Bitcoin ETFs Experience Largest Outflow in 3 Months with $237 Million Exiting

The crypto ETF investment space has shown a clear reaction to the recent downturn in the crypto and U.S. stock markets over the past 12 hours.

Bitcoin ETFs See Largest Outflow in 3 Months with $237 Million Exiting

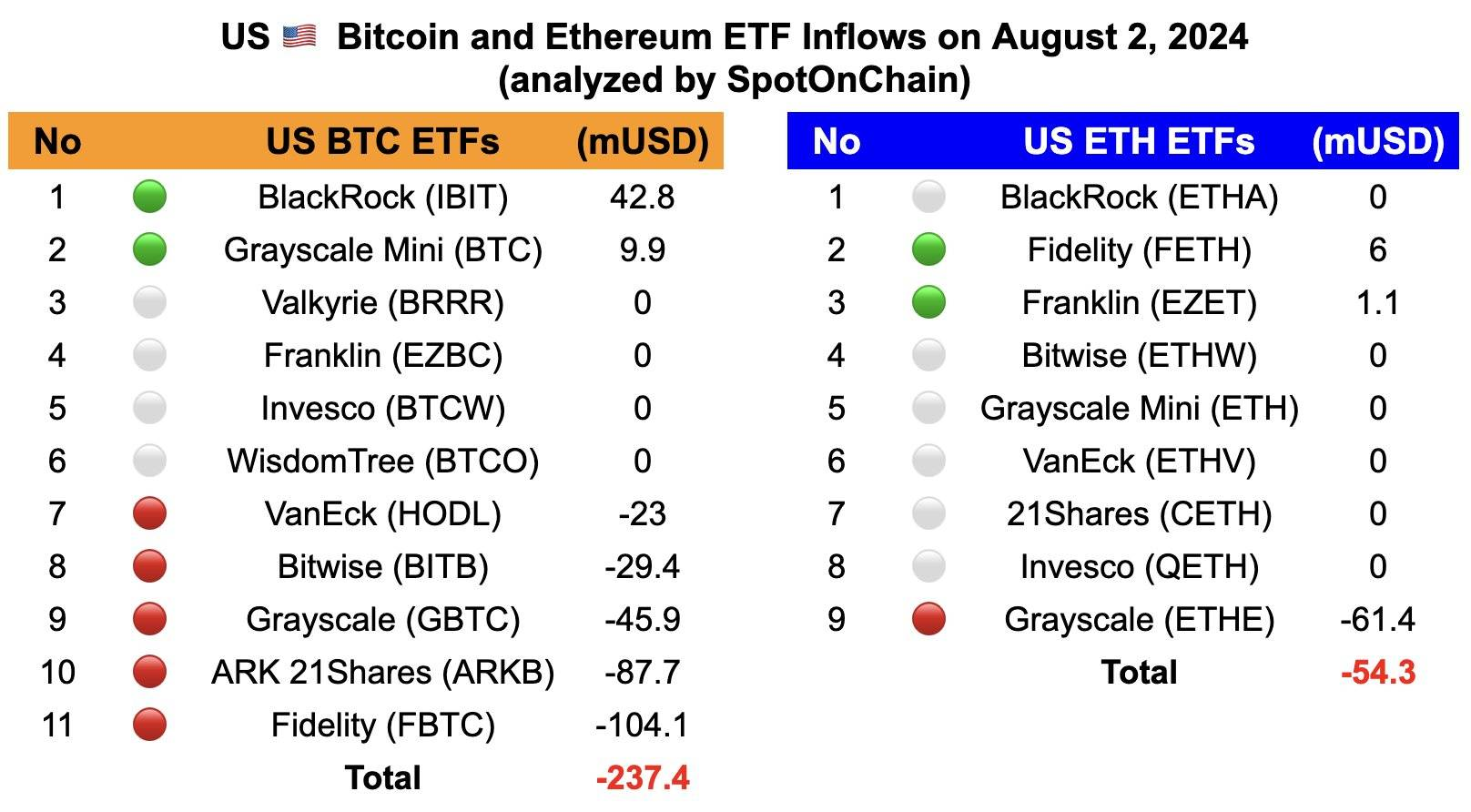

According to the latest data from SpotOnChain, U.S. Bitcoin spot ETFs ended trading on August 2 (U.S. time) with an outflow of $237.4 million.

This marks the highest outflow since May 1, when these investment products saw an outflow of $563.7 million.

Inflow/Outflow Statistics for Bitcoin and Ethereum ETFs on August 2, 2024

Source: SpotOnChain

Leading the sell-off was Fidelity’s FBTC fund, which saw an outflow of $104 million, followed by ARK Invest’s ARKB with $87.7 million and Grayscale’s GBTC with $45.9 million.

