Aptos CEO Defends Fairness of APT Tokenomics Amidst Criticism

The CEO and CTO of the emerging blockchain project Aptos (APT) have defended the fairness of their tokenomics in response to recent criticisms.

Aptos CEO Mo Shaikh (left) and CTO Avery Ching (right)

The Controversial Aptos Airdrop

The Aptos (APT) airdrop has been a major catalyst for the recent surge in retroactive airdrops. Aptos, a layer-1 blockchain project with high expectations, not only positioned itself as a “Solana killer” but also raised $350 million in 2022 from major funds. The project inherited technology from Facebook's failed stablecoin project, Diem, and uses a new programming language called Move.

However, the launch did not go smoothly. After announcing the mainnet launch and token listing, Aptos revealed its tokenomics and distributed APT airdrops to users only at the last minute—something that should have been done before listing. Furthermore, it was discovered that 80% of the total APT supply is controlled by Aptos and major funds, which has led to criticisms that this setup is unfair to the community.

According to APT's tokenomics, the 1 billion token supply is allocated as follows:

- Community: 510,217,359.767 APT (51.02%)

- Core Team: 190,000,000 APT (19%)

- Project Fund: 165,000,000 APT (16.5%)

- Investors: 134,782,640.233 APT (13.48%)

However, within the 51% allocated to the community, only 20 million APT have been airdropped, while the rest will be controlled by Aptos and used for development over the next 10 years. This has led to concerns that Aptos might stake this large amount of APT to generate more tokens instead of distributing them to the community.

In a recent interview with CoinDesk, Aptos CEO Mo Shaikh stated:

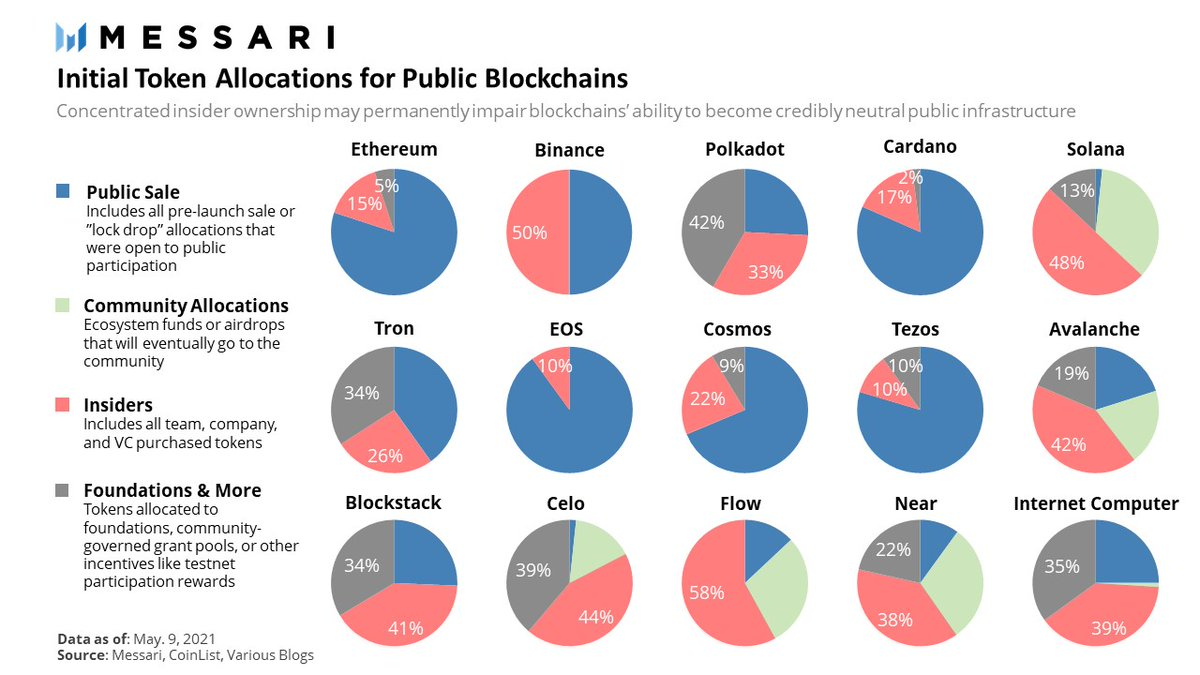

“Our goal in designing APT’s tokenomics was to create something that reflects fairness for the community. Looking at the allocation structure, you can see that Aptos has one of the lowest investor allocations among blockchains.”

Token Allocation Ratios of Notable Layer-1 Blockchains. Source: Messari

Mo Shaikh added:

“We also have a long token lock-up period for investors, so they cannot dump tokens on the market. We have placed significant restrictions on investors, something that has not been done before.”

