Bitcoin (BTC) faced a significant drop to $66,700 as buying pressure from Bitcoin ETFs plummeted.

Bitcoin's price dipped more than 4% in just hours as signs emerged of dwindling buying interest from Bitcoin ETFs.

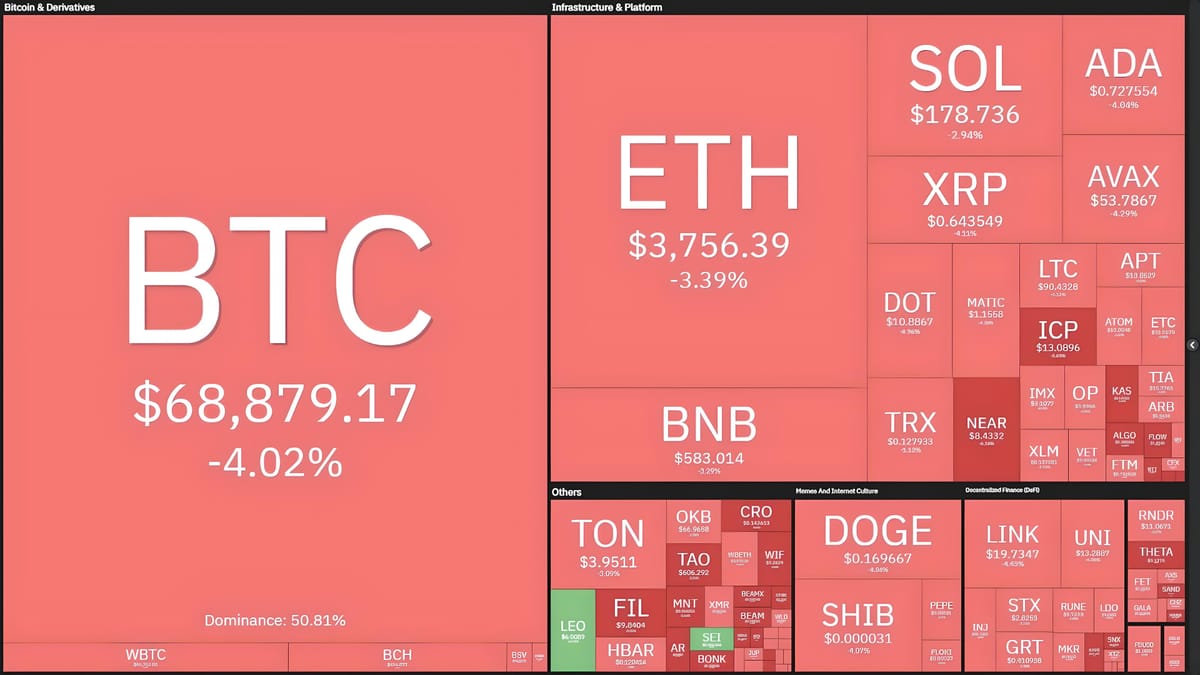

Cryptocurrency market fluctuations, screenshot from Coin360 at 10:55 AM on March 15, 2024

On the morning of March 15, the cryptocurrency market witnessed its latest correction after days of continuous growth throughout March.

Specifically, Bitcoin (BTC) slid from $72,000 to $66,700, struggling to find new support levels. Notably, just the night before on March 14, Bitcoin had set a new all-time high (ATH) at $73,777.

1-hour chart of the BTC/USDT pair on Binance as of 10:55 AM on March 15, 2024

Meanwhile, Ethereum (ETH) dumped from $3,900 to $3,623, a 7% drop compared to 24 hours ago.

1-hour chart of the ETH/USDT pair on Binance as of 10:55 AM on March 15, 2024

However, there were still bright spots, most notably Solana, which surged to $186.7, setting a new market capitalization record and lifting several other tokens within its ecosystem.

Data from CoinGlass shows that over the last 12 hours, $437 million worth of cryptocurrency derivative contracts were liquidated, predominantly on the long side, with BTC and ETH being the major assets.

Statistics of liquidations in the cryptocurrency derivatives market, screenshot from CoinGlass at 10:55 AM on March 15, 2024

There is currently no clear reason behind the latest market volatility. However, some have pointed to the waning buying pressure from Bitcoin ETFs, causing concerns among investors and prompting profit-taking. As reported by Coin68, Bitcoin ETFs have remained a primary growth driver for BTC over the past six months. Financial products for Wall Street insiders even set a record on March 12 by investing up to $1 billion in Bitcoin.

According to aggregated data from Farside Investors, on March 14 (US time), Bitcoin ETFs recorded inflows of only $132.7 million - a fifth of previous days, while outflows from Grayscale's GBTC reached $257.1 million USD.

Inflow/outflow data of Bitcoin ETFs. Source: Farside Investors (March 15, 2024)

A notable example is Fidelity's FBTC, the second largest Bitcoin ETF currently. FBTC saw continuous inflows reaching nine figures since early March, but unexpectedly dropped to just $13.7 million USD on March 14.

BlackRock's BIT, the largest Bitcoin ETF currently, recorded buying pressures exceeding $250 million USD in continuous trading sessions throughout March, managing to keep the inflow/outflow ratio in positive territory at 345.4 million USD.

However, this marks the day with the lowest inflows for Bitcoin ETFs since $92.3 million on February 29, not counting the outflow day of $139.6 million USD on March 1.