Bitcoin Dumps to $27,700, BNB Approaches Liquidation Threshold

Late-night crypto markets on August 17 witnessed the latest price downturn affecting Bitcoin (BTC) and Binance Coin (BNB).

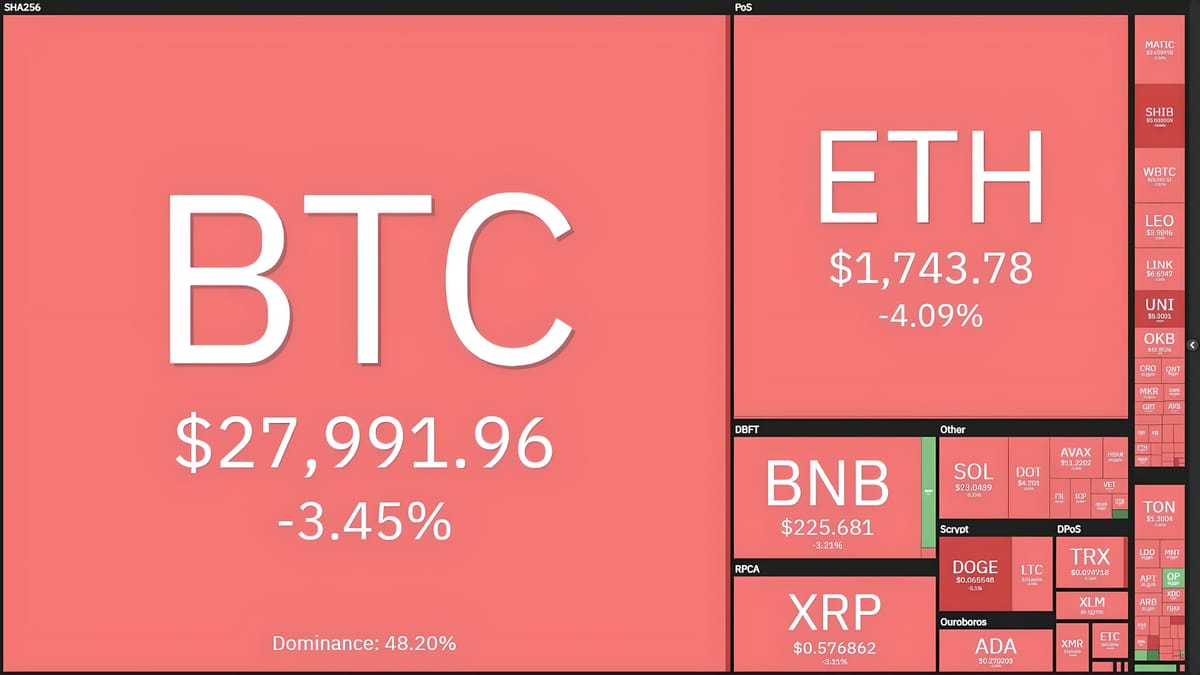

Following nearly a month-long sideways trend between $29,000 and $30,000, Bitcoin plummeted from $28,500 to as low as $27,700 on the evening of August 17, 2023.

This marked BTC's lowest price since June 20, amidst market optimism surrounding ETF prospects from major Wall Street players.

While the SEC has yet to rule on these proposals, the stagnant market conditions could no longer sustain, necessitating the adjustment. Recent statistics from Kaiko indicate that trading volumes have dropped to levels last seen in Q4 2020, a concerning signal exacerbated by dwindling supplies of major stablecoins.

Similarly, Ethereum (ETH) also experienced a sell-off, dropping to $1,726, a 4% decrease over the past 24 hours.

Top altcoins saw declines ranging from 3% to 5%.

All eyes, however, were on BNB as it approached $223.5, nearing the critical $220 threshold to trigger the liquidation of 200 million BNB tokens from the BNB Chain bridge attack in October 2022.

In mid-June 2023, BNB previously dropped to $220.4 amid negative news and subsequent legal challenges from the SEC, fortunately rebounding to avoid triggering liquidation orders.

BNB is in trouble if the price drops by just 2% to $220 USD!

— Ignas | DeFi (@DefiIgnas) August 17, 2023

Currently, BNB trading at 225 USD

There's a $200M liquidation on Venus if BNB price reaches this level.

But the BNB Chain is the sole liquidator of the BNB exploiter address. pic.twitter.com/vN3v6KxqWU

Binance has recently ramped up the frequency of new project launches on its launchpool and launchpad platforms, partly aimed at supporting BNB prices.

According to Coinglass, derivative liquidations totaled $100 million in the last four hours, with 92.3% of these being long positions.