Binance to Consolidate USDC, TUSD, and USDP Balances into BUSD

In a surprising move, leading cryptocurrency exchange Binance has announced a significant shift aimed at boosting the prominence of its own stablecoin, BUSD.

On the evening of September 5, Binance revealed that starting at 10:00 AM on September 29, 2022 (Vietnam time), the platform will consolidate balances of four stablecoins—BUSD, USDC, USDP, and TUSD—into a single balance of BUSD.

Here’s what the upcoming changes entail:

- All USDC, USDP, and TUSD balances will be converted to BUSD starting September 29, 2022. Users can perform the conversion themselves before this date.

- The conversion rate will be 1:1 for all stablecoins, with accounts holding less than 1 unit of any stablecoin not being converted.

- During and after the conversion period, users will still be able to deposit and withdraw stablecoins as usual, but all balances will be displayed as BUSD.

- Binance will delist trading pairs, futures, margin products, staking, saving, conversion, loans, payment, and gift card services for USDC, USDP, and TUSD stablecoins.

#Binance to Auto-Convert $USDC, $USDP, $TUSD to #BUSD (Binance USD).

— Binance (@binance) September 5, 2022

The rationale behind Binance's latest update seems clear: to further promote BUSD, its USD-pegged stablecoin, by effectively “delisting” but not officially “delisting” other stablecoins except for USDT.

Now, when depositing stablecoins other than Tether (USDT) and BUSD onto Binance, all balances will be converted to BUSD. While FTX has long adopted a similar approach by converting all stablecoin balances to USD, the general symbol for the US dollar, Binance’s move is seen as more overtly promotional for BUSD.

Binance claims that this consolidation aims to “improve liquidity and capital efficiency for users,” but this explanation might not be entirely convincing.

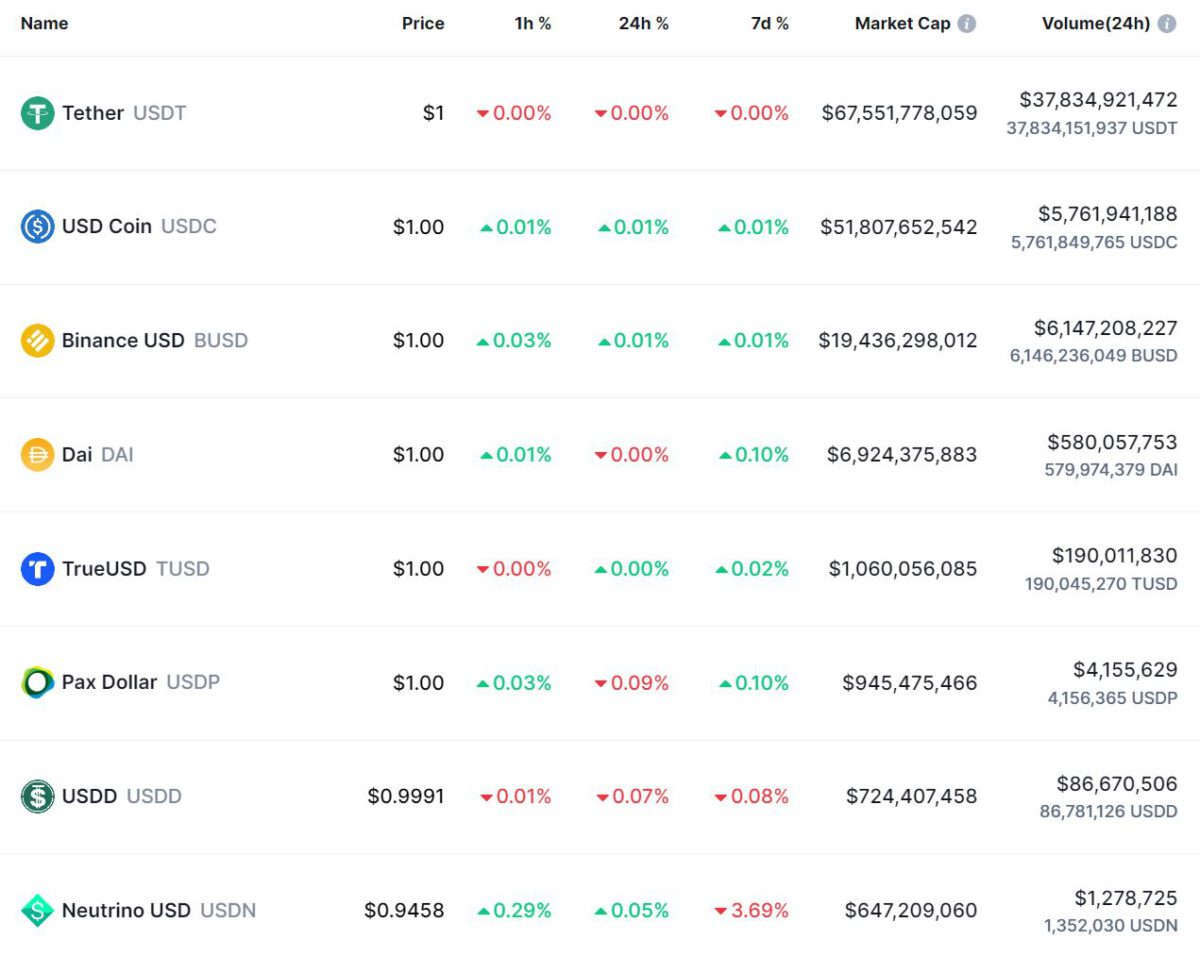

BUSD is currently the third-largest stablecoin by market capitalization, at $19.4 billion, significantly trailing behind USDC ($51.8 billion) and USDT ($67.5 billion).

Stablecoin Market Cap Rankings as of September 5, 2022

Source: CoinMarketCap

By consolidating stablecoin balances, Binance may not only irritate USDC holders but could also displease Paxos, the issuer behind USDP and BUSD.

According to Nansen’s data from late August 2022, over 95% of circulating BUSD is held within Binance’s wallets.

$19.3B BUSD in circulation.

— Alex Svanevik 🐧 (@ASvanevik) August 28, 2022

$18.3B (95%) of that sitting in Binance wallets. pic.twitter.com/BKEk65Oq3G

Recently, Binance has been expanding its market share with moves such as offering unlimited free spot Bitcoin trading, free ETH/BUSD trading pairs until the end of September in conjunction with The Merge event, and now consolidating stablecoin balances into BUSD.

Despite this, Evgeny Gaevoy, CEO of Wintermute, a well-known market maker in the crypto space, argues that consolidating stablecoin markets is more beneficial than harmful. It will reduce liquidity fragmentation across different stablecoin pairs and decrease the need for conversions when using Binance’s products.

Helpful perspective from @wintermute_t , which is spot on. Converged dollar books on Binance — now same as on FTX and Coinbase — is a good thing. USDC utility just increased. https://t.co/QWfMx7f1cZ

— Jeremy Allaire - jda.eth / jdallaire.sol (@jerallaire) September 5, 2022

Jeremy Allaire, CEO of Circle, the company behind USDC, agrees with this assessment, suggesting that USDC may benefit from Binance’s decision by gaining increased utility in products previously limited to BUSD and USDT.