Bitcoin Price Experiences Wild Fluctuations Following Fed's Interest Rate Hike and Powell's Remarks

Bitcoin's (BTC) value has plummeted to the $20,000 range, reverting to levels seen before recent macroeconomic news affected the crypto market.

Top crypto price movements as of 08:10 AM on 03/11/2022. Source: Coin360

In the early hours of November 3rd, the Federal Reserve (Fed) – the central bank of the United States – announced its latest interest rate adjustment. As expected, the Fed maintained its 0.75% rate hike for the fourth consecutive time in 2022.

So far this year, the Fed has raised interest rates a total of six times, pushing the key rate from 0.25% to 4%. This is the highest rate imposed by the Fed since the 2008 economic crisis, aiming to curb U.S. inflation, which has remained at its highest levels in four decades for several months.

The Fed is expected to make one more rate adjustment on December 15th (Vietnam time).

In the press conference following the rate hike decision, Fed Chairman Jerome Powell made notable remarks:

– Powell acknowledged that the rate hikes have significantly impacted U.S. economic growth, leading Fed officials to consider slowing the rate increases. The Fed may start to reduce the pace of rate hikes as early as December, potentially increasing by 0.5%.

– Recent inflation data remains high and hasn’t decreased as anticipated, meaning the Fed is not yet considering halting rate hikes.

– The target interest rate the Fed is aiming for might be higher than previously announced.

Initially, Bitcoin (BTC) showed mixed reactions to the Fed's 0.75% rate hike, which was in line with expectations. BTC dropped from around $20,450 to $20,141 shortly after the Fed's announcement but surged to $20,800 when Powell suggested that the rate hike pace might slow down starting in December.

However, when Powell announced that the target interest rate for 2023 could be higher than previously expected, Bitcoin, the world’s largest cryptocurrency, fell sharply to $20,048 before recovering slightly and trading between $20,100 and $20,200 in the subsequent hours.

15-minute chart of the BTC/USDT pair on Binance at 08:10 AM on 03/11/2022

Bitcoin has thus returned to the price range seen at the end of October, when Bitcoin and the broader market experienced a rally in anticipation of macroeconomic news from the U.S.

Other major cryptocurrencies were also affected by Bitcoin's price movements: Ethereum dipped to $1,502, while other altcoins adjusted between 2% and 8% from their prices 24 hours earlier.

15-minute chart of the ETH/USDT pair on Binance at 08:10 AM on 03/11/2022

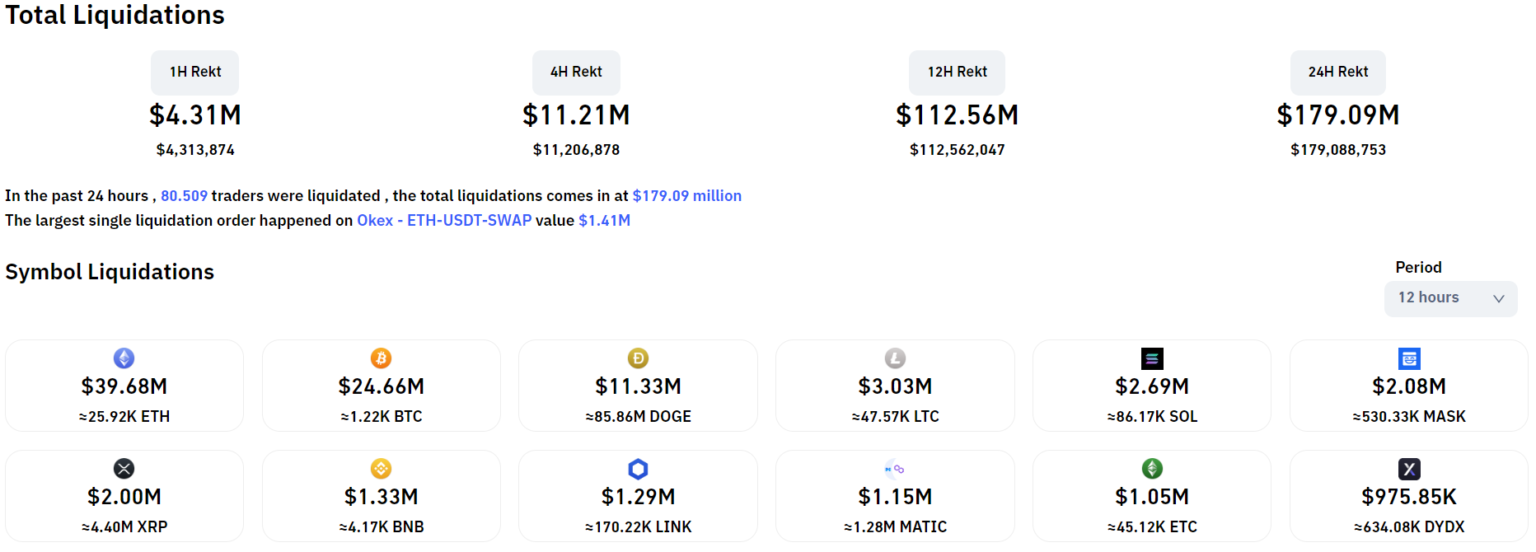

The latest Bitcoin and altcoin volatility resulted in over $112 million in crypto derivatives being liquidated in the past 24 hours, with a significant concentration in ETH, BTC, and DOGE – a coin that surged over 150% in the past week due to news of Elon Musk's acquisition of Twitter. This liquidation ratio reflects a more balanced long-short position, with 65.21% being long, compared to the recent price fluctuations which had shown a significant imbalance.

Value of cryptocurrency liquidations in the last 12 hours, data from Coinglass at 08:10 AM on 03/11/2022

Not only the crypto market but also U.S. stock indices and shares of major corporations were in the red at the close of trading on November 2nd, reflecting the impact of the Fed Chairman’s latest remarks.

[DB] US Close

— db (@tier10k) November 2, 2022

S&P500: -2.39%

Nasdaq: -3.15%

Dow: -1.45%

Top U.S. stock movements at the close of trading on November 2nd. Source: Finvitz

At 07:30 PM on November 10th (Vietnam time), the U.S. will release the Consumer Price Index (CPI) for October – a measure of inflation which will significantly influence the Fed's future interest rate decisions.