Bitcoin Plunges to $19,300, Continues to Sink the Market in a “Sea of Flames”

Bitcoin has once again plunged the cryptocurrency market into a “sea of flames.” Unlike the similar scenario in late August, this time the situation is expected to be much worse.

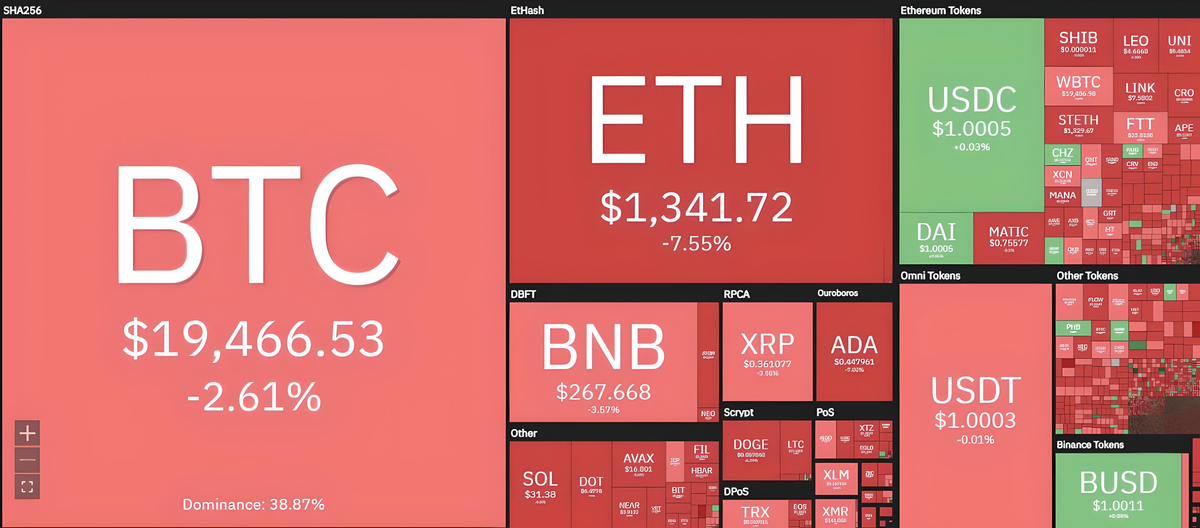

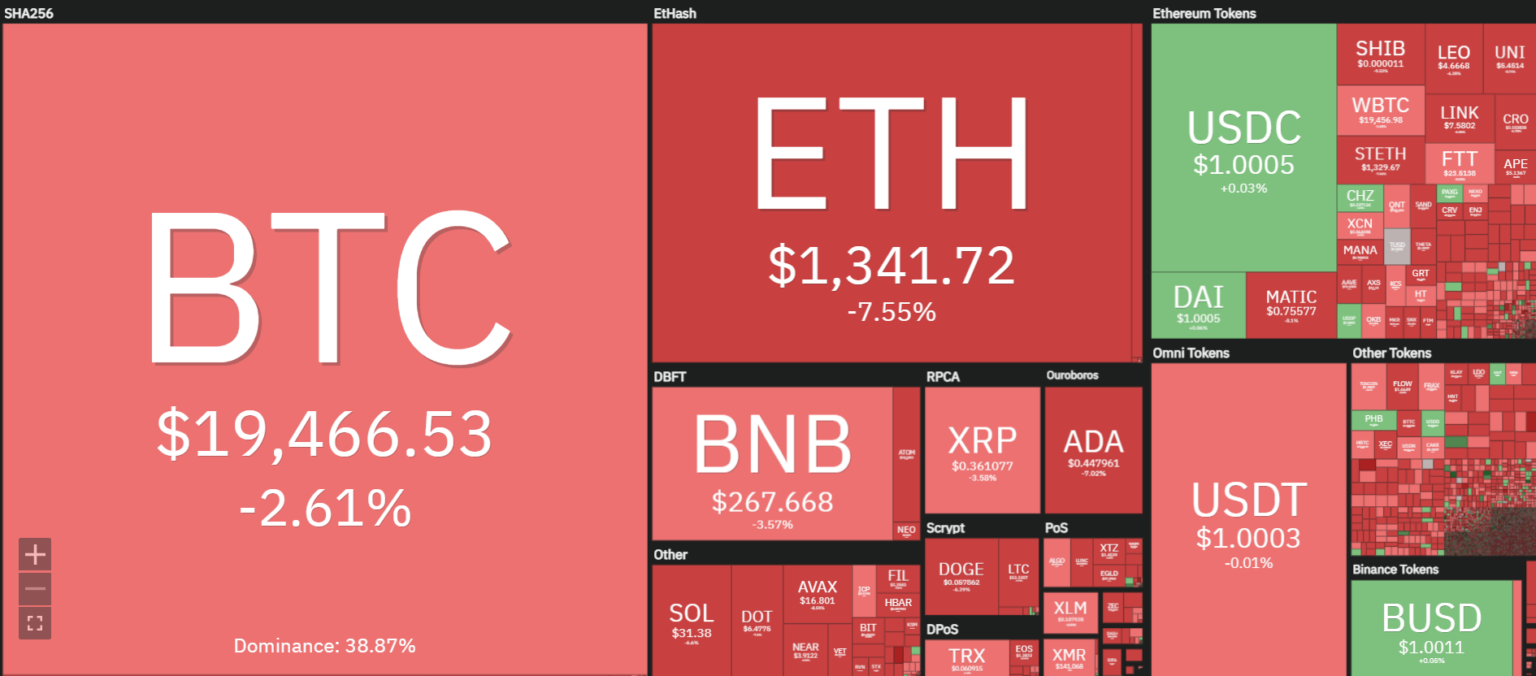

After experiencing a series of “rollercoaster” movements over the past two weeks—rising sharply before the US CPI announcement, then dipping below $20,000 during The Merge, and briefly recovering to around $20,100 over the weekend—Bitcoin suddenly fell to $19,300 in the early hours of September 19. This drop triggered a significant sell-off across the altcoin market, with many assets experiencing double-digit losses.

