Bitcoin Mining Difficulty Hits New All-Time High

In the latest adjustment, Bitcoin’s mining difficulty has surged by 7.56%, setting a new all-time high.

Bitcoin Mining Difficulty Dynamics

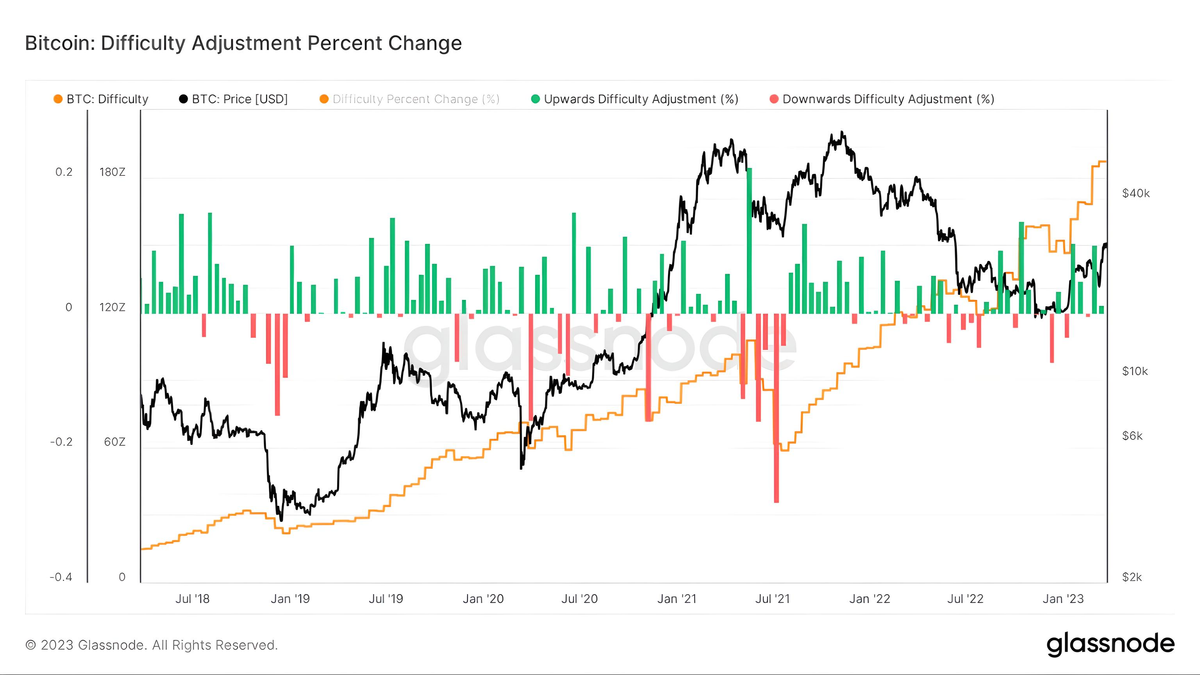

The graph shows Bitcoin’s mining difficulty (gold) and BTC price (black) alongside difficulty changes (green bars) from early 2018 to the present. Source: Glassnode

On March 24, during the bi-weekly difficulty adjustment, Bitcoin’s mining difficulty reached a new ATH of 46.84 T, marking a 7.56% increase from the previous period. The total number of blocks in the network also saw a new high of 782,208 blocks.

Additionally, the hash rate has shown significant growth, climbing to 341.24 EH/s compared to the previous average hash rate of 311.69 EH/s.

Recent Bitcoin Mining Difficulty Adjustments

Source: BTC.com

Mining difficulty refers to the complexity of the computational process required for mining and is adjusted every 2,016 blocks to ensure that block times remain around 10 minutes per block.

Since the beginning of the year, Bitcoin’s mining difficulty has increased by 30%, aligning with Bitcoin's price recovery. The king of crypto has surged 70% from approximately $16,450 to hit $28,700 on March 19.

In 2022, Bitcoin mining companies struggled with shrinking profit margins. Major players like Core Scientific, Argo Blockchain, and Riot Blockchain faced financial difficulties and bankruptcy risks.

Meanwhile, some companies are pivoting their business models. For instance, Stronghold Digital Mining has shifted its core operations to selling mined energy. Applied and Riot have dropped “blockchain” from their brands to signal a strategic shift away from cryptocurrency. Most recently, TeraWulf has adopted a “clean” Bitcoin mining model using nuclear energy, aiming to minimize environmental toxins.