Arkham Continues to Uncover Cluster of Wallet Addresses Holding Grayscale's $4.8 Billion ETH

Following the revelation of Robinhood as a top BTC and ETH whale globally, on-chain data platform Arkham has now aggregated the wallets holding $4.8 billion worth of Ethereum from Grayscale.

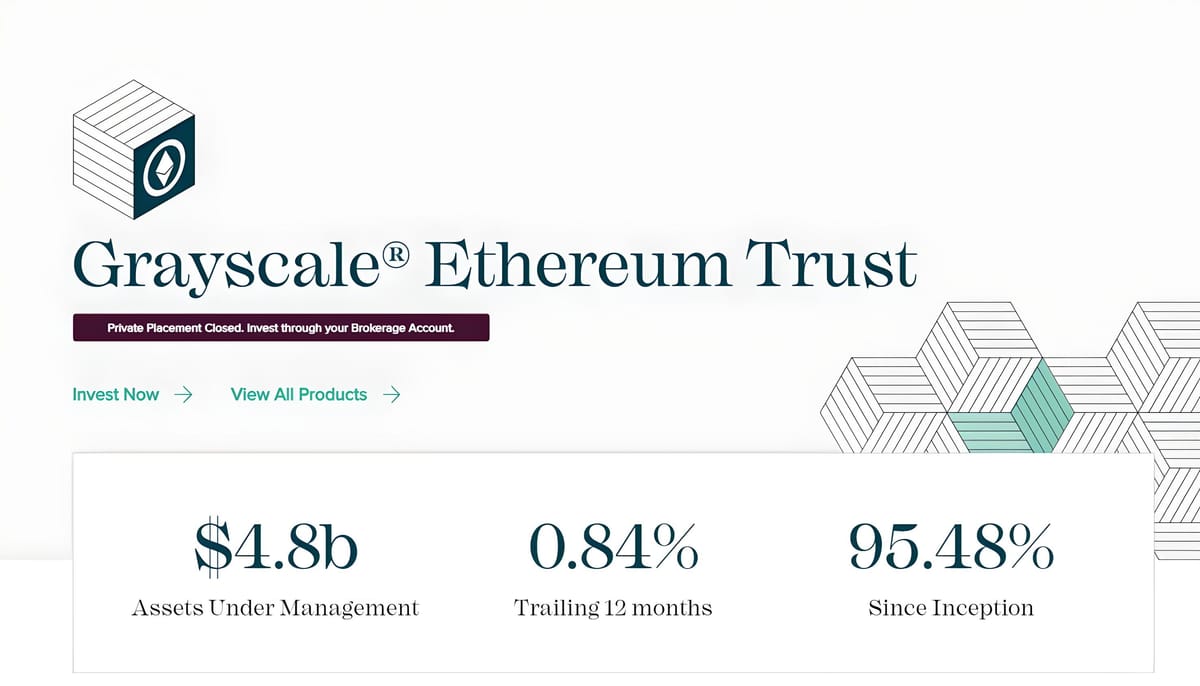

Grayscale Ethereum (GETH) Asset Statistics as of 02/09/2023. Source: Grayscale Website

In a Twitter post on the evening of 01/09, Arkham Intelligence, the on-chain data analytics platform, disclosed that it had identified a cluster of 500 wallet addresses belonging to Grayscale. Grayscale manages large cryptocurrency investment funds.

Arkham noted that tracking Grayscale's activities was challenging, as the organization intentionally divided 2.98 million ETH (worth $4.8 billion at the time of writing) among 500 different wallet addresses, with each wallet holding approximately $30 million.

Breaking: Arkham has identified the Grayscale Ethereum Trust on chain.

— Arkham (@ArkhamIntel) September 1, 2023

It is now the second largest ETH entity globally with $5B in ETH.

This had not been previously reported or publicly identified. pic.twitter.com/MQqKT6E9v6

However, through on-chain analysis and transaction history between wallets, Arkham was able to consolidate these addresses and confirm their ownership by Grayscale.

With this amount, Grayscale ranks as the second-largest holder of Ether on the Ethereum network.

Breaking: Arkham has identified the Grayscale Ethereum Trust on chain.

— Arkham (@ArkhamIntel) September 1, 2023

It is now the second largest ETH entity globally with $5B in ETH.

This had not been previously reported or publicly identified. pic.twitter.com/MQqKT6E9v6

Grayscale is a company specializing in issuing cryptocurrency investment products in the form of trusts. The company holds a certain amount of crypto, such as ETH, in a fund and issues trust shares to investors, making it easier for them to access ETH without directly holding it.

One of Grayscale's Ethereum-related products is the Grayscale Ethereum Trust (GETH), which also holds assets valued at $4.8 billion, coinciding with Arkham's findings.

In addition to Ethereum, Grayscale offers investment trust products for many major cryptocurrencies such as Bitcoin, Solana, Chainlink, Bitcoin Cash, Ethereum Classic, Zcash, DeFi indexes, with total assets under management as of 02/09/2023 amounting to $21.4 billion.

Statistics of Grayscale's cryptocurrency investment trust products as of the morning of 02/09/2023. Image: Grayscale

This week, Grayscale achieved a significant victory with the U.S. Securities and Exchange Commission (SEC) regarding the proposal to convert the Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF.

Both GBTC and GETH experienced significant price declines during the 2022-2023 downtrend compared to their underlying assets, due to the lack of conversion mechanisms from trust shares to BTC or ETH. Grayscale hopes that by converting its cryptocurrency trusts into ETFs, the company can allow investors to convert shares into actual crypto, addressing the price disparity.

Recently, Arkham also provided evidence showing that Robinhood, a popular U.S. stock and crypto trading platform, holds the third-highest amount of BTC and the fifth-highest amount of ETH.