At the time of writing, BTC is struggling to counteract the strong sell pressure and is trading around $19,403.

Source: Binance

The second-largest cryptocurrency, Ethereum, has also seen a severe drop, losing nearly 10% over the past 24 hours and still struggling to recover from the The Merge incident. Ethereum is currently trading at $1,331.89

Source: Binance

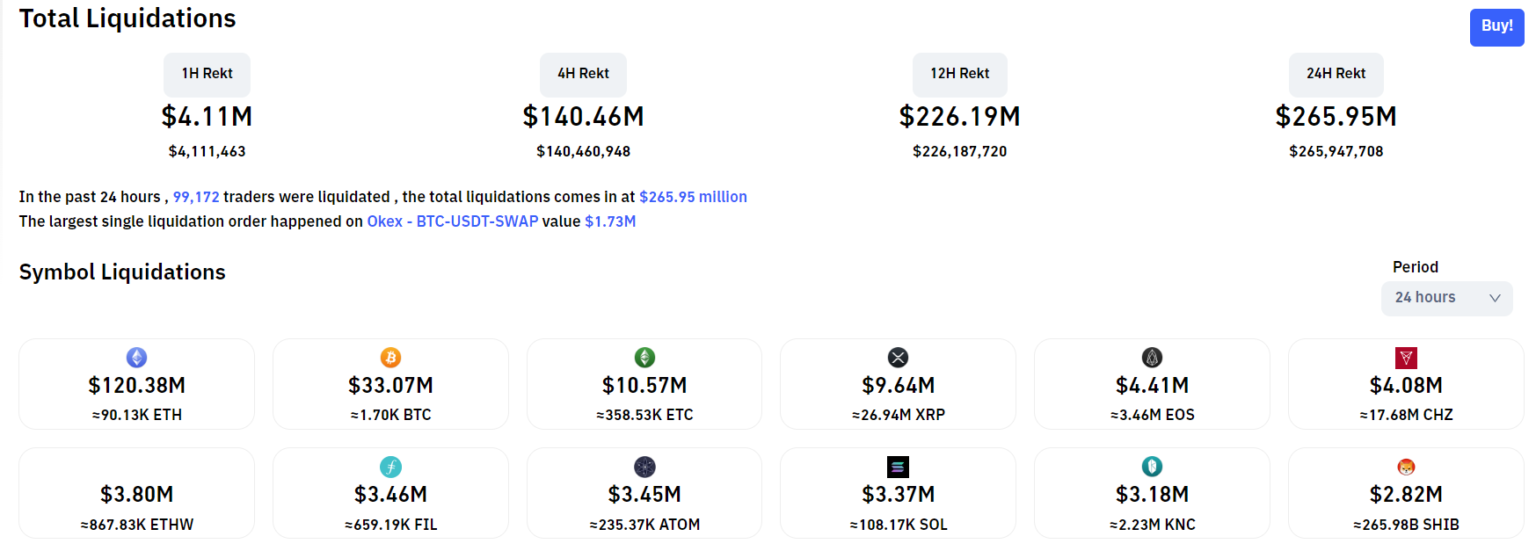

Over the past 24 hours, $265.95 million worth of cryptocurrency positions were liquidated, with nearly 90% being long positions. Ethereum led the liquidations with $120.38 million, followed by Bitcoin at $33.07 million.

Source: Coinglass

The cause of Bitcoin's latest collapse appears to be clear, largely driven by macroeconomic factors influenced by the Federal Reserve.

The ongoing pressure from Fed Chair Jerome Powell’s speech at the Jackson Hole conference on August 26—where he emphasized the Fed’s commitment to raising interest rates despite potential economic pain—combined with the disappointing August CPI figures, has heightened investor fears. This fear is further exacerbated by the anticipated Fed rate hike on September 22.

Additionally, according to blockchain analytics firm Glassnode, as of September 16, 213,000 BTC, equivalent to over $4.3 billion, was moved to exchanges. This represents the highest amount of BTC moved to exchanges in a year, increasing investor anxiety about potential sell pressure.

216k #Bitcoin send to exchanges. I don't make the rules but if they are going to dump it, we will break all residents to down side with Eaaaaas 😅 pic.twitter.com/ifS03BXSCJ

— KGV10000 (@kgv10000) September 16, 2022

Moreover, Glassnode's data from the past week shows a significant spike in the volume of miners transferring BTC to exchanges, reflecting the broader trend as major Bitcoin mining companies began liquidating their holdings in early September.

Miner to spot exchange flow this month. It really doesn't look good. It could indicate preparation to the worst case and a final melt down. #Bitcoin #btc #Miner #capitulation pic.twitter.com/PKtXenKLgk

— KGV10000 (@kgv10000) September 18, 2022

The current scenario may be even worse. During the Jackson Hole conference, Bitcoin fell to $20,000 and repeatedly tested the $19,500 support level 5-6 times before bottoming out at $18,500, recovering only after a two-week struggle.

At the CPI announcement last week, BTC failed to hold the $20,000 level and tested the $19,500 support three times. With the Fed now set to take direct action—likely with a 0.75% rate hike—many experts predict Bitcoin could see a new low in September 2022.