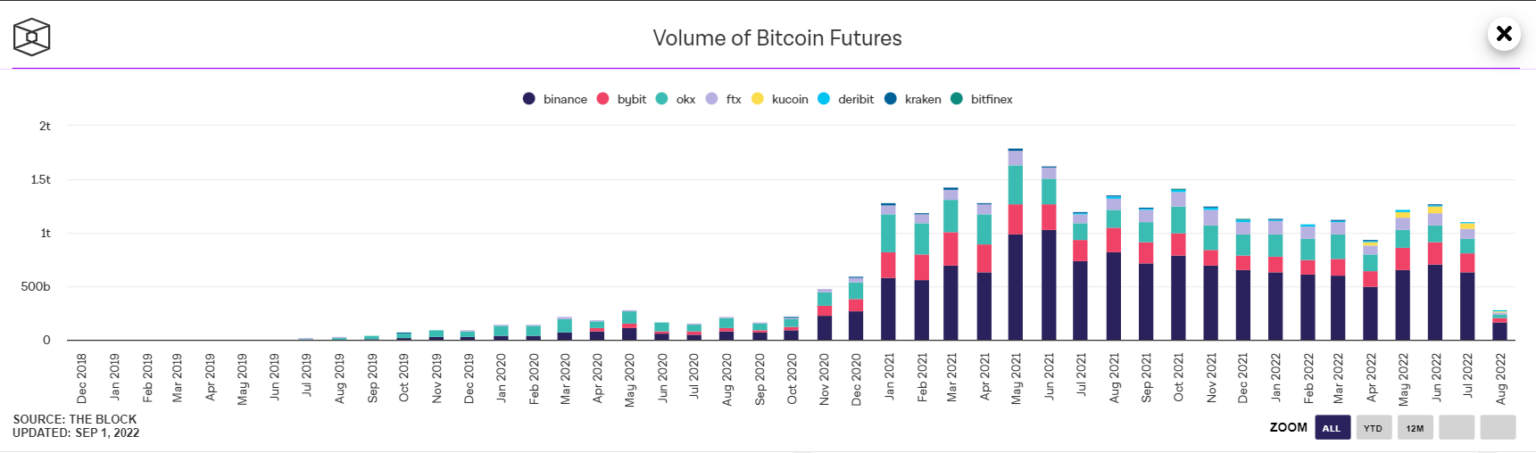

Bitcoin Futures Trading Volume Hits Two-Year Low

In August 2022, Bitcoin futures trading volume hit its lowest point since November 2020.

According to data from The Block Research, Bitcoin futures trading volume for August 2022 totaled $941.5 billion across exchanges. This marks the first month below $1 trillion since December 2020, when the volume was $970.1 billion. The lowest recorded volume was in November 2020, at $779 billion.

Monthly Bitcoin Futures Trading Volume as of September 2, 2022

Source: The Block

The primary reason for this decline appears to be Bitcoin’s poor price performance in recent times, which has seen a continuous downward trend with no significant recovery signals. For example, in July 2022, despite BTC briefly spiking above $24,000 following US inflation news, it quickly fell back to $20,000 after a brief Fed statement.

Adding to the negative sentiment, FUD (Fear, Uncertainty, Doubt) has been swirling around major platforms like Avalanche (AVAX) and Tellor (TRB), with rumors that Mt. Gox might soon release 142,000 BTC, causing concern about a potential market downturn.

Even major investment funds, once considered the last bastion of trust for investors, are now facing severe challenges. Galaxy Digital reported a $554 million loss for Q2 2022, Genesis Trading cut 20% of its staff after significant losses from 3AC, CEO Michael Moro resigned, Meitu lost nearly $44 million from Bitcoin investments, and billionaire Michael Saylor is facing a lawsuit for tax evasion while his company, MicroStrategy, is down over $1.3 billion (-34.4%) as of the time of writing.

On a national level, El Salvador continues to suffer, with its Bitcoin investment now worth half of its original value, equivalent to $59.2 million.

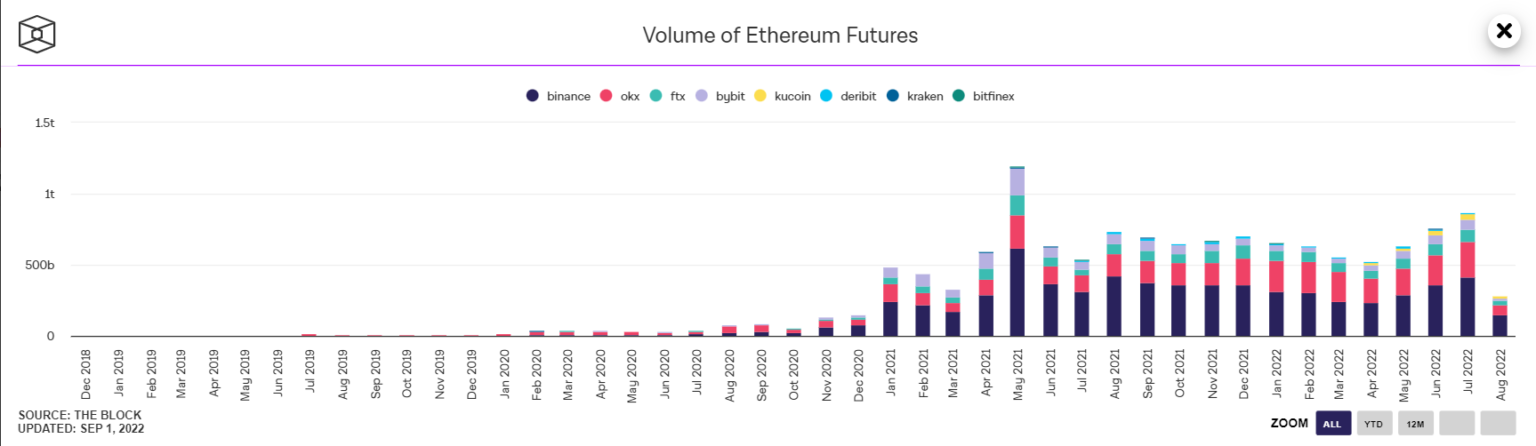

In contrast to Bitcoin, Ethereum (ETH) futures trading is experiencing a boom ahead of The Merge, surpassing the $1 trillion mark for the first time since May 2021.

Monthly Ethereum Futures Trading Volume as of September 2, 2022

Source: The Block

The Merge has significantly boosted Ethereum’s derivatives market, driven by CME’s launch of options for ETH futures and allowing investors to trade Ether futures in euros.

However, the surge in Ethereum futures alone does not guarantee that ETH will rise in value before The Merge is officially implemented on September 15-16. The current on-chain situation suggests a balanced battle among major players. Ethereum miners are actively accumulating, with their ETH balances reaching a four-year high, while Ethereum whales continue to push large volumes of ETH onto exchanges.