On the flip side, BlackRock’s IBIT and Grayscale’s BTC experienced inflows of $42.8 million and $9.9 million, respectively. The inflow for BTC almost evaporated compared to the previous day’s $191 million.

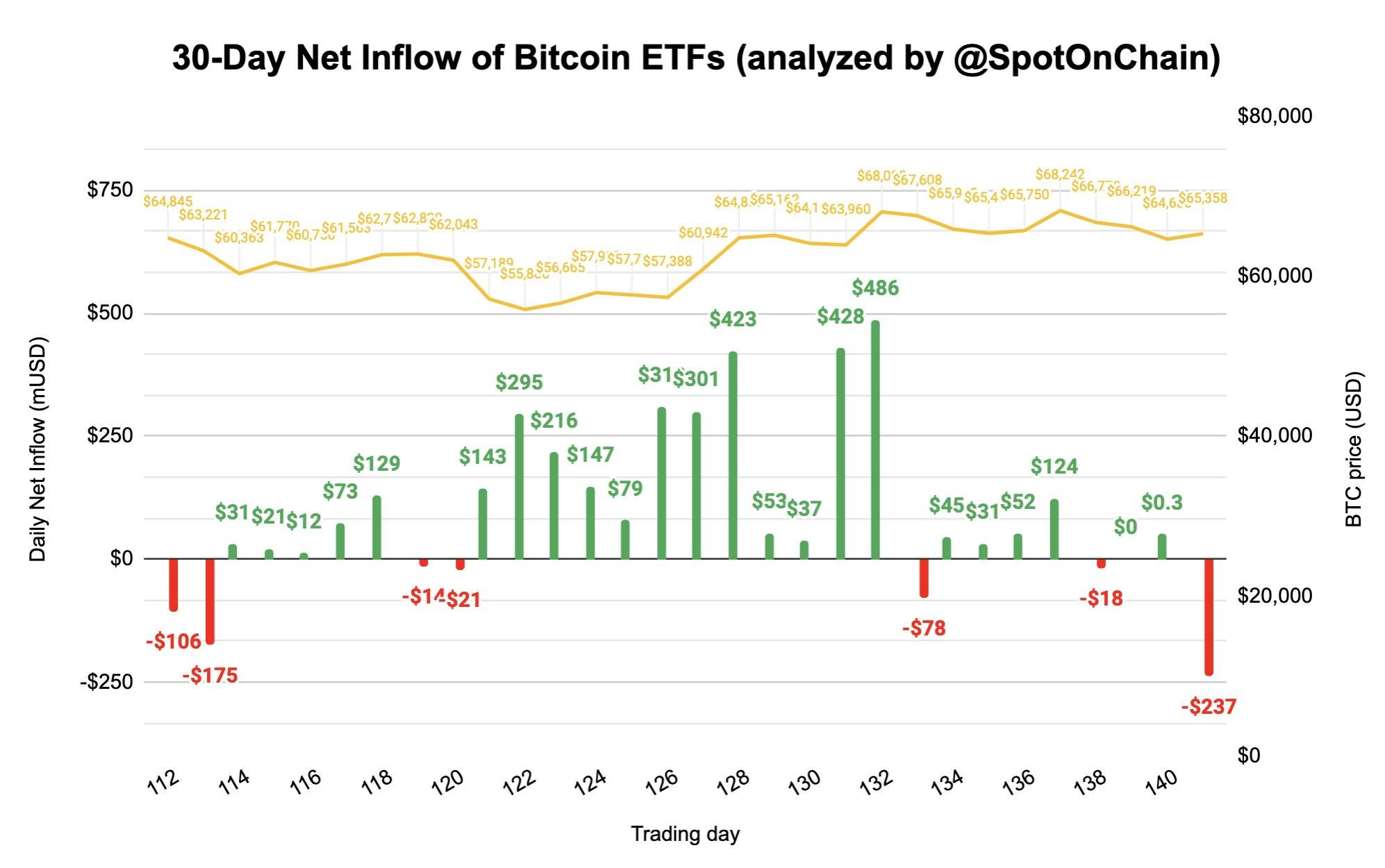

Overall, the 11 U.S. Bitcoin spot ETFs closed the recent trading week with a net outflow of $80.7 million, breaking a streak of weekly inflows that had persisted since early July.

Inflows/Outflows of U.S. Bitcoin ETFs Over the Past 30 Days

Source: SpotOnChain (03/08/2024)

As reported by Coin68, Bitcoin has dropped from $65,000 to $60,500 over the past 12 hours, impacted by the U.S. stock market following news that unemployment rates in the world's largest economy exceeded forecasts, raising recession fears.

