Bitcoin Soars to $18,300 Ahead of U.S. CPI Data for December 2022

Bitcoin and the broader crypto market have seen a significant rebound as the U.S. prepares to release its Consumer Price Index (CPI) data, a key indicator of inflation for the world’s largest economy.

Price Movements of Major Cryptos as of 08:45 AM on January 12, 2023. Source: Coin360

Update on January 12, 2023:

On the morning of January 12, the cryptocurrency market continued its impressive uptrend right before the release of the U.S. CPI data scheduled for later today.

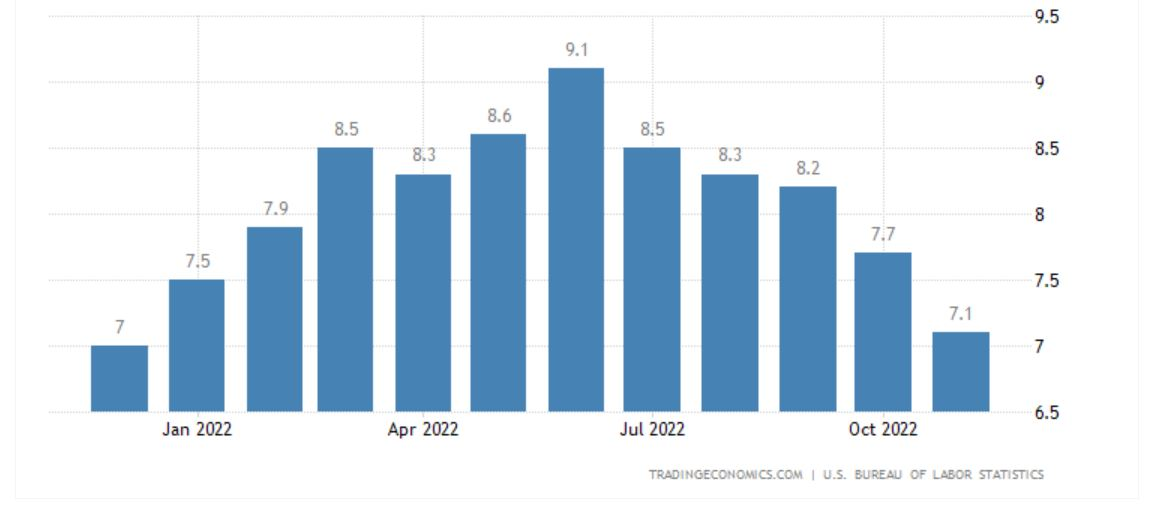

The CPI measures inflation within an economy. CPI releases in 2022 have consistently impacted crypto volatility, as they are closely watched for their potential influence on the Federal Reserve's interest rate decisions. Throughout 2022, due to persistent inflation, the Fed raised rates from 0.25% to 4.5%, negatively affecting both the U.S. stock market and the crypto sector.

Since peaking in June 2022 at 9.1% year-over-year, U.S. inflation has decreased for five consecutive months, reaching 7.1% in the December report. Economists estimate that the latest CPI data for December 2022 will show a further decline to 6.5%.

Inflation Trends in the U.S. by Month for 2022. Source: Trading Economics

If this forecast proves accurate, the Fed will likely face pressure to slow down its rate hikes, despite its recent report indicating expectations for continued increases in 2023, targeting a 5.1% rate for the year.

Meanwhile, the cryptocurrency market has been experiencing a strong recovery, buoyed by positive expectations surrounding the upcoming U.S. CPI data.

Bitcoin (BTC) surged to $18,297, reaching its highest level since December 15, 2022, when the market reacted positively to news of the Fed easing its rate hike pace. Compared to its starting price of $16,541 at the beginning of 2023, BTC has now risen over 10.6%.

4-Hour Chart of BTC/USDT on Binance as of 08:45 AM on January 12, 2023

Ethereum (ETH) has also shown notable strength, climbing back to $1,418, marking an 11.4% increase over the past three days. Compared to its price of $1,196 on January 1, 2023, ETH has recovered 18.5% of its losses. This is the highest ETH has been since November 8, 2022, when the crypto sector faced turmoil due to mass withdrawals from FTX and the subsequent bankruptcy announcement three days later.

4-Hour Chart of ETH/USDT on Binance as of 08:45 AM on January 12, 2023

In contrast, most large-cap altcoins have seen only modest gains, indicating that attention remains focused on BTC and ETH. However, Avalanche (AVAX) is an exception, having surged by 25% following news of its partnership with Amazon Web Services (AWS).

4-Hour Chart of AVAX/USDT on Binance as of 08:45 AM on January 12, 2023

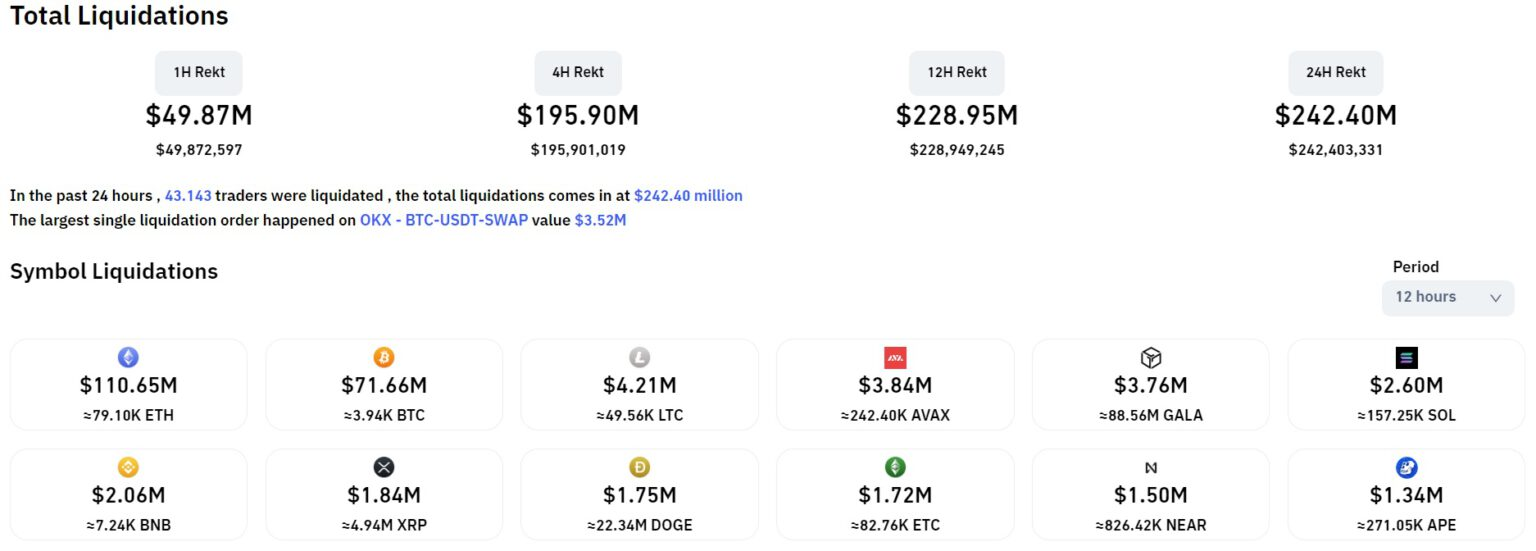

In the past 12 hours, nearly $230 million worth of crypto derivatives positions were liquidated, predominantly in Ethereum and Bitcoin, with short positions making up 90.64%.

Crypto Derivatives Liquidations in the Past 12 Hours, Data from Coinglass as of 08:45 AM on January 12, 2023