Bitcoin Drops Below $20k as Market Reverts to Pre-CPI Levels

In the 12 hours following the latest U.S. Consumer Price Index (CPI) release, the cryptocurrency market has continued to plunge, reverting to price levels from a week ago.

Top Crypto Price Movements at 08:00 AM on 14/09/2022. Source: Coin360

As reported by Coin68, on the evening of September 13, the U.S. released its CPI data for August 2022, a key measure of inflation. The CPI for August came in at 8.3%, slightly down from July’s 8.5% but missing the 8.1% expectation set by economic analysts.

In contrast, the core CPI (excluding volatile items like fuel and food) rose from 5.9% to 6.3%, exceeding the forecast of 6.1%. This indicates that while inflation might be easing due to a cooling energy crisis, prices for other goods in the economy are still rising.

U.S. CPI Trends Over the Past Year. Source: CNBC

This news has significantly impacted both traditional financial markets and the cryptocurrency space, as it directly influences the Federal Reserve's decision on interest rate hikes at the end of the month. Previously optimistic expectations that the Fed might only raise rates by 0.5% instead of the anticipated 0.75% have shifted to concerns that the Fed might implement a more aggressive hike of up to 1% on September 22.

Over the past 12 hours, Bitcoin fell to as low as $19,860, losing nearly 13% from its peak of $22,800 following the inflation news. This is Bitcoin’s lowest price since September 9, when the largest cryptocurrency started to rebound in anticipation of the inflation data.

4-Hour Chart of BTC/USDT on Binance at 08:00 AM on 14/09/2022

Ethereum (ETH) has similarly suffered, dropping more than 12% from $1,760 to $1,552, despite The Merge event being just about 24 hours away. It appears that ahead of this critical upgrade, crypto investors are becoming more cautious rather than betting on a price increase post-Merge.

4-Hour Chart of ETH/USDT on Binance at 08:00 AM on 14/09/2022

In line with the declines in BTC and ETH, major cryptocurrencies in the market have also recorded retracements of 5-10% over the past 24 hours.

The total cryptocurrency market capitalization dropped by $136 billion during the worst of the recent sell-off, now standing at $988 billion and falling below the $1 trillion mark once again.

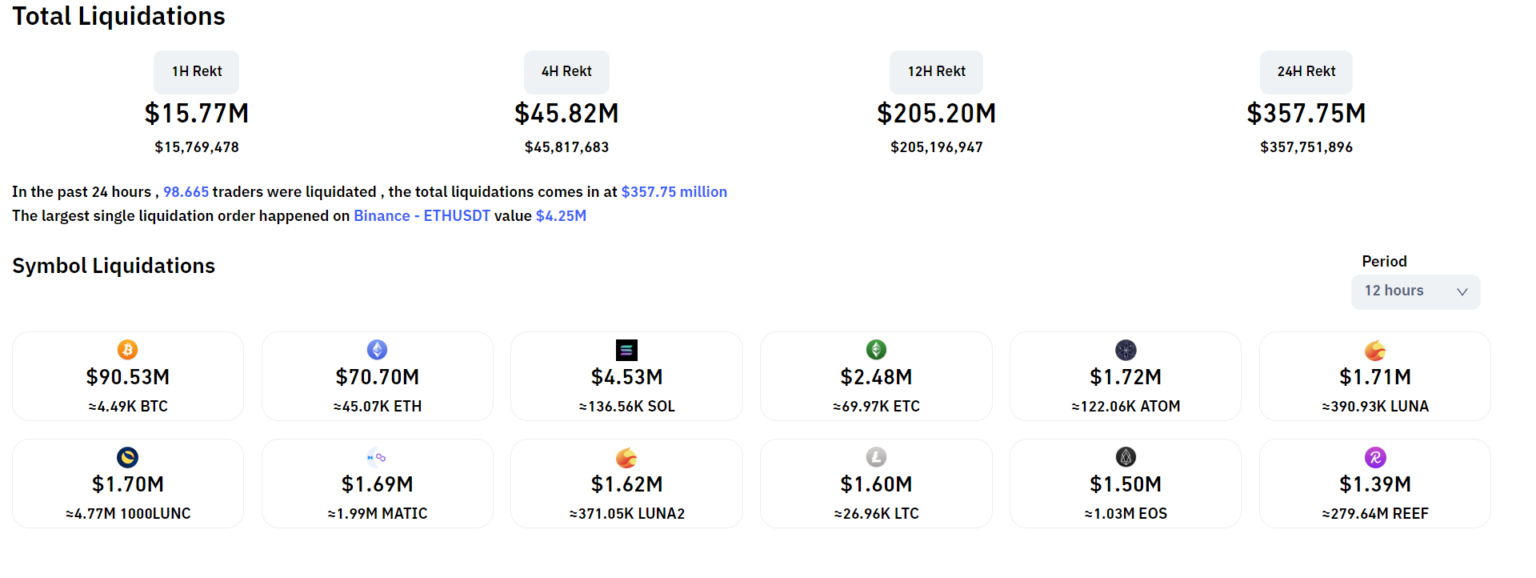

During this market downturn, $235 million in derivatives positions were liquidated in the past 12 hours, predominantly in BTC and ETH, with long positions comprising 82% of the liquidations.

Value of Liquidated Cryptocurrencies in the Past 12 Hours, Data from Coinglass at 08:00 AM on 14/09/2022

The U.S. stock market also ended trading on September 13 (U.S. time) with broad losses, with major indices falling between 4-5%.

[DB] US Close

— db (@tier10k) September 13, 2022

S&P500: -4.25%

Nasdaq: -4.99%

Dow: -3.92%

The stock market has lost approximately $1.6 trillion in capitalization due to this decline, marking it as the worst trading day of 2022 so far.

The U.S. stock market wiped out $1.6 trillion today pic.twitter.com/KzsFvXbMli

— Fintwit (@fintwit_news) September 13, 2022