Bitcoin Soars to $21,200, Market Turns Green

Bitcoin (BTC) has experienced a remarkable surge in recent days, bringing the cryptocurrency close to its pre-FTX disaster levels.

Price Movement of Major Cryptocurrencies as of 09:20 AM on January 14, 2023. Source: Coin360

On the morning of January 14, Bitcoin (BTC) extended its streak of consecutive daily gains to seven, with a recovery of up to 25% during this period.

Starting from $16,943 on January 8, Bitcoin steadily climbed as the market anticipated the U.S. CPI news, which was released on the evening of January 12. With CPI results aligning with forecasts, BTC seemed to shed its burdens, temporarily overlooking potential risks such as the Gemini – Genesis – DCG situation and the Fed's rate adjustment in early February. As a result, Bitcoin gained an average of $1,000 in value per day.

1D Chart of BTC/USDT on Binance as of 09:20 AM on January 14, 2023

As of the morning update on January 14, Bitcoin has reached $21,258, marking the highest value of 2023 so far and its peak since November 6, 2022, when Binance CEO Changpeng Zhao revealed surprising information about FTT, triggering the FTX crisis.

Looking at the daily chart, BTC has swiftly recovered its losses at a pace similar to the drop during the FTX collapse.

At the same time, the cryptocurrency market is awash with green, with many altcoins also recording gains of over 10% in the past 24 hours.

4H Chart of ETH/USDT on Binance as of 09:20 AM on January 14, 2023

Ethereum (ETH) has risen to nearly $1,600, approaching the price range before the FTX collapse.

4H Chart of SOL/USDT on Binance as of 09:20 AM on January 14, 2023

Solana (SOL) has surged by over 35% to $22.45, nearly tripling from its December lows of $8. SOL was one of the cryptocurrencies severely impacted by FTX, having long been associated with the exchange and Alameda Research.

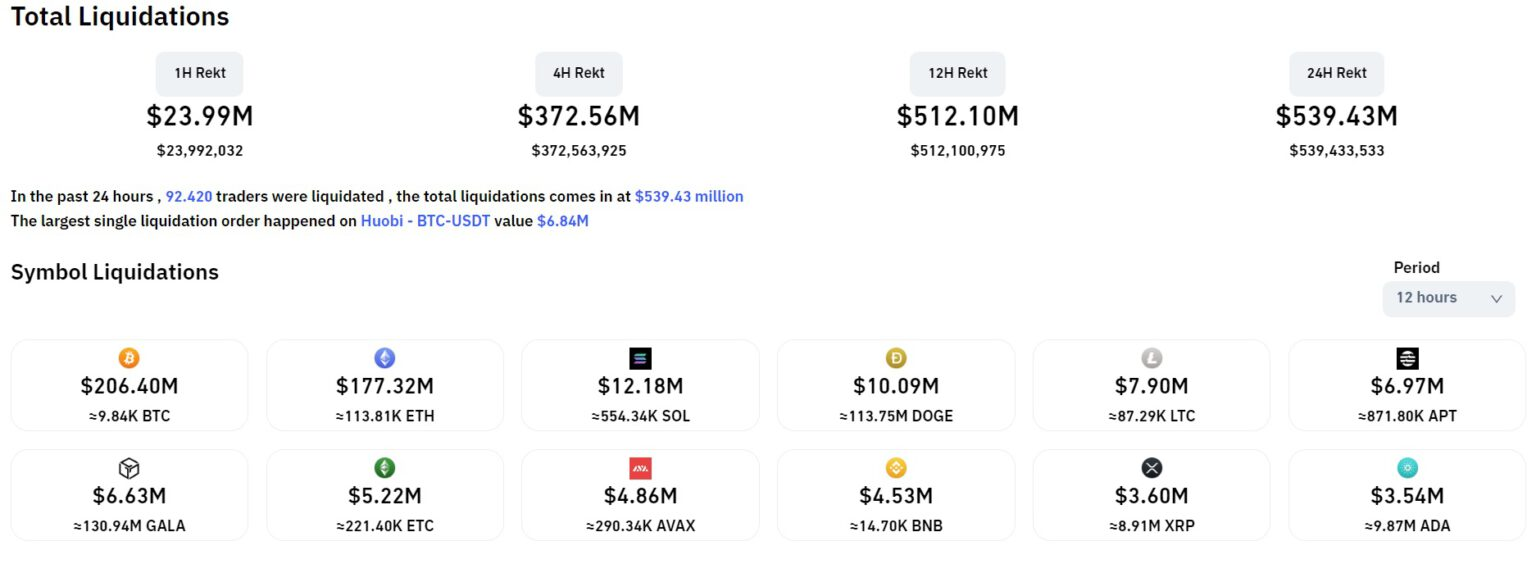

Value of Liquidated Cryptocurrencies in the Last 12 Hours, Data from Coinglass as of 09:20 AM on January 14, 2023

In the past 12 hours, over $500 million in derivatives orders have been liquidated, primarily in BTC and ETH, with short orders accounting for nearly 93%.