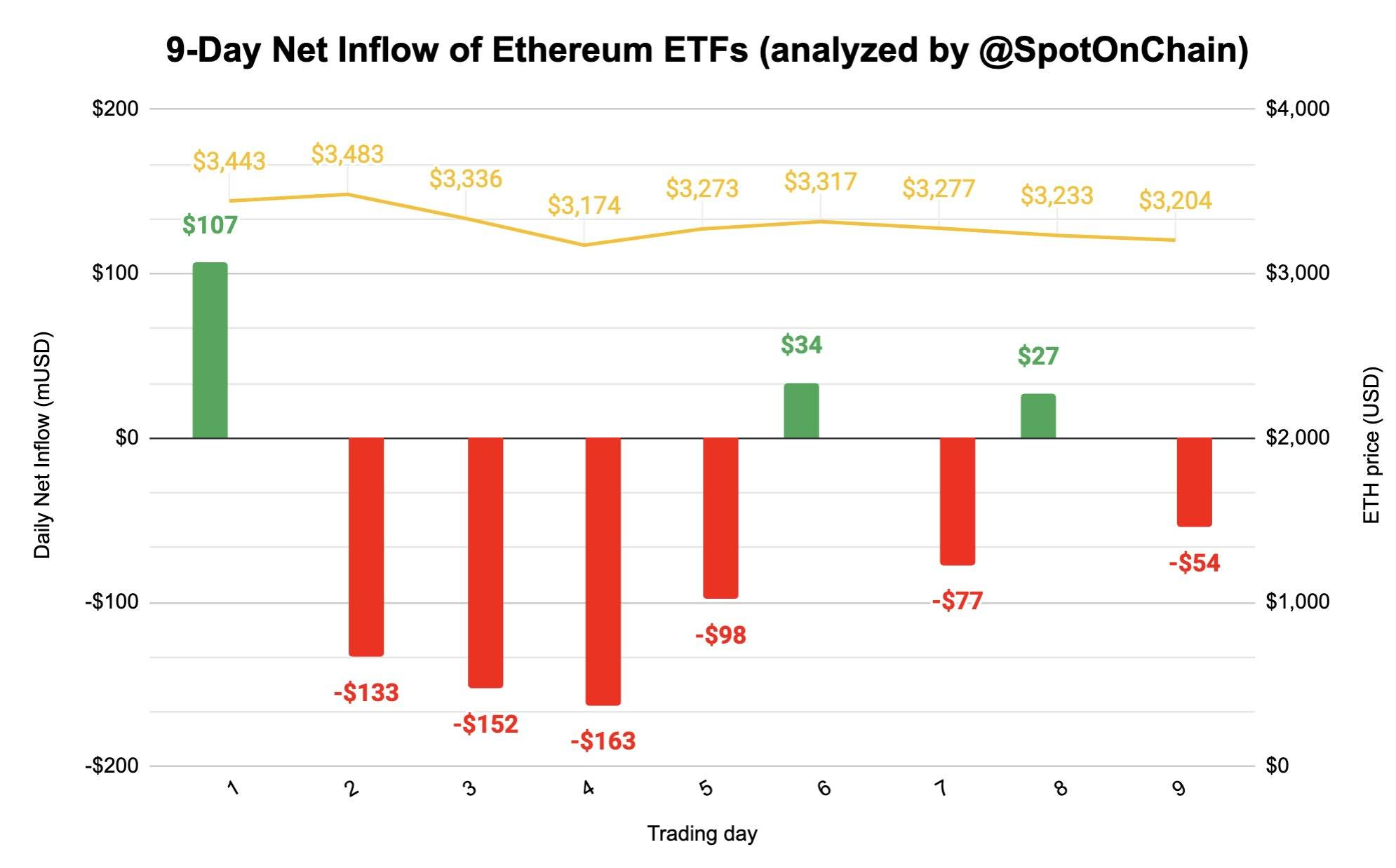

Meanwhile, Ethereum ETFs ended the second week with a total outflow of $169.4 million, including an outflow of $54.3 million on August 2.

Aside from minor inflows to Fidelity’s FETH and Franklin Templeton’s EZET, other funds saw no new capital, furthering the dominance of outflows from Grayscale’s ETHE.

Inflows/Outflows of U.S. Ethereum ETFs Over the Past 9 Days

Source: SpotOnChain (03/08/2024)

The surge in outflows from Ethereum ETFs in the early weeks of trading was anticipated, as investors shift from existing products like ETHE with a 2.5% annual management fee to newer funds with fees significantly lower.

Both BTC and ETH are experiencing sharp declines at the time of writing, nearly erasing gains made since early July.

4H Chart of BTC/USDT on Binance as of 11:15 AM, August 3, 2024

4H Chart of ETH/USDT on Binance as of 11:15 AM, August 3, 2024