Bitcoin Dips to $60,500 Amid U.S. Economic Recession Fears

In the past 12 hours, both the U.S. stock market and the cryptocurrency market have witnessed a massive sell-off driven by a spike in unemployment rates.

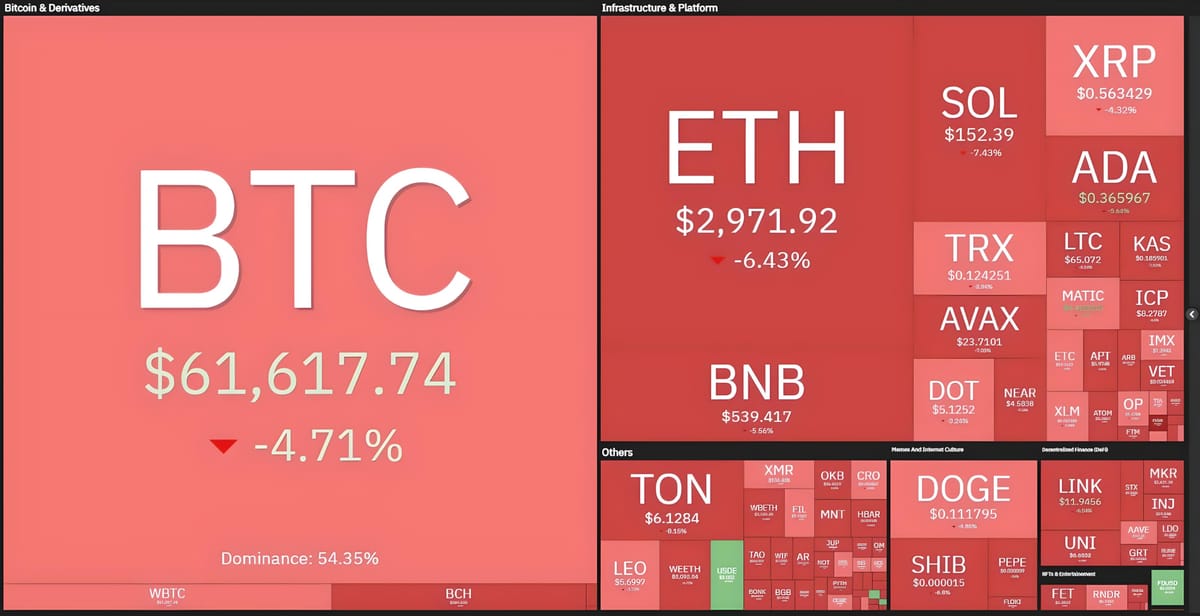

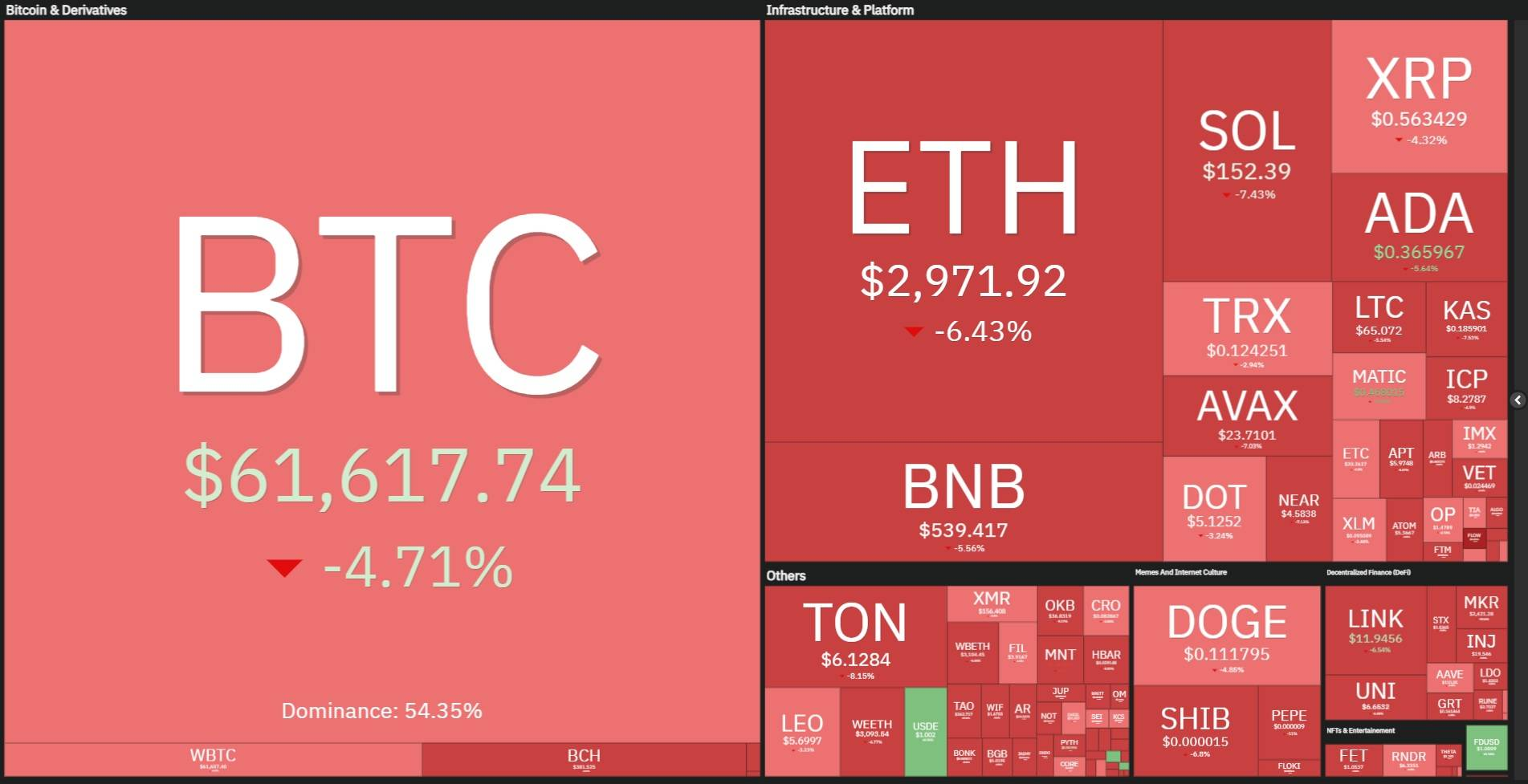

Cryptocurrency Price Movements at 09:20 AM on August 3, 2024

On the evening of August 2, U.S. employment data revealed that the unemployment rate for July rose to 4.3%, exceeding the forecast of 4.1%.

The technical term for the payroll report that just came out is "dumpster fire". pic.twitter.com/zYes7albu0

— Lyn Alden (@LynAldenContact) August 2, 2024

This news quickly fueled concerns across financial markets, as investors feared it could signal the onset of a new economic recession, spreading red across the board.

Major U.S. indices, including the S&P 500, Nasdaq, and Dow Jones, fell by 2% to 2.9% on August 2, marking the worst performance in several months.

The total market capitalization of U.S. stocks plummeted by $1.2 trillion during the session, while global stock markets lost $2.9 trillion, with Japan recording its worst trading day since 1987.

JUST IN: Over $2.9 trillion has been wiped out from major indices and stocks this morning due to growing fears of a global recession.

— Jacob King (@JacobKinge) August 2, 2024

This is the worst day for stocks since March 16, 2020, during the COVID-19 pandemic fears. pic.twitter.com/qIPu7xiz5X

In response to the unexpected turn in the stock market and economic conditions, the probability of the Federal Reserve (Fed) needing to cut interest rates in September surged. The Fed maintained its current interest rates this week due to ongoing uncertainties about inflation.

