Bitcoin Plunges to $20,000 Ahead of Fed Speech, Sinks Market into "Sea of Fire"

Bitcoin (BTC) and the entire cryptocurrency market experienced intense volatility in the early hours of August 27th, following remarks by Fed Chair Jerome Powell about the current inflation situation in the U.S.

On the evening of August 26th, during his highly anticipated annual policy speech at the Jackson Hole conference in Wyoming—where central banks, finance ministers, investors, and global financial market researchers gather—Fed Chair Jerome Powell stated that the Fed would use its financial tools more aggressively to tackle inflation, which remains near a 40-year high.

Fed Chair Jerome Powell was expected to speak for 30 minutes at Jackson Hole, but ended up speaking for only a third of that time.

— Bloomberg (@business) August 26, 2022

Watch his full speech: https://t.co/zBg8H0mk6M pic.twitter.com/80ImcoAEgJ

Powell indicated that the Fed plans to continue raising interest rates despite the potential for causing some “pain” to the U.S. economy. He described this as a firm commitment to curbing inflation. Powell commented:

“While higher interest rates, slower growth, and softer labor market conditions will reduce inflation, they will also bring some harm to households and businesses. These are the unfortunate costs of reducing inflation. Restoring inflation to our 2% target is our most important focus right now.”

Jerome Powell says restoring inflation to the 2% target is the central bank’s “overarching focus right now” even though consumers and businesses will feel economic pain https://t.co/WkU7g95Sdm pic.twitter.com/GXDyqMSueh

— Bloomberg TV (@BloombergTV) August 26, 2022

Before this announcement, Bitcoin had already seen dramatic fluctuations, dropping sharply to around $21,000 before bouncing back to $21,800. However, once Powell's remarks were made public globally, BTC began to decline again, crashing from $21,800 to as low as $20,100, marking its lowest price since July 15, 2022. At the time of writing, BTC is trading around $20,311.

BTC/USDT 1H Chart. Source: Binance

Bitcoin’s freefall quickly engulfed the market in a "sea of fire," causing most top altcoins to plummet by double digits. Ethereum (ETH), which has been under significant investor scrutiny due to the upcoming Merge, was not spared from the carnage.

ETH fell through the $1,500 support level to $1,486.85, representing a nearly 10% drop over the past 24 hours, and is currently trading at $1,515. The sell-off was exacerbated by Ethereum whales offloading large amounts of ETH before the Merge activation.

ETH/USDT 1H Chart. Source: Binance

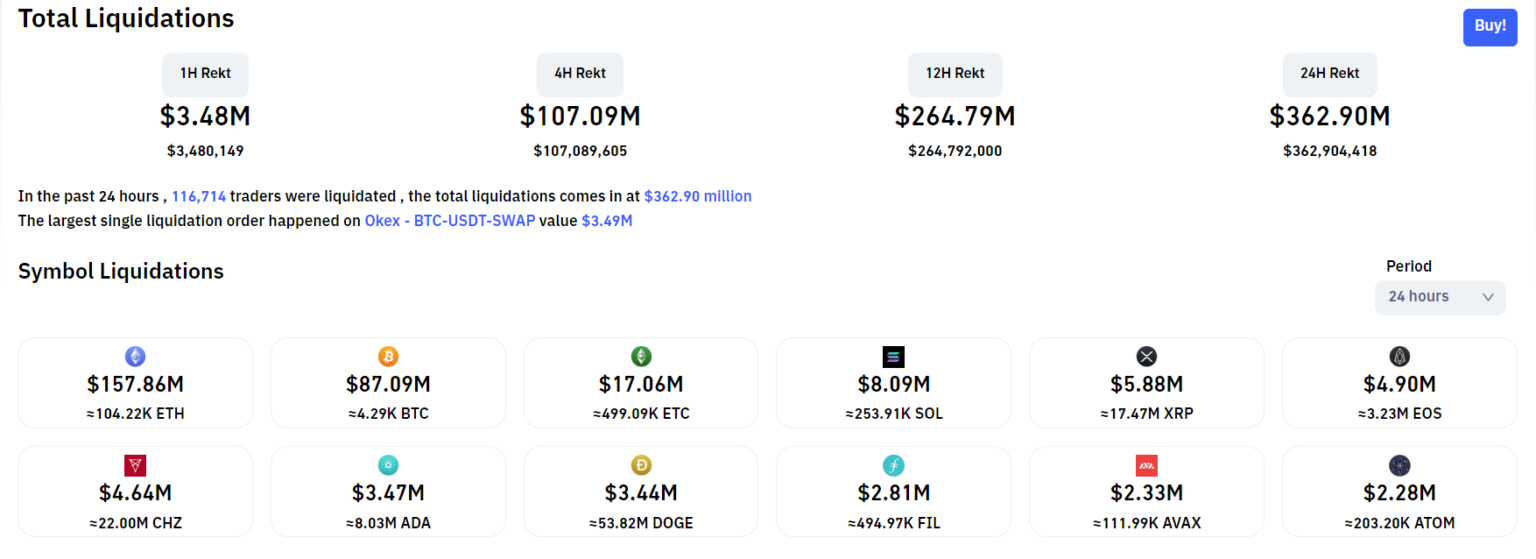

In just the past 24 hours, $362.9 million worth of crypto positions were liquidated, with over 92% of these being long positions, predominantly in ETH and BTC.