Indeed, while APT allocated to Core Team members and Investors will be locked for one year and vest over the following four years, Aptos admits that staking rewards for these entities will not be locked. This means these parties can still use their substantial holdings to generate new APT and sell them at will.

Since its listing on October 19, APT has experienced a sharp decline and is currently trading between $7 and $9.

4-hour Chart of APT/USDT on Binance as of 08:30 PM on November 4, 2022

Aptos Faces Low Network Activity

Another criticism is that the APT airdrop lacked mechanisms to prevent Sybil attacks, where users create multiple accounts to receive more tokens. The conditions for receiving the APT airdrop were simply to 1) register for the Aptos Incentivized Testnet or 2) mint the NFT APTOS:ZERO testnet.

Regarding this issue, CTO Avery Ching said:

“It’s a significant challenge to ensure rewards go to those who have genuinely contributed to the network. You need to find ways to identify unique users. We’ve worked hard to filter and ensure that airdrop recipients are individual entities, with each address receiving the airdrop only once.”

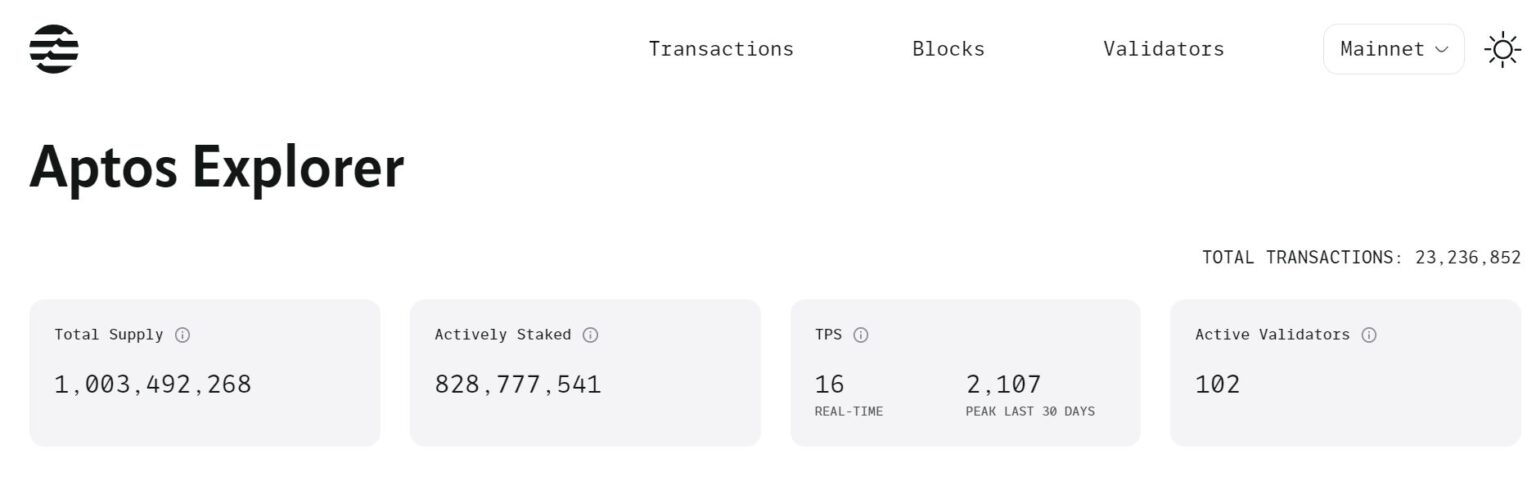

In addition to its investment backing and technological platform, Aptos claims it can support speeds of up to 10,000 transactions per second. However, as of now, the Aptos Explorer reports only 16 transactions per second, with a peak of 2,107 transactions per second.

Aptos Blockchain Activity Overview, Screenshot from Aptos Explorer at 08:30 PM on November 4, 2022

Ching acknowledged:

“On the testnet, we confirmed the ability to achieve several thousand transactions per second. We hope to push the mainnet to these limits in the near future.”

The low network activity on Aptos is likely due to the limited number of applications deployed, even though many projects (especially those from Solana) have announced plans to launch on this new blockchain.

One reason for the delay could be that projects need more time to adapt their products to Aptos’s Move programming language, which is inherited from Facebook’s failed Diem stablecoin project. Another blockchain emerging from Diem, Sui, also uses the Move language.

Aptos CTO added:

“Move is inspired by Rust [the programming language of Solana] in many ways. The difference is that Move is designed specifically for smart contract programming. We find that using Move is even simpler than using Solidity [Ethereum’s programming language].”

Addressing concerns about the security of Aptos due to the use of a new programming language, especially in light of the $3 billion in hacks across the crypto industry since the beginning of 2022, Ching said:

“We thoroughly tested before launching the project. We identified potential vulnerabilities and worked with security assessment firms and other projects to identify potential risks. Move is inherently secure, but we have conducted additional testing beyond what is necessary to ensure it is as secure as possible.”