Bitcoin Bounces Back to $20,000 Despite US CPI Data

The world’s largest cryptocurrency, Bitcoin, has unexpectedly surged back to $20,000, despite initially being heavily impacted by the latest US Consumer Price Index (CPI) data.

As reported by Coin68, on the evening of October 13, the US released its CPI data for September. Although the CPI showed a slight decrease compared to August, it fell short of market expectations.

The immediate reaction was a significant sell-off, affecting both US stock markets and the crypto market. Bitcoin (BTC) plummeted to as low as $18,190, marking its lowest value since mid-September.

However, in the subsequent 12 hours, Bitcoin made an impressive recovery, rallying over $1,700 to peak at $19,551 – its highest price since October 7.

It seems that after the CPI data release, Bitcoin managed to escape the macroeconomic pressures that have been weighing down the market since early October. This price movement also aligns with recent positive news about Bitcoin, such as the continuous record-setting hash rate of its network.

Despite this, the slight CPI decrease could have long-term negative implications for the market, as it might prompt the US Federal Reserve (Fed) to persist with its interest rate hikes to combat inflation. The Fed has two more rate adjustments planned for November and December, meaning the rest of October could provide a "breather" for the crypto space.

1-hour BTC/USDT Chart on Binance at 09:25 AM on October 14, 2022

Thanks to Bitcoin’s rebound, major cryptocurrencies across the market have also recovered, regaining losses from the October 13 sell-off.

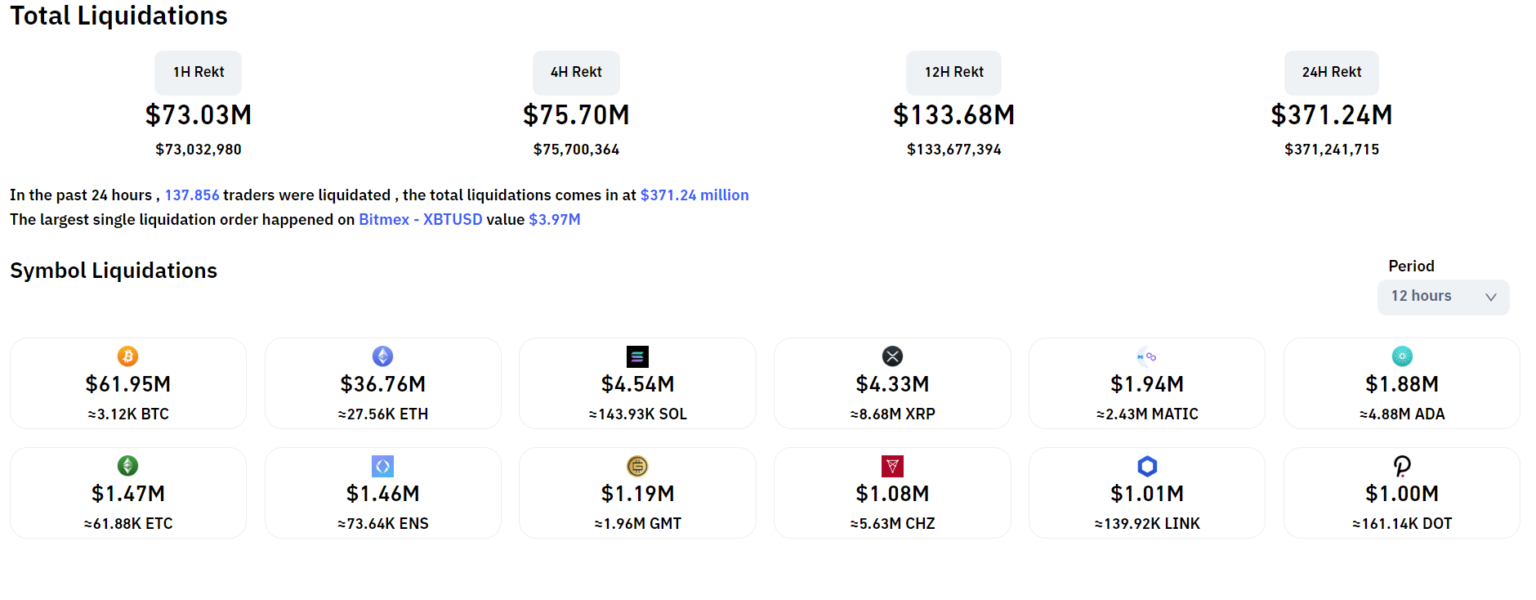

This sudden reversal is also evident in the derivatives market. In the past 12 hours, over $133 million in futures contracts were liquidated, with nearly 88% of the liquidations being short positions.

Crypto Liquidation Values in the Past 12 Hours, Data from Coinglass at 09:25 AM on October 14, 2022