Bitcoin Hits $29,000 Before Reversing Back to Previous Levels

The world’s largest cryptocurrency, Bitcoin (BTC), swiftly shook off negative news from Binance to reach a high of $29,000.

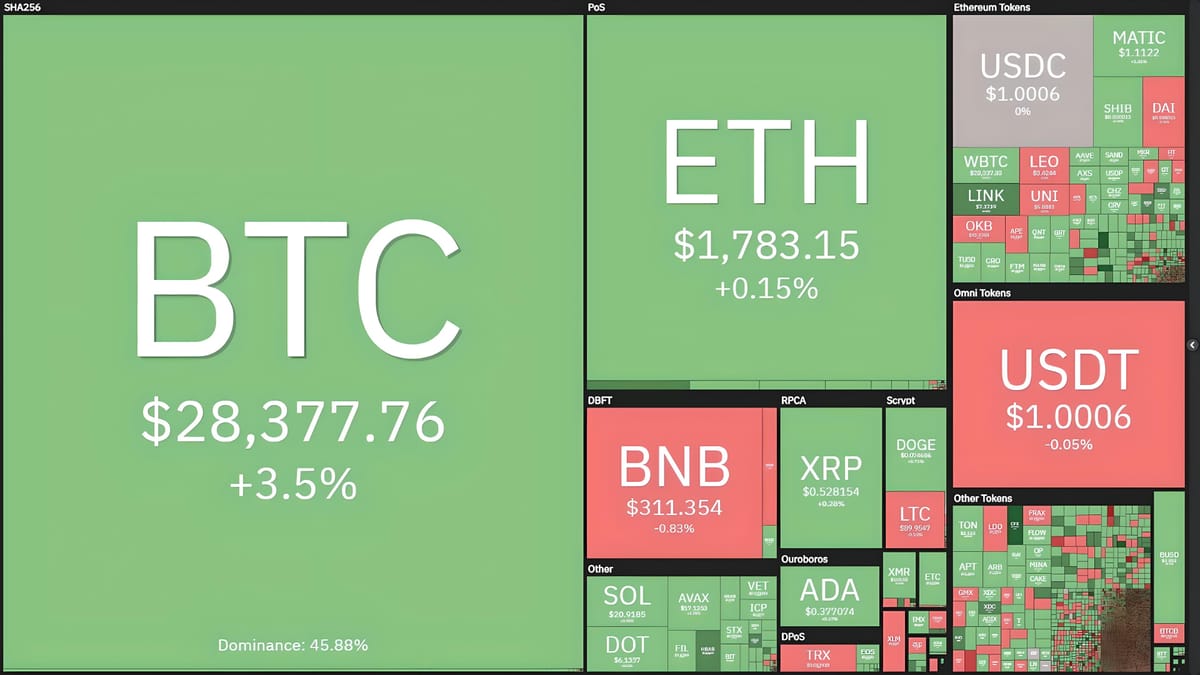

Price Movements of Major Cryptocurrencies at 10:15 AM on 30/03/2023. Source: Coin360

On the morning of March 30, Bitcoin surged from $28,400 to a new 2023 high of $29,184. This marks Bitcoin’s first return to the $29,000 range since early June 2022.

On the evening of March 29, Bitcoin also made a strong recovery from $27,500 to $28,600, marking a significant rebound from a dip to $26,500 on March 27, triggered by news of the U.S. Commodity Futures Trading Commission (CFTC) suing cryptocurrency exchange Binance. This news had disrupted Bitcoin’s upward momentum following the Federal Reserve’s decision to hold off on aggressive rate hikes on March 23, which nearly pushed BTC past the $29,000 mark.

However, Bitcoin’s price unexpectedly dumped $1,000, falling back to $28,100.

15-Minute Chart of BTC/USDT on Binance at 10:10 AM on 30/03/2023

Since the mid-March banking FUD, Bitcoin has surged nearly $10,000 from $19,549 to $29,184, representing a 49.2% increase.

If Bitcoin maintains its current price, it stands a chance of closing March and Q1 2023 in the green. Specifically, Bitcoin’s monthly candle is up 25.28%, marking a continuous rise over the past three months and contributing to a 75% increase for Q1.

Another notable development this week is MicroStrategy’s disclosure of a $150 million purchase of additional BTC at an average price of around $23,400. With Bitcoin’s rebound to $29,000, the company’s nearly 139,000 BTC holdings (worth $4 billion) are now just 3.5% away from breakeven.

Ethereum (ETH) also leveraged Bitcoin’s rally to rise back to $1,829 but still needs another leg up to surpass the $1,857 peak from March 23 to set a new 2023 record.

15-Minute Chart of ETH/USDT on Binance at 10:10 AM on 30/03/2023

The total market capitalization of cryptocurrencies has reached $1.2 trillion, with BTC making up 46.7% of this total.

The recent Bitcoin pump-dump has left a negative impact on the derivatives market, with $41 million in futures positions liquidated within the last hour, split evenly between long and short positions.

Cryptocurrency Liquidation Value in the Last Hour, Data from Coinglass at 10:20 AM on 30/03/2023