Bitcoin Soars to 7-Week High Ahead of U.S. October CPI Report

Bitcoin (BTC) and the broader crypto market continue their recovery streak that began at the end of October, reaching a 7-week high.

Price Movements of Leading Cryptocurrencies as of 09:20 AM on November 5, 2022. Source: Coin360

As of the morning of November 5, Bitcoin (BTC) has surged to a peak of $21,460, marking an increase of nearly 5.5% from 24 hours prior. This is also the highest price point for the world’s largest cryptocurrency since mid-September.

1-hour Chart of BTC/USDT on Binance as of 09:20 AM on November 5, 2022

The current BTC rally is driven by the October 2022 U.S. jobs report, which revealed the creation of 261,000 jobs—surpassing the forecast of 200,000. This led to a strong recovery in U.S. equities, which had been impacted by recent interest rate hikes and comments from Fed Chair Jerome Powell. However, the October unemployment rate came in at 3.7%, slightly higher than the anticipated 3.6%.

U.S. NONFARM PAYROLLS: +261,000 (EST. +200,000)

U.S. UNEMPLOYMENT RATE: 3.7% (EST. 3.6%)

U.S. AVERAGE HOURLY EARNINGS: +0.4% (EST. +0.3%)

— Tree of Alpha (@Tree_of_Alpha) November 4, 2022

Ethereum (ETH), the second-largest cryptocurrency, briefly surged to $1,680 on the evening of November 4, also marking a 7-week high.

1-hour Chart of ETH/USDT on Binance as of 09:20 AM on November 5, 2022

Many other altcoins are also showing strong recovery signals.

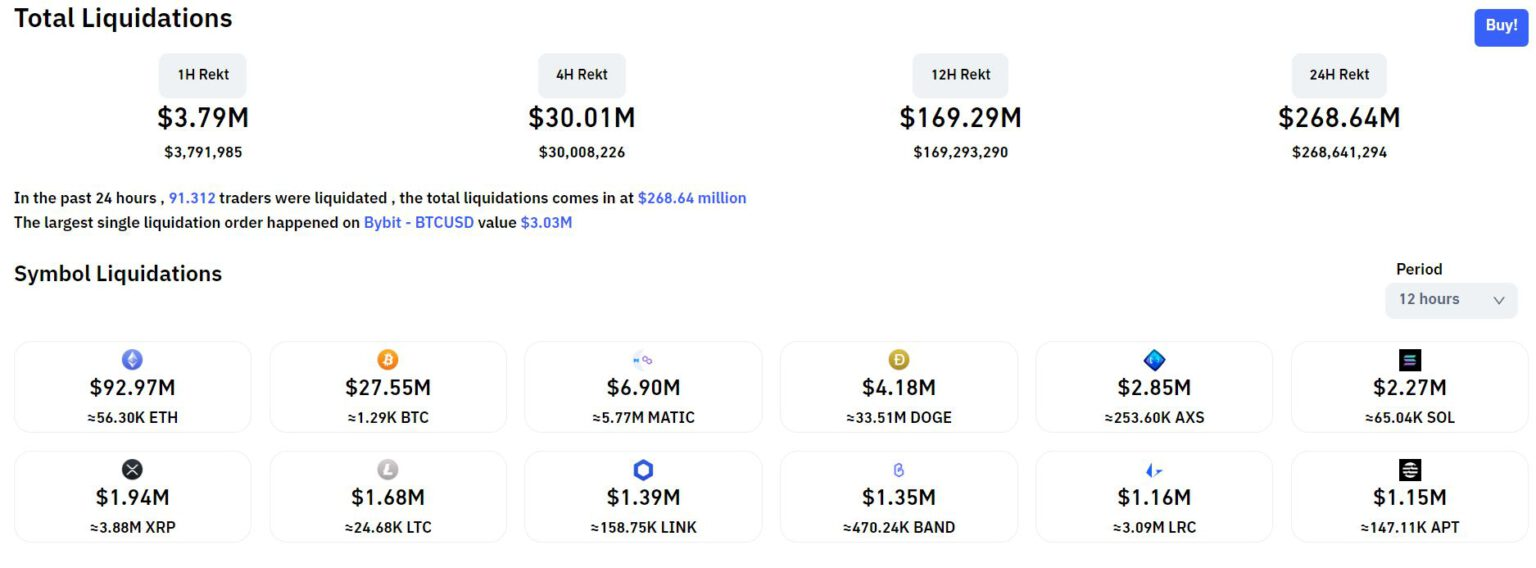

In the past 12 hours, nearly $170 million worth of derivatives have been liquidated, with ETH experiencing three times more liquidations than BTC. The percentage of short liquidations stands at 76%.

Crypto Liquidation Value in the Past 12 Hours, Data from Coinglass as of 09:20 AM on November 5, 2022

Looking ahead to next week, on November 10 at 07:30 PM (Vietnam time), the U.S. will release its Consumer Price Index (CPI) report for October. This key metric will represent inflation in the world’s largest economy and has historically caused significant volatility in the crypto market whenever results deviate from expectations.