Traders on polymarket are predicting a 60% chance that there will finally be a rate cut amid a tanking stock market ! https://t.co/UZxMfO1f9w

— *Walter Bloomberg (@DeItaone) August 2, 2024

The cryptocurrency market also felt the impact, with Bitcoin dropping from $65,000 to $60,500 in the past 12 hours, hitting its lowest point since mid-July. Bitcoin was also affected by news of potential escalation in the Middle East conflict following Israel's assassination of a Hamas leader earlier in the week.

1H Chart of BTC/USDT on Binance at 09:25 AM, August 3, 2024

Since reaching $70,000 on July 29, Bitcoin has lost 13.5% of its value in just one week.

Ethereum has experienced an even steeper decline, dropping 7% to return to the $2,910 range.

1H Chart of ETH/USDT on Binance at 09:25 AM, August 3, 2024

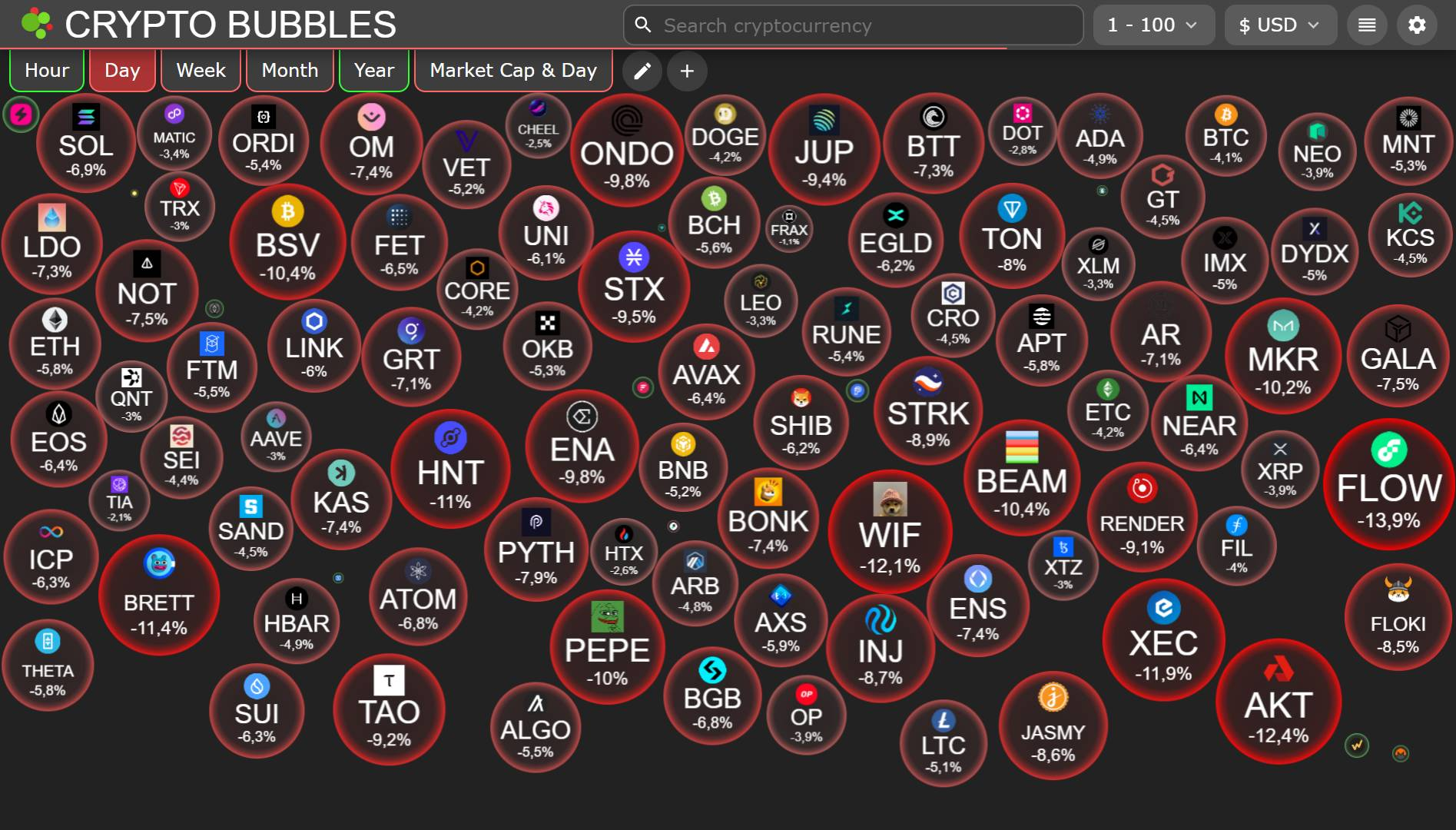

Other major altcoins have also turned red, with losses ranging from 3% to 15% compared to the same time the previous day.

Top Altcoin Movements Over the Past 24 Hours, Screenshot from CryptoBubbles at 09:25 AM, August 3, 2024

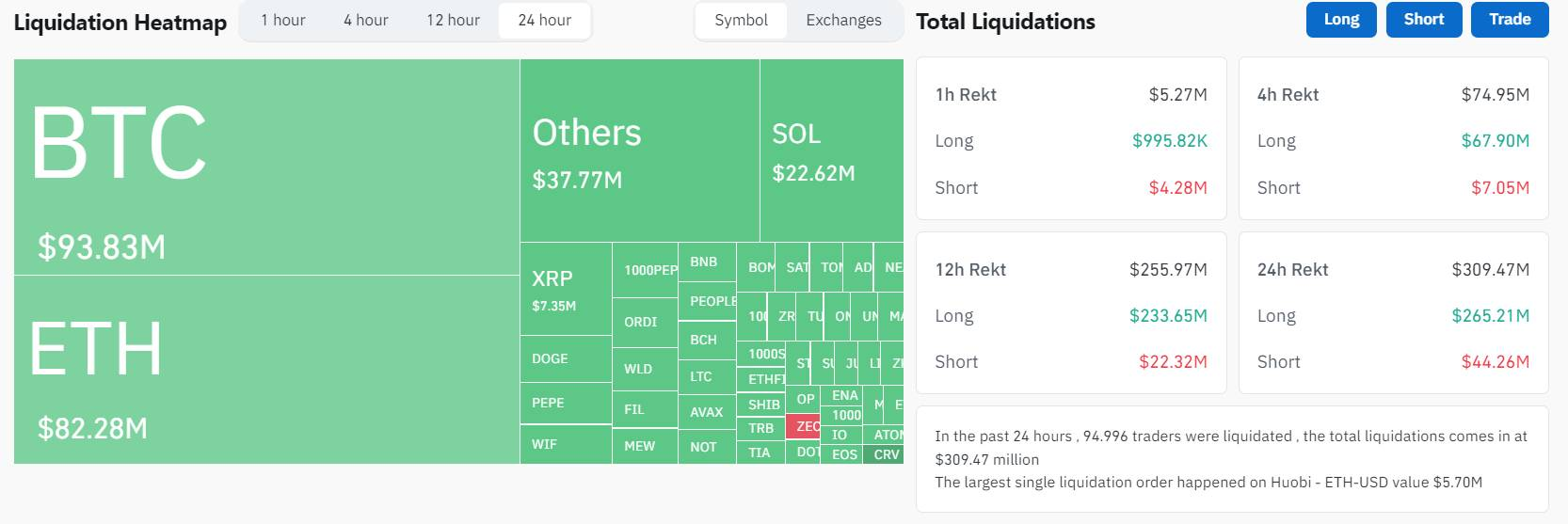

The latest market adjustment has led to nearly $310 million in liquidations in the past 24 hours, with long positions accounting for 87% of the liquidations.

Crypto Derivatives Liquidation Data, Screenshot from CoinGlass at 09:25 AM, August 3, 2024