Bitcoin Approaches $27,000 as Fed Injects Liquidity into US Financial Sector

The world’s leading cryptocurrency, Bitcoin, surged to a new high for 2023, driven by macroeconomic news from the Federal Reserve.

Bitcoin Approaches $27,000 as Fed Injects Liquidity into US Financial Sector

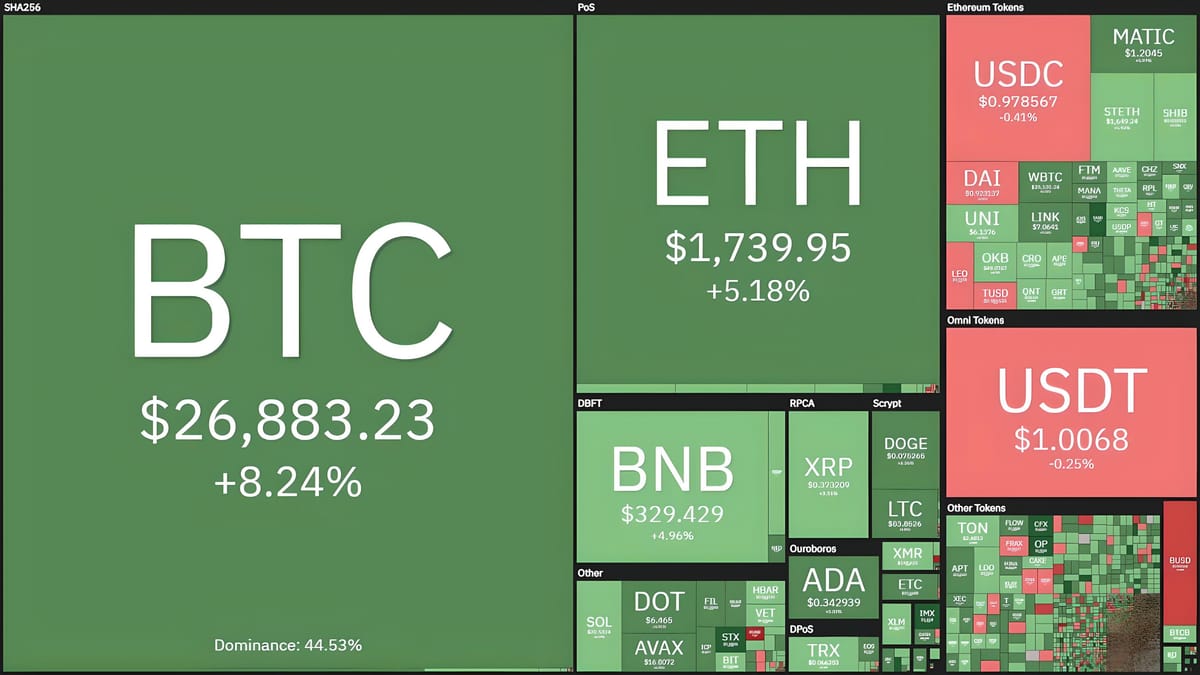

On the evening of March 17, Bitcoin (BTC) recorded an over 8.3% gain, reaching $26,970 and surpassing the previous peak of $26,368 from March 14, setting a new record for 2023.

This marks Bitcoin's highest value since mid-June 2022, a period when the market was reeling from the liquidity crisis and subsequent collapse of Three Arrows Capital.

In the past week alone, Bitcoin has seen a remarkable increase of more than 37%, climbing from a low of $19,549 on March 10 to $26,970 on March 17.

4H BTC/USDT Chart on Binance at 07:00 PM March 17, 2023

Just a week ago, BTC was grappling with a series of negative news hits: interest rate updates from the Fed, the collapse of US banks tied to the crypto sector, a 30% tax on crypto mining in the US, Voyager selling assets, and particularly the depegging of USDC due to the Silicon Valley Bank crisis.

However, following the Fed and the US Treasury's intervention to rescue the banks, Bitcoin has experienced a series of strong rebounds.

Recently, data from the Federal Reserve revealed that the central bank of the world's largest economy injected $300 billion into the financial sector in just a few days. This amount equals half of the liquidity withdrawn by the Fed throughout 2022 during its quantitative tightening phase, which saw interest rates raised to combat inflation—a consequence of the Fed's money printing to avoid a crisis during the COVID-19 pandemic, increasing the money supply from $4 trillion to nearly $9 trillion in under two years.

Many analysts suggest that, under pressure from the potential collapse of the US banking system, the Fed may be forced to postpone further rate hikes or at least slow down their pace in the upcoming meeting on March 23 (Vietnam time). Some scenarios even posit this could signal the end of the Fed's quantitative tightening policy.

The addition of more USD into the market is expected to devalue the US dollar relative to other assets such as gold or cryptocurrencies, which could drive their prices up—an effect we are currently witnessing.

Another factor boosting BTC is Binance's announcement earlier this week that it will convert $1 billion of its rescue fund into BTC, ETH, and BNB to mitigate risks associated with stablecoins, especially after BUSD faced warnings from US regulators. Additionally, Mt. Gox's trustee extending the deadline for Bitcoin payouts to April has eased some of the selling pressure on BTC.

Ethereum (ETH), the second-largest cryptocurrency, is up modestly by 6% to $1,760 but has yet to surpass the $1,780 peak from March 14.

Nearly half of the Fed’s quantitative tightening effort has been wiped out in a single week. pic.twitter.com/G7unsEEOKj

— ted (@tedtalksmacro) March 16, 2023

Most other big-cap altcoins have risen between 4-7%, indicating that the current market rally is being led predominantly by BTC.

In the past 12 hours, 88% of liquidations were short positions, totaling over $108 million.

Cryptocurrency Liquidations in the Past 12 Hours

Data Source: Coinglass, March 17, 2023, 07:00 PM