Bitcoin and Ethereum ETFs Experience Inflows on the Same Day for the First Time

For the first time, Bitcoin and Ethereum ETFs saw positive inflows on the same day, marking a significant milestone.'

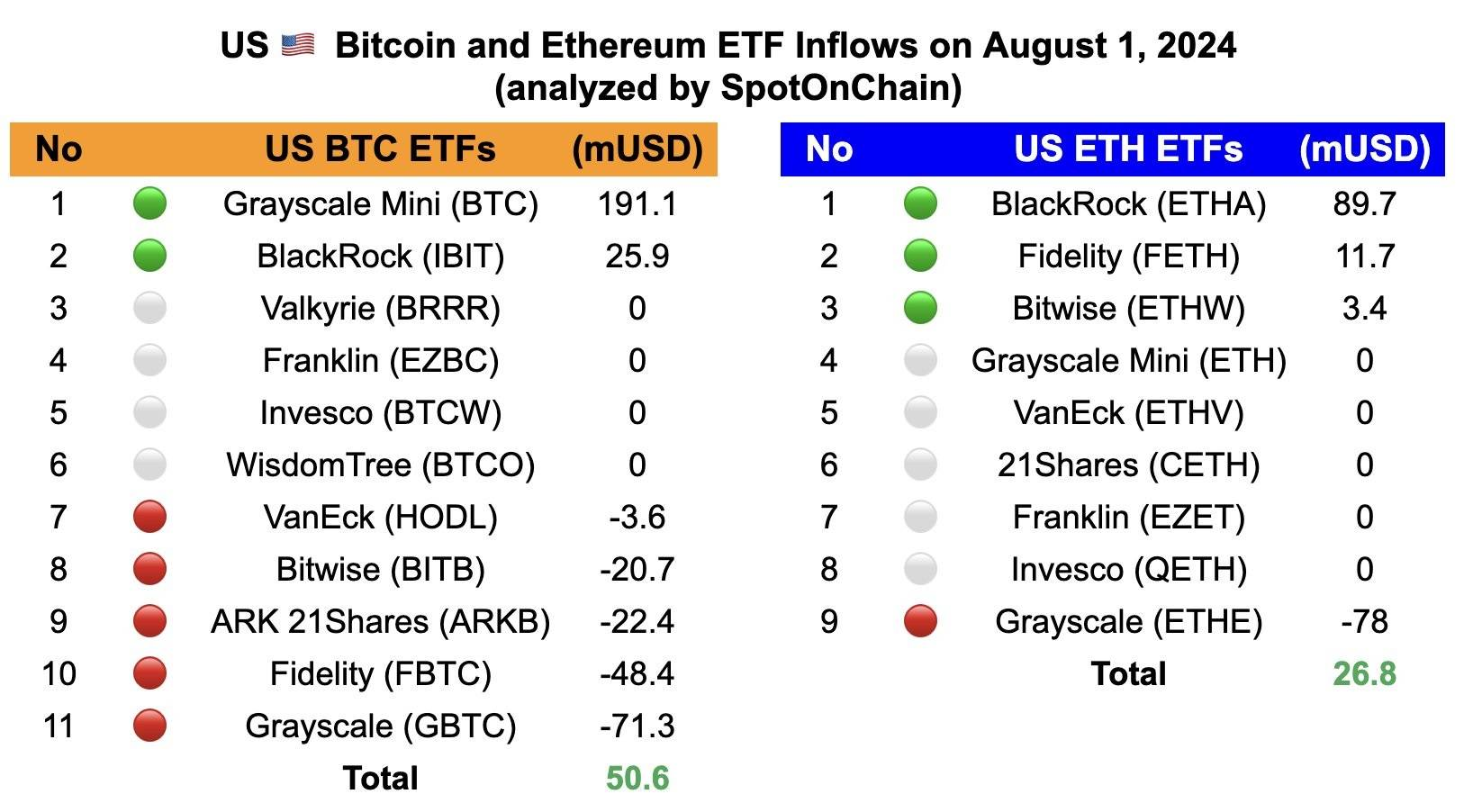

According to SpotOnChain data, U.S. Bitcoin spot ETFs ended the trading session on August 1st with an inflow of $50.6 million, a sharp increase from the $0.3 million recorded on July 31st.

