Aptos (APT) Reveals Tokenomics

After much speculation, the Aptos team has finally unveiled the tokenomics and detailed information about the upcoming APT coin, which is set to be listed on exchanges soon.

The most anticipated news on October 18, 2022, is undoubtedly the announcement from Aptos blockchain about its mainnet launch, the introduction of its first projects, and the issuance of the APT coin.

Despite major exchanges announcing support and listing of APT on October 19, the community expressed skepticism due to the lack of tokenomics details for APT, including its utility, allocation, and release schedule. This fundamental information is crucial for investors to make informed decisions. The absence of tokenomics details has led to significant criticism of Aptos.

By early afternoon on October 18, the project finally shared the tokenomics for APT.

1/ Creating a network for the people requires a tokenomics designed with the community and fairness at its center.

— Aptos (@Aptos) October 18, 2022

The overview of that tokenomics is available here: https://t.co/KeU7RXANkd

APT Allocation Ratio

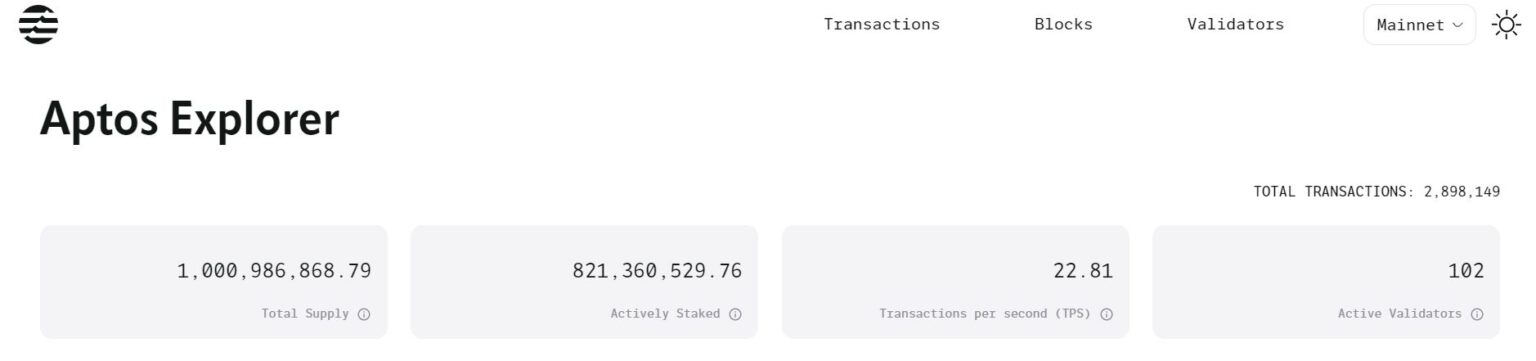

At the time of the mainnet launch on October 12, 2022, the circulating supply of APT was 1 billion coins, distributed as follows:

– Community: 510,217,359.767 APT (51.02%)

– Core Team: 190,000,000 APT (19%)

– Project Fund: 165,000,000 APT (16.5%)

– Investors: 134,782,640.233 APT (13.48%)

Of the amount allocated to the community, 410,217,359.76 APT will be managed by the Aptos Foundation, while the remaining 100 million will be managed by Aptos Labs. These funds will be used for ecosystem development activities over the next 10 years.

The APT allocated to Core Team and Investors will be locked for 1 year and released gradually over the following 4 years.

