Bitcoin Slides to $60,600 Due to Iran-Israel Conflict, Crypto Market Records Over $800 Million Liquidations for Second Consecutive Day

Bitcoin and the cryptocurrency market continued to plummet early on April 14 due to news of Iran striking Israel.

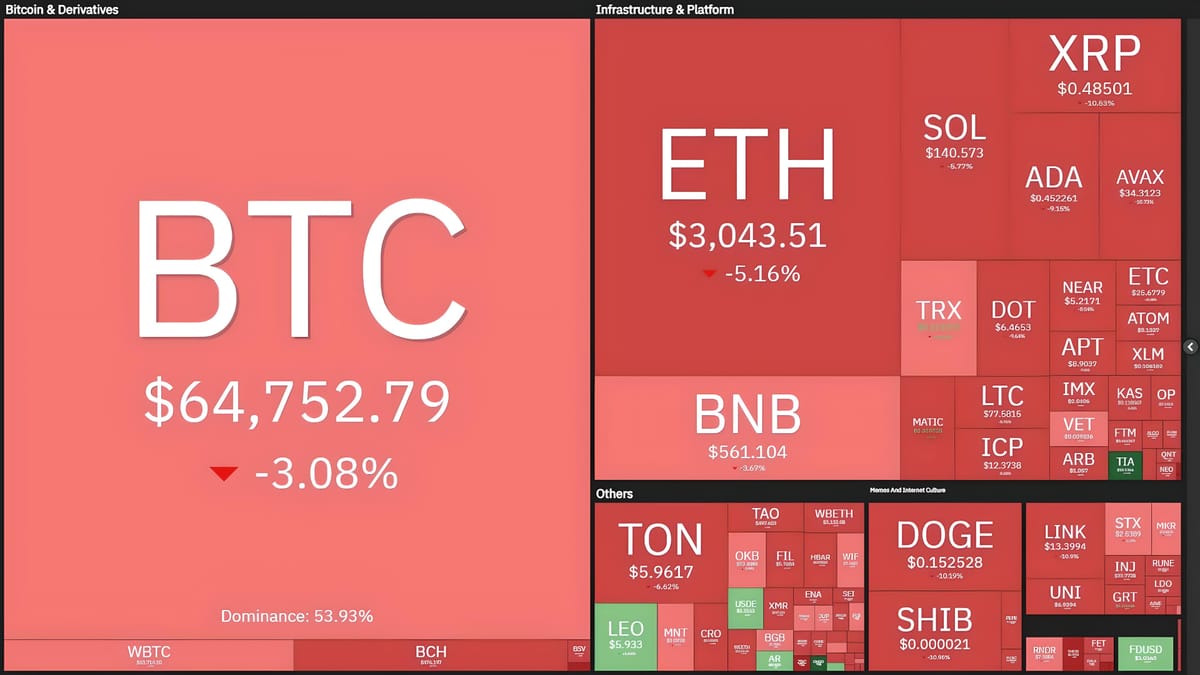

Cryptocurrency Top Coins' Fluctuations at 08:55 AM on April 14, 2024

Early on April 14 (Vietnam time), Iran announced the launch of over 100 missiles and unmanned aerial vehicles (UAVs) into Israel in retaliation for an attack on a consulate in Syria. This marks the first military escalation between the two militarily potent nations in the Middle East, raising concerns of a potential full-scale war between two nuclear-capable countries if tensions escalate further.

Iran's spokesperson at the United Nations declared this retaliatory action as "concluded," but warned of more severe repercussions if Israel engages in further aggression against Muslim countries. Iran also cautioned the U.S. against intervening in the ongoing conflict.

Axios reported that U.S. President Biden had a phone call with Israeli Prime Minister Benjamin Netanyahu, stating that the U.S. would not escalate tensions by supporting retaliatory actions from Israel.

Upon confirmation of these developments, Bitcoin's price plunged from $67,200 to $60,600 within half an hour. This is the lowest Bitcoin has traded since March 5, when the world's largest cryptocurrency hit an all-time high above $69,000 before crashing to $59,000 within an hour.

1-hour chart of BTC/USDT pair on Binance at 08:55 AM on April 14, 2024

Bitcoin had previously dropped from $70,800 to $65,000 on April 13 following U.S. government warnings about the risk of an Iranian attack on Israel.

However, Bitcoin subsequently rebounded to $65,600 before retreating back to around $63,800 at the time of writing. Yet, concerns remain over Bitcoin's recovery prospects, especially with the halving event—occurring in just 5 days—looming.

Similarly, major altcoins suffered significant declines following Bitcoin's downturn. Ethereum (ETH) dropped to as low as $2,852, its lowest since February 21. Several other top altcoins saw declines of 8-12%, marking double-digit losses over two consecutive days.

1-hour chart of ETH/USDT pair on Binance at 08:55 AM on April 14, 2024

The aftermath of the latest "black swan" event in the cryptocurrency market and subsequent volatility is evident in the derivatives market. Over the last 12 hours, $880 million in derivative positions have been liquidated, with 83.5% being long positions. This marks the second consecutive day with over $800 million in liquidated orders.

Data on liquidations in the cryptocurrency market over the last 12 hours, screenshot from CoinGlass at 08:55 AM on April 14, 2024

Political conflicts often have significant impacts on the cryptocurrency market. During the Russia-Ukraine war outbreak in February 2022, Bitcoin prices also briefly dropped from $39,250 to $34,720 before rebounding the next day.