However, this doesn’t fully capture market demand, as aside from BlackRock’s IBIT and Grayscale’s BTC ETFs, which saw inflows of $25.9 million and $191.1 million respectively, other ETFs experienced concerning outflows amounting to tens of millions of dollars.

Inflow/Outflow Statistics for Bitcoin and Ethereum ETFs on August 1, 2024. Source: SpotOnChain

This shift might be due to investors moving their positions from traditional ETFs to Grayscale’s newly launched BTC mini ETF, which offers the lowest management fee in the market at 0.15%.

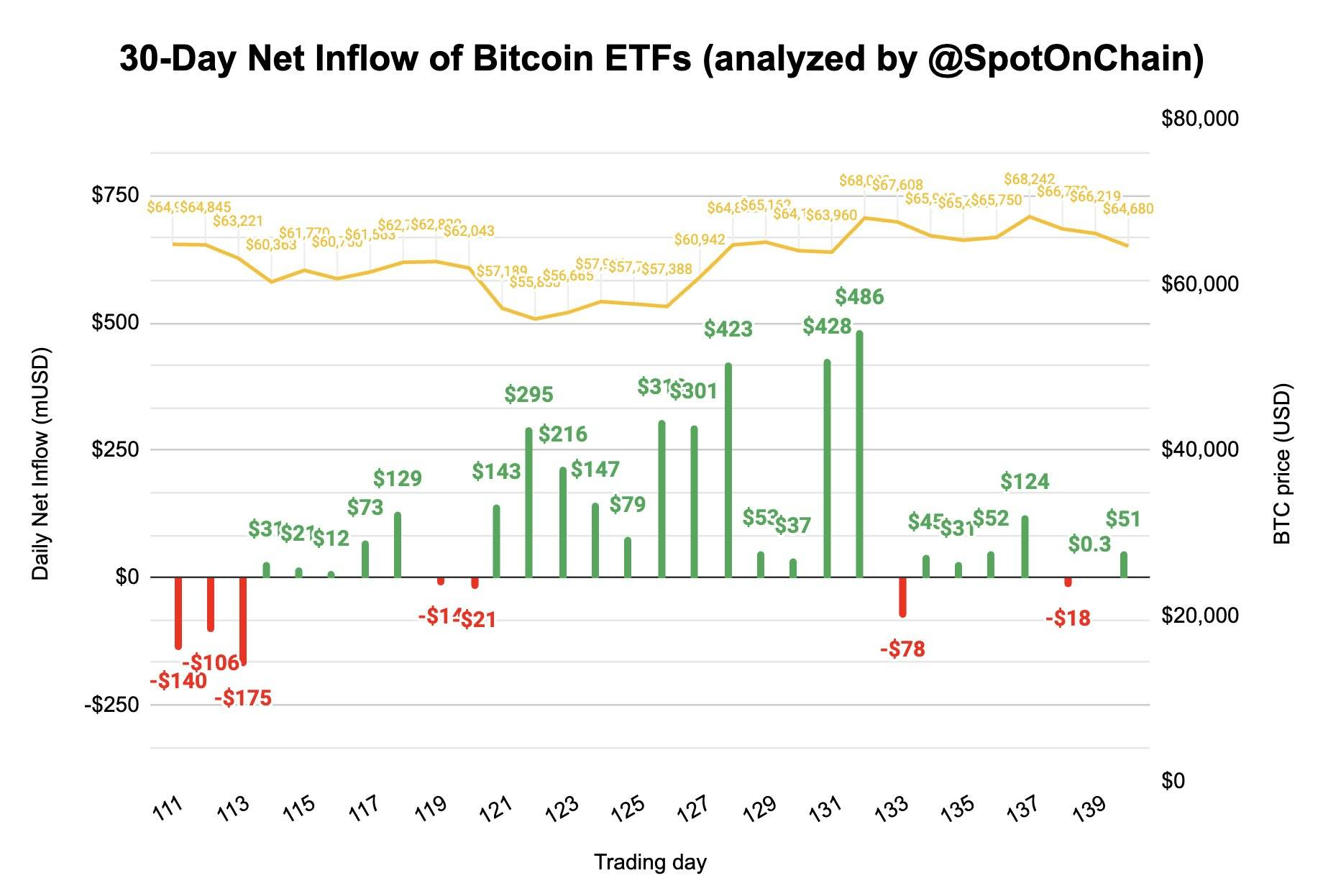

Inflow/Outflow Statistics for U.S. Bitcoin ETFs. Source: SpotOnChain (02/08/2024)

