Bitcoin Price Fluctuates Sharply After Fed Rate Hike and Powell's Remarks

The price of Bitcoin (BTC) has dropped to around $20,000, the level it was at before recent macroeconomic news impacted the crypto market.

Top Crypto Price Movements at 08:10 AM on 03/11/2022. Source: Coin360

In the early hours of November 3rd, the Federal Reserve (Fed) announced its latest interest rate adjustment. As anticipated, the Fed raised rates by 0.75% for the fourth consecutive time in 2022.

This brings the total number of rate hikes this year to six, increasing the key rate from 0.25% to 4%. This is the highest interest rate the Fed has imposed since the 2008 financial crisis, aimed at curbing U.S. inflation, which has been at its highest level in four decades for several months.

The Fed is expected to make one more rate adjustment at its meeting on December 15 (Vietnam time).

During the press conference following the rate hike decision, Fed Chair Jerome Powell made some notable statements:

– Powell acknowledged that the rate hikes have significantly impacted U.S. economic growth, leading Fed officials to consider slowing the pace of rate increases. A reduction in the rate hike pace could start as early as December, with a possible increase of 0.5%.

– Recent inflation data remains high and does not show the expected decrease, meaning the Fed is not yet considering halting rate hikes.

– The target interest rate set by the Fed may end up being higher than previously announced.

Initially, Bitcoin (BTC) had an unclear reaction to the Fed’s 0.75% rate hike, as expected. BTC fell from around $20,450 to $20,141 shortly after the Fed's announcement, then surged to $20,800 when Powell indicated that rate hikes could slow down starting in December.

However, when Powell stated that the target interest rate for 2023 might be higher than previously projected, Bitcoin, the largest cryptocurrency, dropped sharply to $20,048 before slightly recovering and trading within the $20,100 – $20,200 range in the following hours.

15-minute Chart of BTC/USDT on Binance at 08:10 AM on 03/11/2022

Thus, Bitcoin has returned to the price range seen at the end of October, when Bitcoin and the broader market experienced a rally in anticipation of upcoming macroeconomic news from the U.S.

Other major cryptocurrencies were also affected by Bitcoin's price fluctuations: Ethereum fell slightly to $1,502, while other altcoins adjusted between 2% to 8% compared to their prices 24 hours ago.

15-minute Chart of ETH/USDT on Binance at 08:10 AM on 03/11/2022

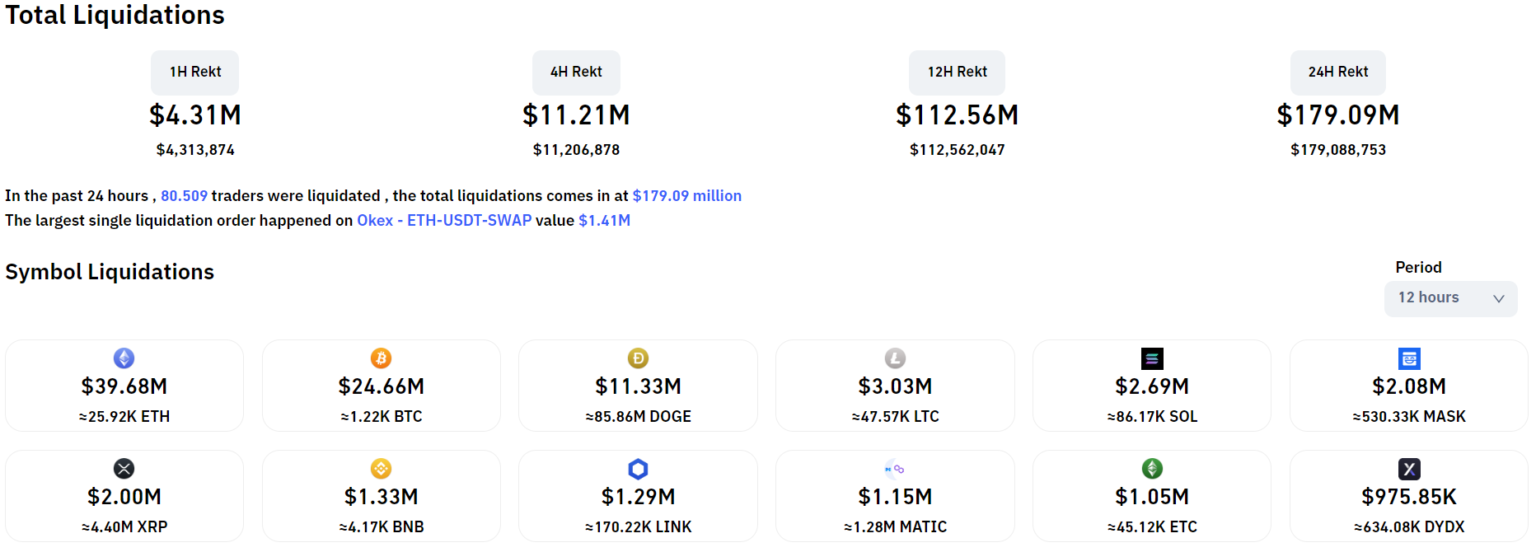

The latest Bitcoin and altcoin volatility led to over $112 million in crypto derivatives being liquidated in the past 24 hours, predominantly affecting ETH, BTC, and DOGE—the latter of which surged over 150% in the past week due to news of Elon Musk acquiring Twitter. The liquidation rate this time shows a more balanced distribution between long and short positions, with 65.21% long positions, as opposed to previous imbalances in recent price movements.

Crypto Liquidation Values in the Last 12 Hours, Data from Coinglass at 08:10 AM on 03/11/2022

Not only did the crypto market react, but U.S. stock indices and major corporate stocks also saw significant declines at the close of trading on November 2nd, following Powell’s latest remarks.

[DB] US Close

— db (@tier10k) November 2, 2022

S&P500: -2.39%

Nasdaq: -3.15%

Dow: -1.45%

Top U.S. Stock Movements at Market Close on November 2nd. Source: Finvitz

On November 10th at 07:30 PM (Vietnam time), the U.S. will release the Consumer Price Index (CPI) for October, a key measure of inflation that will significantly influence the Fed’s future rate hike decisions.