Bitcoin and Ethereum Surge Following US CPI Data and Shanghai Upgrade

The leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), experienced significant gains on the morning of April 14, 2023.]

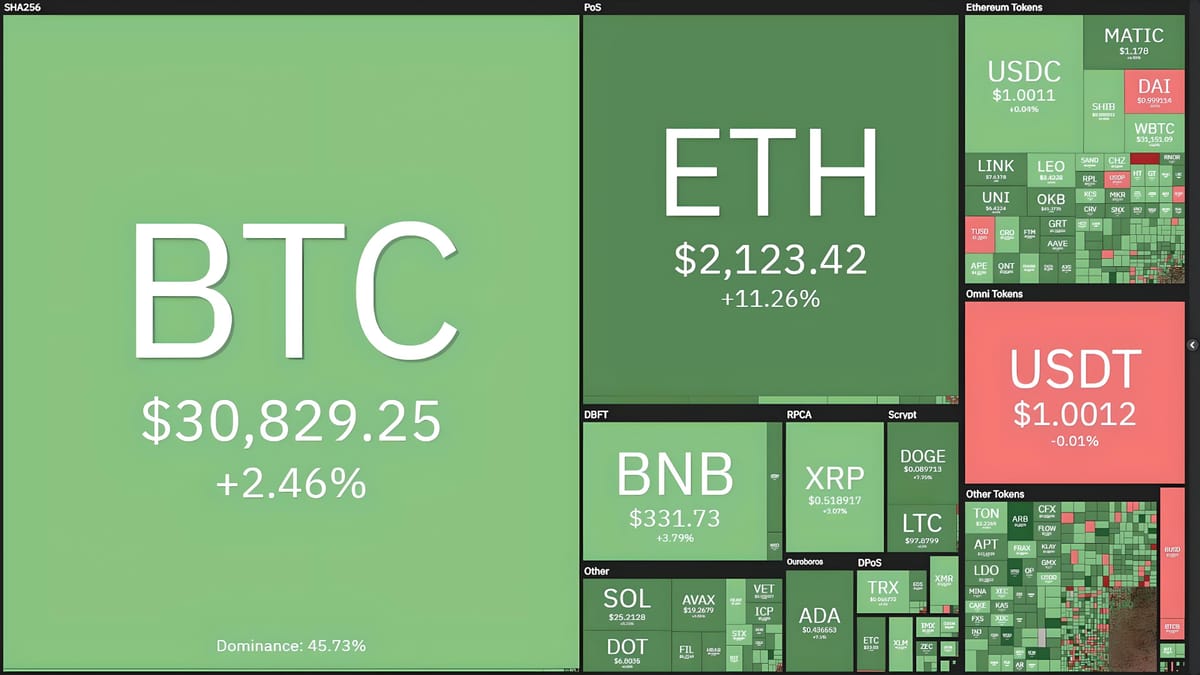

Price Movements of Top Cryptos as of 08:50 AM, April 14, 2023. Source: Coin360

The cryptocurrency market has seen a bullish turn recently, driven by both the latest CPI data and the Shanghai upgrade.

- Related Reading: Key Crypto Events for April 2023

As reported by Coin68, the US March CPI data released on April 12 showed that inflation continued to decline for the ninth consecutive month. This news boosted the stock market, gold, and crypto assets, while the USD depreciated.

This outcome was anticipated by market observers and added pressure on the Federal Reserve to consider cutting or halting interest rate hikes in its May meeting. This move is eagerly awaited by the financial sector to mitigate risks following the recent banking crisis.

Consequently, BTC has maintained its impressive uptrend, surging to $30,893—a new high for 2023 and the highest level since early June 2022, just before the liquidity crisis involving Three Arrows Capital, Celsius, and Voyager.

1H Chart of BTC/USDT on Binance at 08:50 AM, April 14, 2023

Additionally, Ethereum successfully completed the Shanghai upgrade (also known as Shapella) on April 13, which officially enabled the withdrawal of ETH staking that had been locked since December 2020.

While it was anticipated that this event might lead to a large-scale withdrawal and sell-off of ETH, the reality has been different. According to the design, only about 57,600 ETH are expected to be withdrawn daily, not the entire 18.5 million ETH locked in staking contracts. Furthermore, major staking platforms like Lido, Coinbase, and Binance have announced that they will start processing staking withdrawal requests from next week or even May, limiting the immediate impact.

ETH Deposits (Green) and Withdrawals (Orange) from Ethereum

Staking Contract as of 08:50 AM, April 14, 2023. Source: Nansen

As of the time of this report, nearly 230,000 ETH have been withdrawn from staking since the Shanghai upgrade was activated, equivalent to approximately $485 million. However, the amount of ETH being restaked has also reached over 98,500 ETH, indicating that a significant portion of validators are actively withdrawing ETH from staking only to restake it in liquid staking protocols like Lido or Rocket Pool for increased liquidity flexibility.

ETH is currently one of the top 10 performing cryptocurrencies over the past 24 hours, rising more than 10% to a new high of $2,128—the highest since mid-May 2022, right after the LUNA-UST crash. The prices of LDO and RPL have also surged, benefiting from Ethereum's momentum.

1H Chart of BTC/USDT on Binance at 08:50 AM, April 14, 2023

Other major cryptocurrencies are also experiencing gains of 3% to 8%, with green across the board. The total cryptocurrency market cap has returned to $1.284 trillion—a level not seen since mid-May 2022.

In the past 12 hours, $120 million worth of derivative contracts have been liquidated, with over 85% coming from short positions. Notably, the volume of ETH liquidations is nearly three times that of BTC, a rare occurrence indicating that while many anticipated a dump in Ethereum post-Shanghai, the actual scenario has turned out quite the opposite.

Derivatives Liquidation Statistics as of 08:50 AM, April 14, 2023. Source: Coinglass