Bitcoin (BTC) Now Less Volatile Than U.S. Stock Indices

Bitcoin (BTC) has become a more "stable" asset compared to U.S. stocks amidst a prolonged downturn in the crypto market.

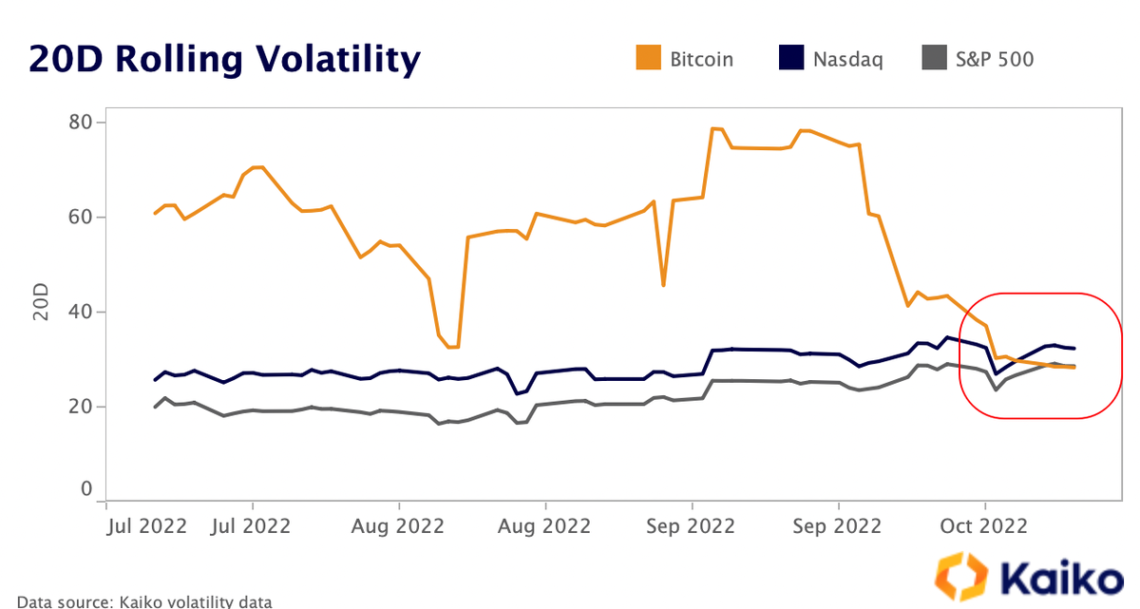

According to cryptocurrency data analysis firm Kaiko, the 20-day average volatility of Bitcoin (BTC) has recently dropped below that of Nasdaq and S&P 500, two of the leading U.S. stock indices.

This is the first time since 2020 that Bitcoin's volatility has been lower than these major stock indices. During that period, the crypto market experienced a significant crash due to COVID and subsequently saw a strong uptrend from late 2020 to early 2022.

Comparison of 20-Day Volatility of Bitcoin (Orange), Nasdaq (Green), and S&P 500 (Pink). Source: Kaiko

Despite this, both U.S. stocks and Bitcoin experienced peaks in volatility before this 20-day period due to macroeconomic impacts, notably persistently high U.S. inflation leading to rate hikes by the Federal Reserve.

Kaiko’s Research Director, Clara Medalie, noted that Bitcoin’s volatility has significantly decreased since July 2022, following the LUNA-UST collapse and the subsequent liquidity crisis affecting major institutions.

However, cryptocurrency trading volumes have remained stable despite low volatility, indicating that a substantial number of investors are still committed to the crypto space.

In contrast, U.S. stock markets have seen heightened volatility due to various factors including rising interest rates, a recovering U.S. dollar, ongoing high inflation, the EU energy crisis, and the Russia-Ukraine conflict.

1D Chart of BTC/USDT on Binance as of 09:45 AM on 21/10/2022