Total Crypto Liquidations in the Past 24 Hours as of 8:28 AM on August 27, 2022. Source: Coinglass

Not only did the crypto market suffer, but Powell's brief remarks also wiped out $1.25 trillion from the U.S. stock market on August 26th.

The U.S. stock market wiped out $1.25 trillion today pic.twitter.com/Dfk6gKZlvl

— Fintwit (@fintwit_news) August 26, 2022

The Bitcoin dump has created a shockwave across the entire crypto sector, given the Fed's more aggressive stance on interest rates. It was somewhat anticipated since Bitcoin had managed to recover somewhat in the first two weeks of August, owing to the lack of Fed rate hikes and positive reactions to GDP and CPI data, pushing BTC above $24,000.

However, with the market now in a “frozen” state and lacking significant news to drive further recovery, BTC’s susceptibility to macroeconomic catalysts has been highlighted.

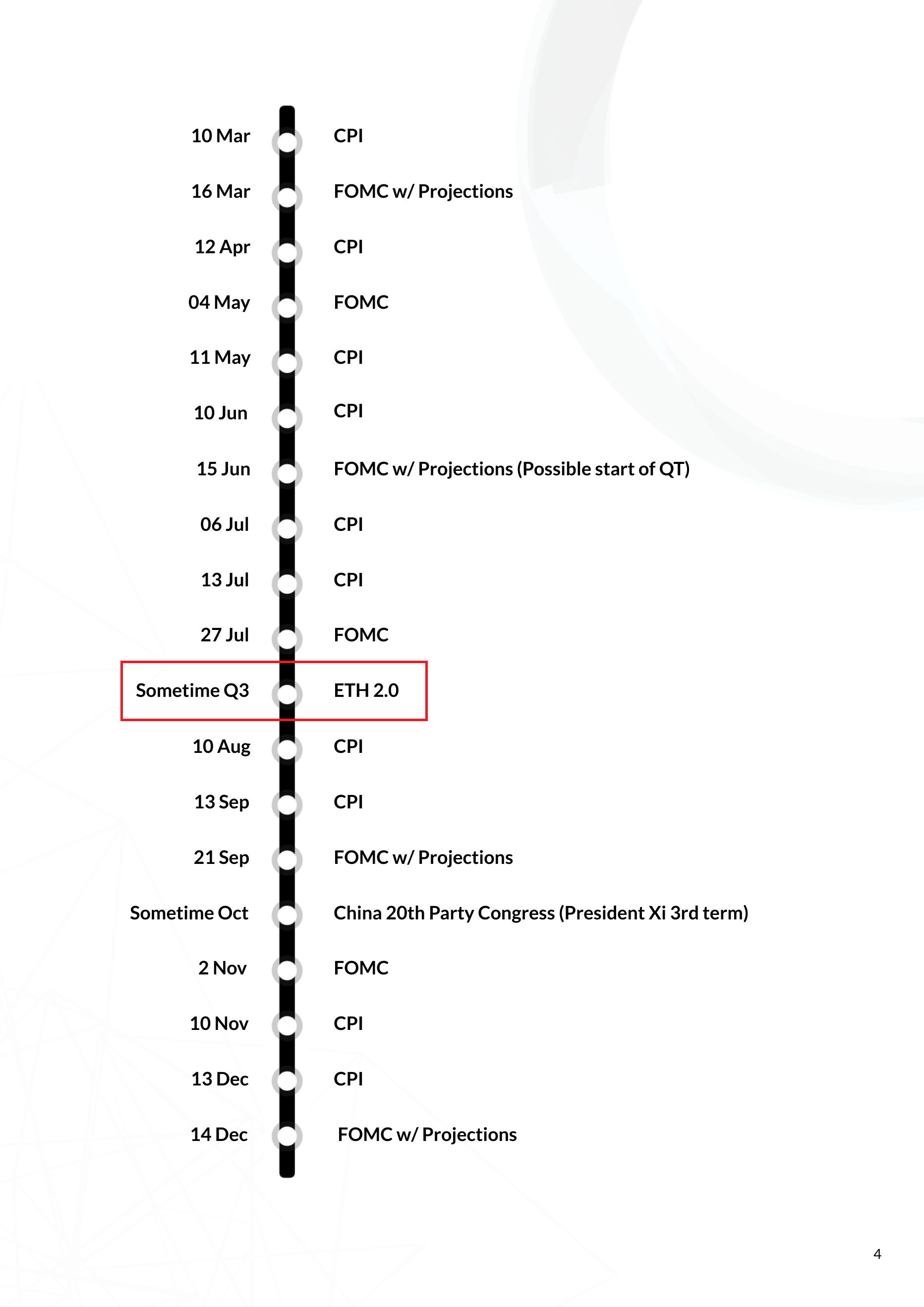

Looking ahead, the Fed is scheduled for three more rate hikes on September 21, November 2, and December 14, meaning Bitcoin and the broader market may face even more challenges in the future.