Bitcoin Whale Sell-Off in November 2022 Sets New Record

Bitcoin whales—investors holding the largest amounts of Bitcoin in the market—have sold off the highest volume of BTC ever recorded over the past 30 days.

According to blockchain analytics platform Glassnode, Bitcoin whales sold a total of 280,000 BTC within the past month.

BTC Holdings by Whale Accounts. Source: Glassnode

As of now, Glassnode estimates that whales collectively hold around 9 million BTC, a significant portion of Bitcoin's total supply of 21 million BTC. The distribution is as follows:

- Whales holding 1,000 to 10,000 BTC: 3.6 million BTC

- Whales holding 10,000 to 100,000 BTC: 1.9 million BTC

- Whales holding 100,000 BTC or more: 3.6 million BTC

This massive sell-off explains why Bitcoin's price has struggled to recover despite a reduction in negative sentiment around the FTX crisis.

To gain a broader perspective on why whales chose this moment to disrupt the market, it's useful to analyze the industry’s conditions over the past two years. The strong growth cycle of 2020-2021 led to record realized profits on the blockchain.

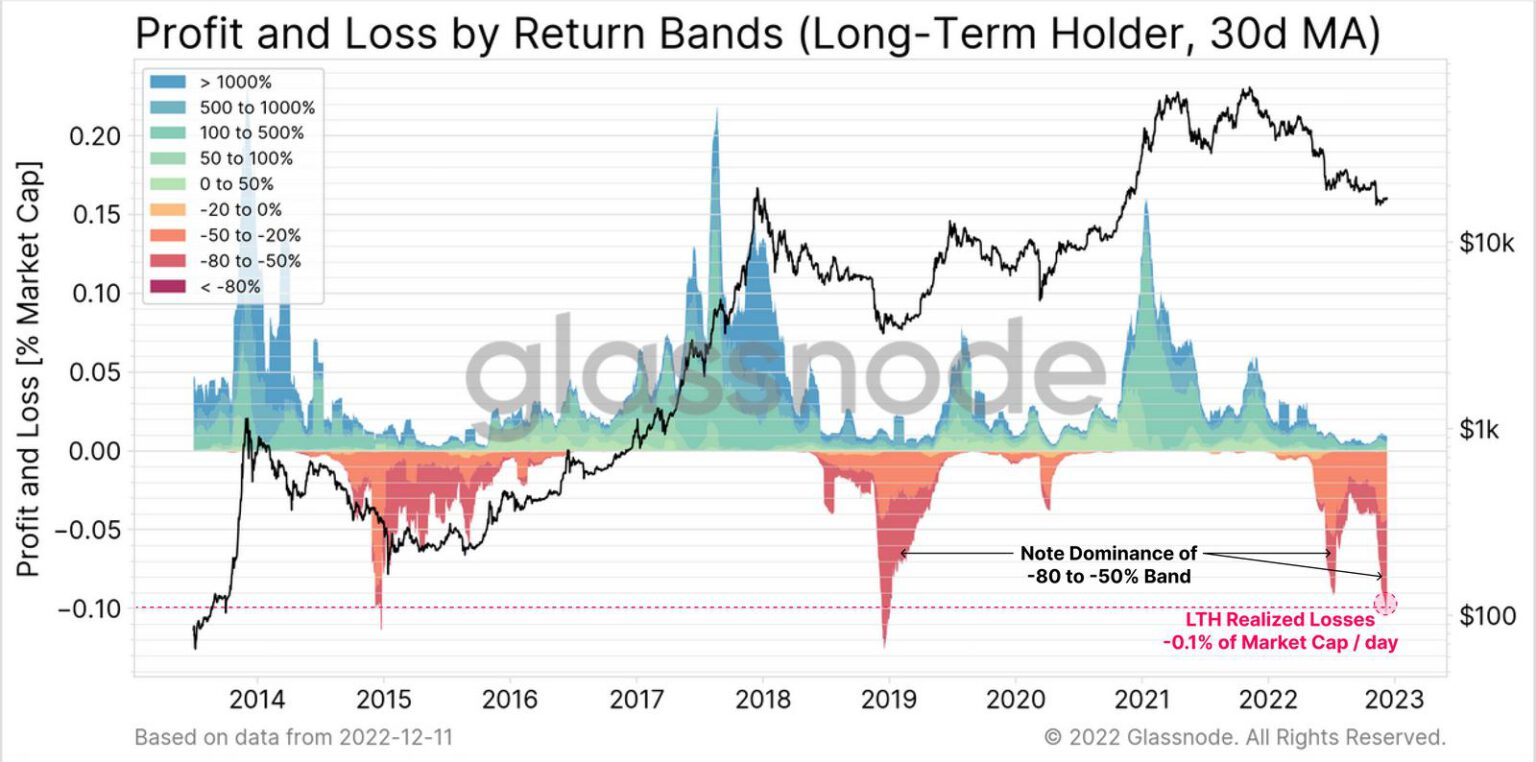

Profit and Loss Volatility of Long-Term BTC Holders. Source: Glassnode

Over $455 billion in annual profit was transferred on-chain by Bitcoin investors, peaking shortly after BTC's all-time high of $69,000 in November 2021.