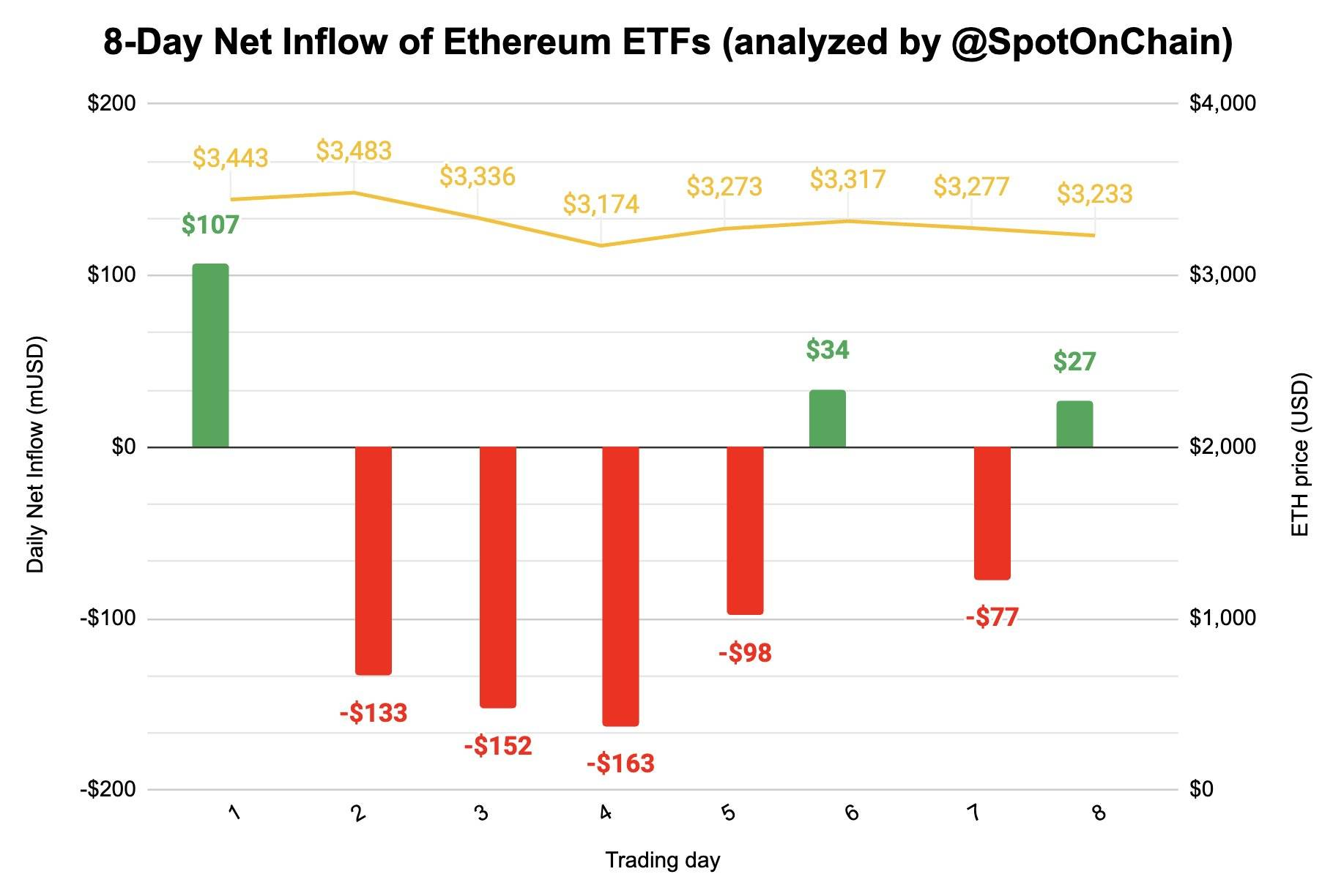

Meanwhile, Ethereum spot ETFs also saw inflows for the third time ever, with $26.8 million flowing in.

