchain project dubbed the “Solana Killer.”

Aptos garnered significant attention, having raised $350 million across two funding rounds in 2022, and received backing from major funds such as FTX Ventures, Binance Labs, a16z, Jump Crypto, and Multicoin Capital.

Following its announcement on October 18, APT was listed on major exchanges including Binance, FTX, and Coinbase at 08:00 AM on October 19 (Vietnam time). Despite Aptos' delay in releasing tokenomics and conducting the APT airdrop, which affected initial liquidity, the token saw significant volatility upon listing.

At launch, APT spiked to $100 on Binance’s APT/USDT pair, while other pairs on Binance and other exchanges peaked at $16-$17 before gradually falling to a low of $6.70 as more users deposited airdropped tokens and sold.

5m Chart of APT/USDT on Binance as of 12:35 PM, 20/10/2022

Currently, APT is trading around $7.60, showing signs of stabilization.

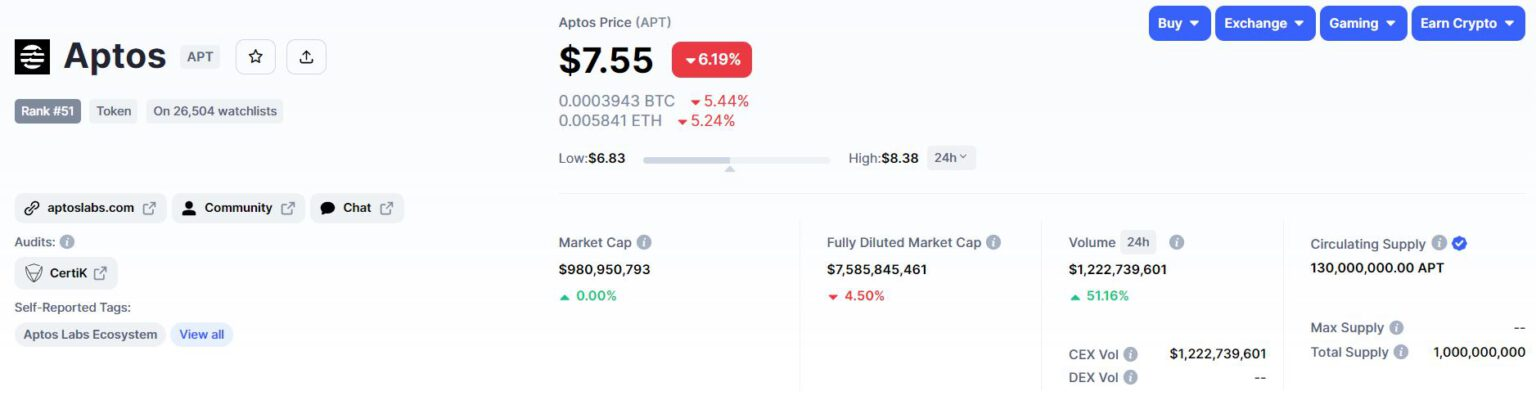

With this price, Aptos’ diluted market cap stands at nearly $7.6 billion, while its market cap is $980 million. The 24-hour trading volume of APT is over $1.2 billion.

Aptos (APT) Information Summary, CoinMarketCap Screenshot as of 12:35 PM, 20/10/2022

Reasons for APT Sell-Off

The strong sell-off following Aptos' listing can be attributed to several factors. First, investors were uneasy about the project’s rushed and patchy launch, including last-minute airdrop announcements. Investors had to scramble to list airdropped tokens, as the project only provided this information about 2 hours before the listing.

Additionally, despite Aptos claiming that 51% of the total APT supply would be allocated to the community, the actual distribution is under the project’s control. Furthermore, 80% of the total APT supply has been staked by the project and participating funds, with these staked rewards not subject to the same 4-year lock-up period as the investment funds.

Secondly, APT futures trading was supported by exchanges relatively quickly, just 1 hour after the spot listing. According to Wu Blockchain, Aptos had requested that exchanges delay futures listings for APT by 2 weeks. However, after Binance announced APTUSDT futures contracts at 09:00 AM on October 19 (Vietnam time), other exchanges quickly followed suit to avoid losing trading volume to competitors.

Exclusive: Aptos asked major exchanges not to list perpetual contracts within 2 weeks, but Binance announced that APTUSDT perpetual contracts will be listed on October 19th. Aptos is urgently persuading Binance to stop. https://t.co/4ADxe1xSS8

— Wu Blockchain (@WuBlockchain) October 18, 2022

Lastly, the ease of receiving airdrops—requiring only participation in Aptos’ testnet or minting NFTs—led to a massive influx of users registering accounts to farm airdrops. Wu Blockchain reported that over 28,000 addresses deposited 16.3 million APT on Binance yesterday, with 40% of these addresses involved in airdrop farming. Notably, 7 addresses deposited over 50,000 APT each.

Aptos' chaotic airdrop plan caused prices to plummet. X-explore research shows that Binance has accumulated 28,000 users who have deposited 16.3m APTs, and the Sybil address is close to 40%, exceeding 6.3m. There are 7 large Sybil addresses with more than 50,000 APT each. pic.twitter.com/PfHTqyfbXo

— Wu Blockchain (@WuBlockchain) October 20, 2022

Following the airdrop, it remains to be seen how Aptos will proceed to expand its ecosystem and develop further.

Nevertheless, the Aptos airdrop has revitalized interest in airdrops and retroactive rewards in the crypto space for the remainder of 2022, with potential upcoming projects such as Sui (SUI), Arbitrum (ARBI), zkSync (ZKS), StarkWare, LayerZero, Blur (BLUR), and Sudoswap (SUDO).