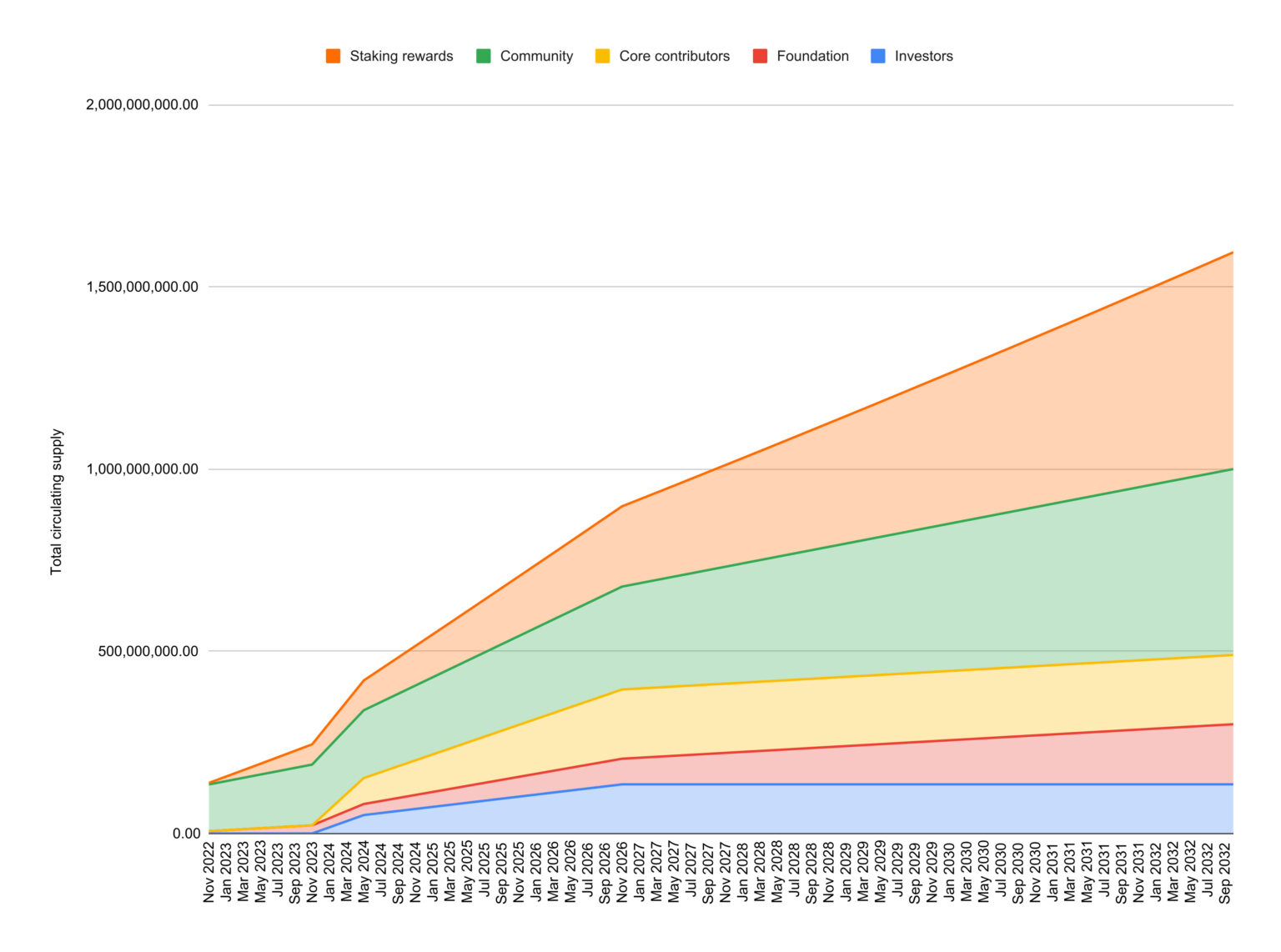

Aptos (APT) Supply Growth Forecast

Notably, staking rewards for these entities will not be locked. Currently, all 102 Aptos validators are project-affiliated and investment funds, with over 80% of the total APT supply locked in staking.

APT Utility

Aptos confirms earlier community findings that 82% of the current APT supply is engaged in staking. Staking is crucial for enabling network validators to verify transactions, in exchange for staking rewards.

The annual inflation rate from staking will be 7% per year, decreasing by 1.5% each year until it reaches 3.25%.

Transaction fees on the network, paid in APT, will be burned to create deflationary pressure.

Additionally, APT holders will have governance rights to vote on project parameter changes and other decisions, such as staking inflation rates and transaction fee burns.

Aptos has stated that more information about APT will be provided in the future.

Analysis

The mainnet launch of Aptos and the delay in providing complete information for the APT listing have painted a "chaotic picture" for what is considered one of the most significant days in the history of this blockchain.

With $350 million raised in major funding rounds in 2022, elevating Aptos' valuation to billions, the community has a right to question why a project backed by top investors such as FTX Ventures, Binance Labs, a16z, Multicoin Capital, Coinbase Ventures, and Jump Crypto is facing such preparation issues.

The tokenomics details also raise questions. Despite allocating half of the total APT supply to the "Community," Aptos has yet to conduct any airdrop or retroactive events. This allocation is managed by Aptos Labs and Aptos Foundation and is likely intended for distributing rewards or funding development projects.

The utility of APT aligns with standard features for a Proof-of-Stake blockchain coin, including transaction fees, staking, and governance, offering no significant innovations or potential.

Thus, a lingering question remains: On the morning of APT's exchange listing, what price will investors need to pay to acquire APT?