Bitcoin Rallies to $22,600 as Crypto Market Recovers from Fed's Bank Rescue Decision

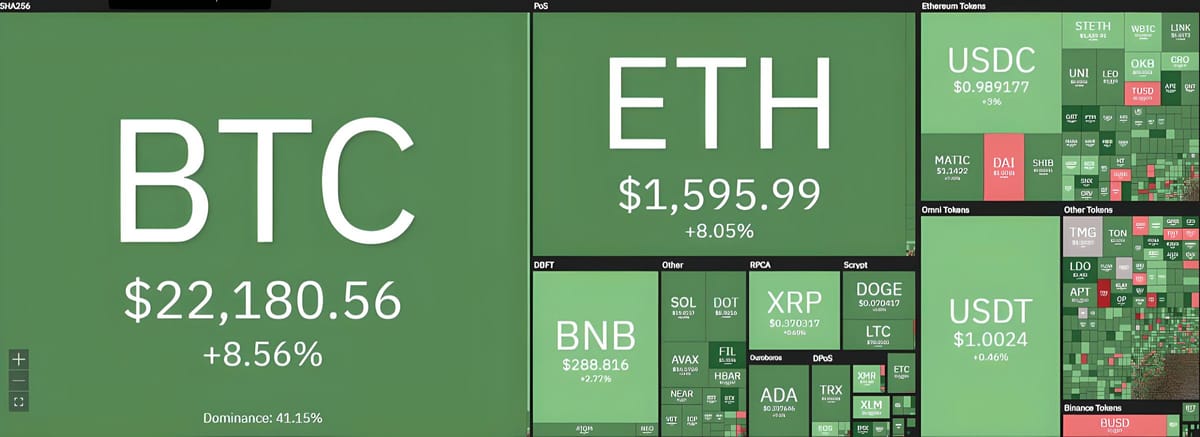

The cryptocurrency market has shown a strong rebound following the U.S. government's decision to rescue Silicon Valley Bank.

Source: Coin360

In the early hours of March 13, the Federal Reserve (Fed) held an unexpected emergency meeting. Subsequently, the federal government launched the Bank Term Funding Program (BTFP) to support struggling depository institutions and meet the needs of all depositors.

According to the Washington Post, U.S. authorities are considering rescuing uninsured deposits at Silicon Valley Bank if a buyer for the 16th largest commercial bank in the U.S., which collapsed last week, cannot be found.

@federalreserve announces Bank Term Funding Program (BTFP) to support American businesses and households, assure banks have ability to meet needs of all their depositors: https://t.co/JIMjkooIDV

— Federal Reserve (@federalreserve) March 12, 2023

The Treasury Department will also allocate $25 billion from the Exchange Stabilization Fund for the Fed’s program, although the Fed does not expect this amount to be utilized.

Bloomberg reports that the FDIC and the Federal Reserve are contemplating the creation of a special fund to guarantee deposits at troubled banks following SVB's collapse. Regulators are discussing this measure with bank leaders, hoping to establish a fund to reassure customers and alleviate market fears.

Following this news, the financial markets and the crypto sector have experienced a notable recovery. Bitcoin surged to $22,600 before slightly retracing to its current level.

15m BTC/USDT Chart on Binance at 09:55 AM on March 13, 2023

Additionally, stablecoins such as BUSD, USDC, and DAI have regained their pegs. USDC, which had suffered the most, has recovered to $0.99.

1H USDC/USDT Chart on Binance at 09:55 AM on March 13, 2023

As previously reported by Coin68, Silicon Valley Bank (SVB) was one of the most prominent lenders in the tech startup world in Silicon Valley and became the largest bank to fail since the 2008 financial crisis due to a liquidity crisis and a wave of investor withdrawals.

SVB has been handed over to the Federal Deposit Insurance Corporation (FDIC) for asset liquidation and repayment to depositors and creditors. According to the FDIC, only insured deposits up to $250,000 will be fully accessible by March 14.

The FDIC is also working intensively to sell SVB’s assets and find a way to return uninsured deposits to customers. Notably, a significant portion of deposits at this bank was not covered by FDIC insurance.