Bitcoin Surges to $68,700, Approaching ATH Level

The world's largest cryptocurrency, Bitcoin, continues its upward trajectory in early March 2024, nearing the ATH of $69,000.

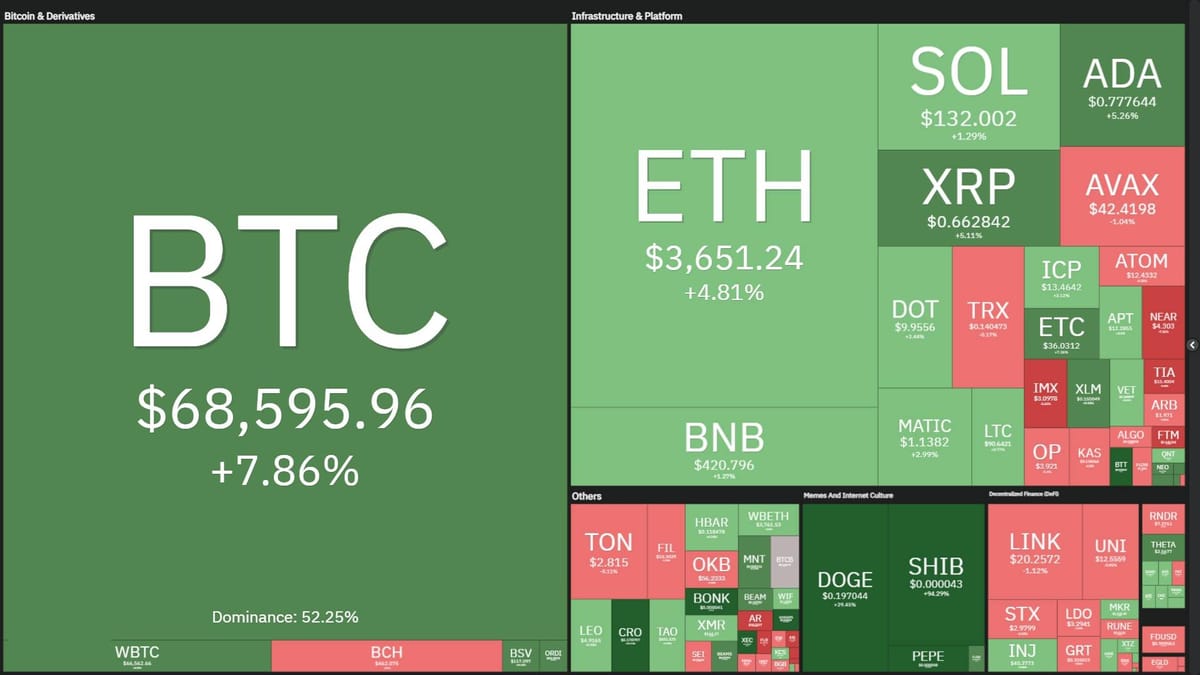

Crypto Market Movement at 09:00 AM on 05/03/2024. Source: Coin360

Throughout March 4th and into the morning of March 5th, Bitcoin (BTC) maintained its bullish momentum by steadily surpassing milestones at $65,000, $66,000, $67,000, and finally $68,000 within just 12 hours.

Previously, on February 28th, BTC saw a similar upward trend from $57,000 to $64,000 before a slight correction.

BTC ended February 2024 with a notable 44.2% increase, with just a few weeks remaining until the crucial halving event in mid-April.

At the time of writing, BTC has temporarily peaked at $68,686, only about $400 shy of the November 2021 ATH of $69,000. Despite this, Bitcoin's market capitalization reached a historic peak, surging to $1.3 trillion as of the morning of March 5th.

1-hour chart of BTC/USDT pair on Binance at 09:00 AM on 05/03/2024

In fact, Bitcoin has reached all-time highs against many major fiat currencies including the British pound, euro, Japanese yen, Chinese yuan, South Korean won, and even the Vietnamese dong over the past few days.

Bitcoin's upward momentum is further bolstered by strong trading activity from U.S. financial institutions. According to Bloomberg ETF expert Eric Balchunas, the newly approved Bitcoin ETFs saw trading volumes reaching $5.5 billion by the close of trading on March 4th (U.S. time), marking the second-highest volume to date. Leading the charge is still BlackRock's IBIT fund, accounting for $2.4 billion of the trading volume.

Confirmed: today was second biggest volume day for the Ten at about $5.5b. $IBIT alone did $2.4b of it and has crossed $11b in aum. Each of them is up over 30% in 6 days, which will prob help keep flow ball rolling. Getting a bit of ARK Mania deja vu. pic.twitter.com/BDRYVPBk34

— Eric Balchunas (@EricBalchunas) March 4, 2024

March 4th also saw significant inflows into these ETFs, with substantial capital flowing in after days of notable inflows.

BlackRock's IBIT fund continues to solidify its position as the leading Bitcoin ETF with accumulated assets surpassing $11 billion in just over 50 days of trading, making it one of the fastest-growing ETFs in U.S. history.

Over the weekend, the crypto market witnessed a surge in memecoins, with several tokens experiencing over 100% growth. However, as BTC resumes its upward trend in the past 12 hours, attention has shifted back to the world's leading cryptocurrency, causing slight corrections in many memecoins.

Ethereum (ETH) also benefited from BTC's momentum, surpassing the $3,650 mark - its highest since March 2022.

1-hour chart of ETH/USDT pair on Binance at 09:00 AM on 05/03/2024

In the past 12 hours, there have been $280 million in liquidations in the crypto derivatives market, predominantly in BTC, with shorts accounting for the majority at 59.1%.

Derivatives liquidation data, screenshot from CoinGlass at 09:00 AM on 05/03/2024