Bitcoin Sets New 1.5-Month Low Due to Israel's Retaliation Against Iran

On the morning of April 19, Bitcoin continued its descent towards the $60,000 USD mark, with numerous altcoins seeing red amid the latest developments in the Iran-Israel conflict.

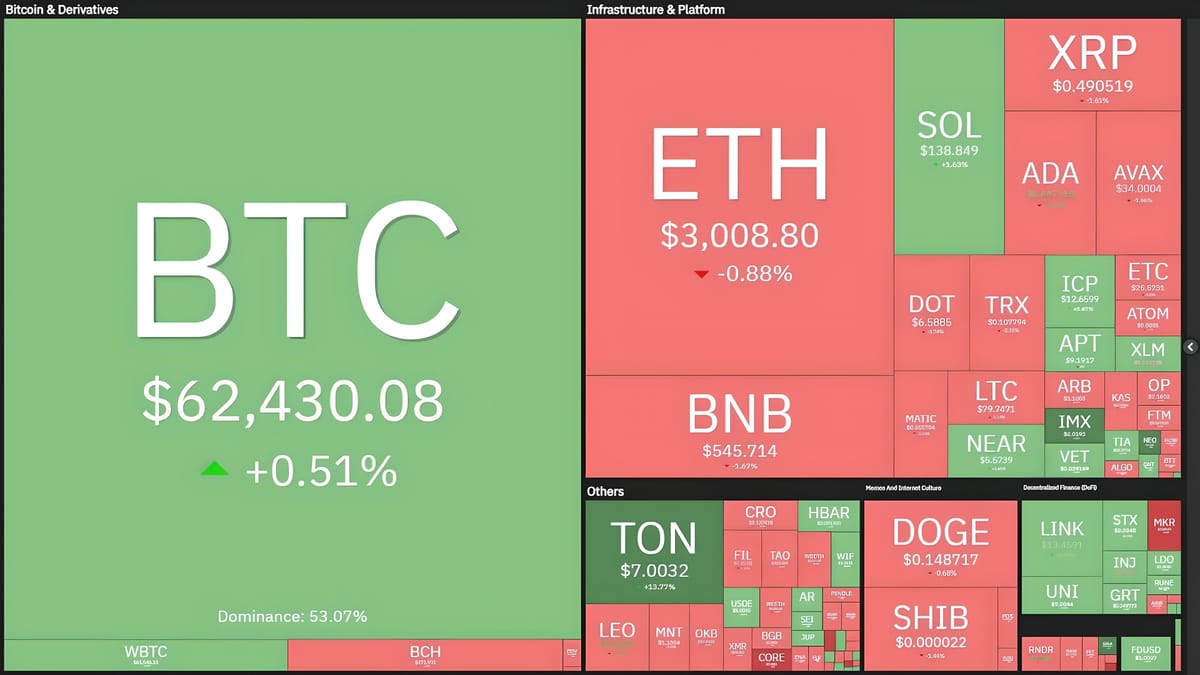

Cryptocurrency market fluctuations at 11:40 AM on April 19, 2024

Once again, the cryptocurrency market followed Bitcoin's downward trajectory amidst the looming halving event, scheduled around 11:00 AM on April 20th, Vietnam time.

At 7:00 AM on April 19th, Vietnam time, BTC continued its decline from $63,460 USD to $59,600 USD, before rebounding to $62,650 USD at the time of writing.

15-minute chart of BTC/USDT pair on Binance exchange at 11:40 AM on April 19, 2024

With today's dump, BTC hit its lowest level since dropping to $59,005 USD in early March. The king coin continues to establish a new bottom trend at $59,600 USD today compared to $60,600 USD on April 14th and $59,700 USD on April 18th, when BTC plummeted due to news of Iran's attack on Israel and negative comments from the Fed Chairman regarding interest rate cut prospects.

A U.S. official confirmed to ABC News Israeli missiles have hit a site in Iran. The official could not confirm whether Syria and Iraq sites were hit as well. https://t.co/pxI70OhdqJ

— Wu Blockchain (@WuBlockchain) April 19, 2024

The latest Bitcoin price drop stems from escalating tensions between Iran and Israel. According to ABC News, on April 19th, a senior U.S. official confirmed Israel conducted airstrikes on Iran in retaliation for Tehran's recent attack on its territory over the weekend.

Amid escalating tensions between Iran and Israel, the stock market closed, leaving users with only one choice: the Bitcoin market, causing the king coin's price to "stumble" along with the conflict.

Another contributing factor comes from Bitcoin spot ETFs. Formerly a major driver of capital inflows into BTC, ETF funds are now also experiencing declining inflows ahead of the halving event.

According to Farside Investors, the trading session on April 18th (U.S. time) saw a net outflow of $4.3 million USD. Of note, Grayscale's GBTC fund recorded an outflow of $90 million USD, completely overshadowing inflows from other remaining ETFs.

Statistics of capital flows into Bitcoin ETFs. Source: Farside Investors (April 19, 2024)

Thus, the market has witnessed the fifth consecutive day of outflows from Bitcoin ETFs. However, the outflow volume has significantly decreased compared to four days ago, but this trend could change as today's trading session opens and investors react to news of Israel's retaliatory actions against Iran.

Long orders continue to dominate the derivatives market. In the past 12 hours, $164.10 million USD has been liquidated, with 71.53% of orders being long positions across most coins such as BTC, ETH, ORDI, XRP, WIF, NEO,... However, SOL is the only coin with a higher percentage of short positions being liquidated, as investors struggled to anticipate the market's volatile decline and subsequent surge on the morning of April 19th.

Statistics of liquidation data in the cryptocurrency market over the past 12 hours, screenshot from CoinGlass at 11:35 AM on April 19, 2024