Bitcoin Drops Below $19,000 Ahead of US Inflation Data

The world’s largest cryptocurrency, Bitcoin (BTC), has once again fallen below the $19,000 mark ahead of the US inflation data release for September.

Price Movement of Major Cryptocurrencies as of 09:20 AM on October 11, 2022. Source: Coin360

In the early hours of October 11, the cryptocurrency market experienced a significant dump, with Bitcoin (BTC) dropping to a low of $18,950.

Similarly, major altcoins saw declines of 3-5% over the past 24 hours. While these drops are not severe, they are enough to cast a red shadow over the price charts.

1H Chart of BTC/USDT on Binance as of 09:20 AM on October 11, 2022

In the last 12 hours, $128 million worth of derivative positions were liquidated, with long positions accounting for 90%. As usual, ETH and BTC were the most liquidated cryptocurrencies.

Value of Liquidated Cryptocurrencies in the Last 12 Hours, Data from Coinglass as of 09:20 AM on October 11, 2022

The exact cause of this latest dump is unclear. However, it may be influenced by the US stock market's performance ahead of the latest inflation data release on October 13. As previously reported by Coin68, Bitcoin has shown strong volatility whenever the US releases its monthly CPI data since October 2021.

The NASDAQ index ended its trading session on October 10 at its lowest level since July 2020, signaling investor pessimism about inflation prospects. This is compounded by Federal Reserve officials’ statements indicating that they will maintain their current interest rate hike strategy to combat inflation.

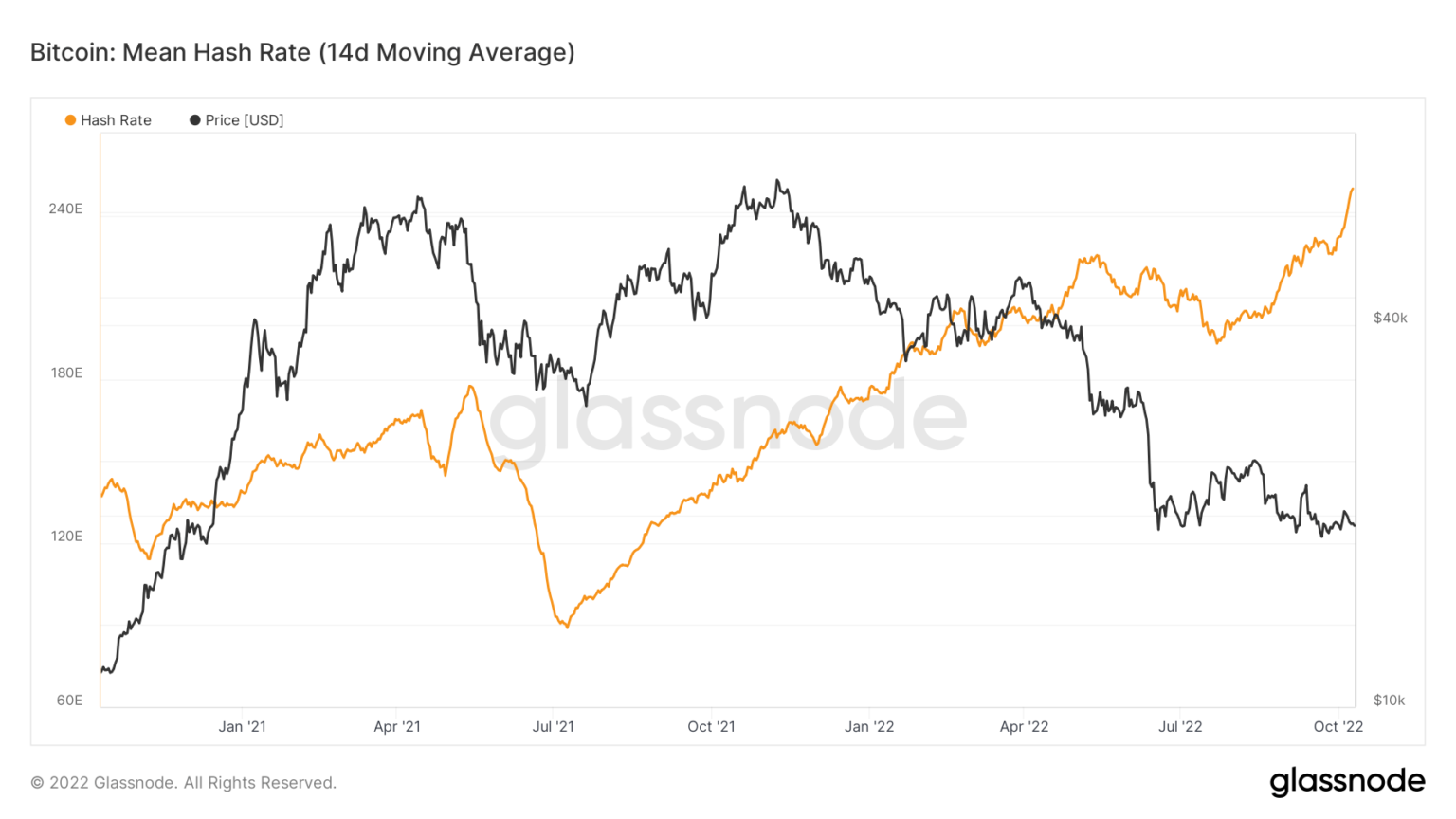

Another notable point is that despite the Bitcoin network hash rate setting a new record on October 10, this positive signal has not been enough to reverse BTC’s price trend.

Hash Rate Trend of the Bitcoin Network (Gold) and BTC Price (Black). Source: Glassnode