Bitcoin Mining Giant Argo Blockchain Faces Bankruptcy Rumors

Bitcoin mining heavyweight Argo Blockchain might be on the verge of filing for bankruptcy, according to leaked internal communications.

Argo Blockchain Faces Bankruptcy Rumors

Argo Blockchain, a prominent player in the Bitcoin mining space, has reportedly accidentally disclosed its bankruptcy filing plans. This news was shared by Will Foxley, Director of Content at Compass Mining, who posted a screenshot of the confidential notice from Argo Blockchain on December 9.

Argo is preparing for a bankruptcy on Monday, per a screenshot of a document sent my way (likely accidentally posted). https://t.co/aXmFuMNSXF pic.twitter.com/kQtLwZOKct

— Will Foxley 🔳 (@wsfoxley) December 9, 2022

The notice to investors suggests that Argo may be preparing to file for Chapter 11 bankruptcy in the U.S. Bankruptcy Code.

The situation is further substantiated by the fact that on the same day, it was reported that Argo's shares had been temporarily suspended by the UK's Financial Conduct Authority (FCA) following a significant drop in November's revenue.

Bitcoin Miner Argo’s Shares Suspended in UK as Revenue Declines https://t.co/9QijAzS1r2 — Will Foxley ? (@wsfoxley) December 9, 2022

If these rumors prove true, it would represent a significant blow to the cryptocurrency mining sector, potentially impacting the broader market in the near future amid ongoing liquidity challenges.

In November 2022, Bitcoin hit a low of $15,476, partly due to the FTX fallout but also due to massive selling pressure from Bitcoin miners. This "panic" may worsen as the industry's top players, such as Bitcoin mining giants Core Scientific and Iris Energy, are facing record-low revenues.

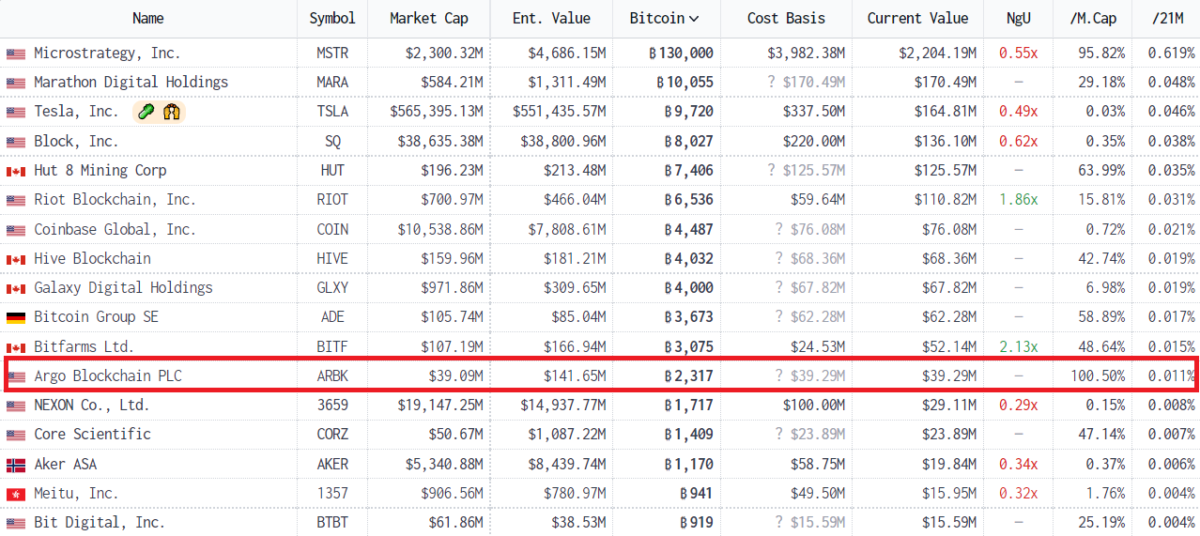

According to Bitcointreasuries, Argo Blockchain is among the top publicly listed companies holding a substantial amount of Bitcoin, approximately 2,317 BTC.

Largest Bitcoin Investments and Holdings of Publicly Listed Companies. Source: Bitcoin Treasuries

On the flip side, the chart highlights Marathon Digital’s significant position, with 10,005 Bitcoins, trailing only behind MicroStrategy. Marathon Digital is considered a final bastion for miners, steadfastly holding onto Bitcoin through the "crypto winter" despite a 44% reduction in mining productivity in Q2 2022 and a mining facility closure following a severe storm on June 11.

However, last week, Marathon Digital revealed exposure of up to $80 million to Compute North Holdings, a data center company supporting Bitcoin miners that has now filed for bankruptcy. This gap raises concerns about Marathon Digital’s financial health, adding to investor anxiety.

Top Bitcoin mining firm Marathon Digital Holdings disclosed it has over $80 million of exposure in the bankrupt data center firm Compute North Holdings https://t.co/EezfH3sFAc

— Bloomberg Crypto (@crypto) October 9, 2022