The selling pressure from Grayscale’s ETHE continues to decrease, while the buying momentum from newer Ethereum ETFs like BlackRock’s ETHA and Fidelity’s FETH plays a crucial role in maintaining positive inflows.

This marks the first trading day since the approval of the ETH ETF on July 23rd where both Bitcoin and Ethereum ETFs recorded positive daily inflows.

Inflow/Outflow Statistics for U.S. Ethereum ETFs. Source: SpotOnChain (02/08/2024)

The ETF crypto sector's response reflects Wall Street’s sentiment amidst the volatility of the cryptocurrency market on August 1st.

Bitcoin’s price fluctuated dramatically, dropping to $62,300 due to concerns over renewed Middle Eastern conflicts after Israel's assassination of a Hamas leader, prompting threats of retaliation from Arab nations. However, Bitcoin quickly rebounded to around $65,500 in the hours following.

1-hour Chart of BTC/USDT on Binance at 11:25 AM on August 2, 2024

Ethereum experienced even greater volatility, plummeting to $3,080 before recovering to $3,170 at the time of this update.

1-hour Chart of ETH/USDT on Binance at 11:25 AM on August 2, 2024

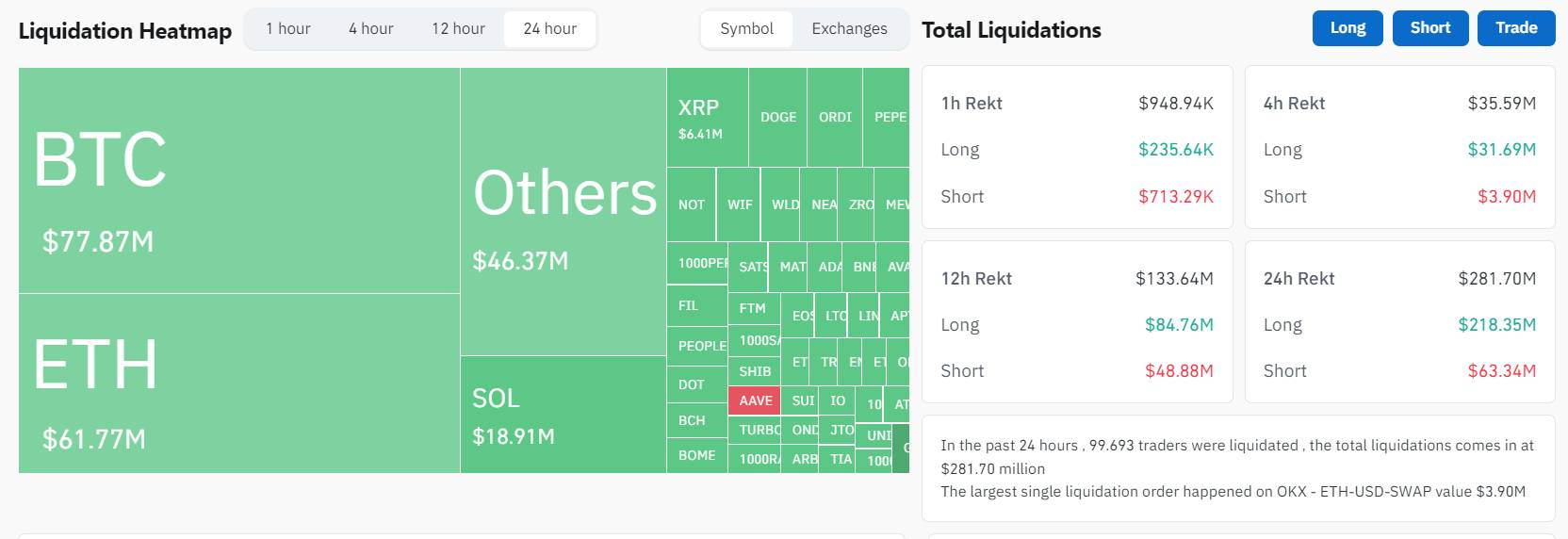

The severe market fluctuations led to a spike in derivative liquidations, reaching $281 million in the last 24 hours, with long positions accounting for 78% of the liquidations.

Derivative Market Liquidation Data, Screenshot from CoinGlass at 11:25 AM on August 2, 2024