Since then, the market quickly entered a bearish phase, resulting in over $213 billion in realized losses. This figure represents 46.8% of the profits gained during the 2020-2021 bull run, which is comparable to the 47.9% loss observed during the 2018 bear market.

Despite these significant losses and swift reversals, the total Bitcoin supply held by long-term holders (LTH)—the group considered to be whales—continues to grow, indicating their ongoing confidence in BTC's recovery.

BTC Holdings by Long-Term Addresses. Source: Glassnode

The chart below shows that since May 2022, the BTC held by LTHs has remained largely out of circulation, even as the market faced major upheavals, such as the collapse of LUNA/UST, the Celsius-3AC liquidity crisis, and the dramatic failure of FTX.

However, Bitcoin has failed to show impressive resilience, particularly towards the end of the year, remaining trapped in the $16,000–$17,000 range. This period is especially sensitive, as traditional financial markets appear to be "taking a break," and investors need cash to cover end-of-year expenses. Thus, the impatience and practical needs of LTHs leading to BTC sell-offs are understandable.

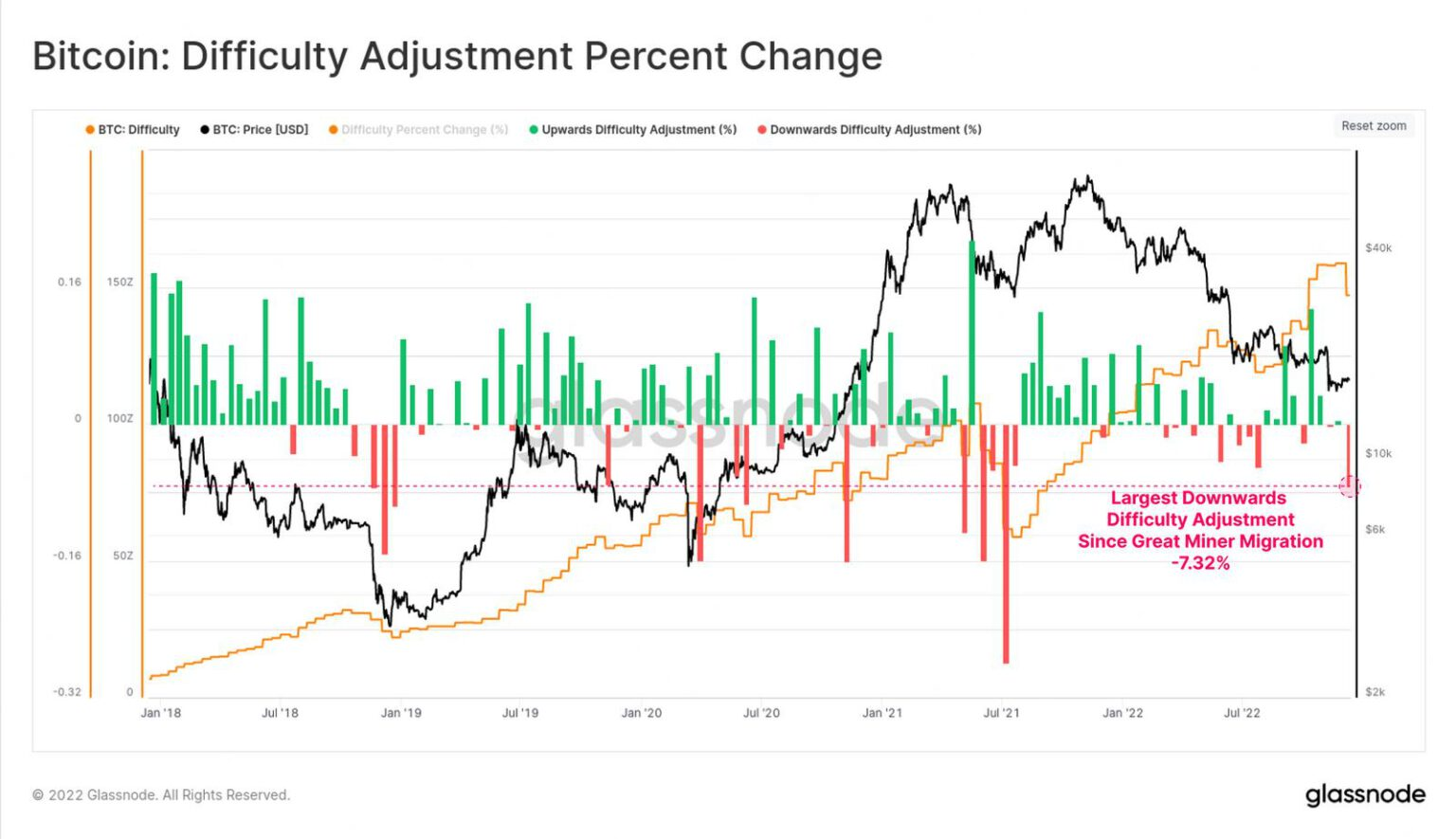

Bitcoin Mining Difficulty Volatility. Source: Glassnode

Additionally, November 2022 saw the largest decrease in mining difficulty since China's BTC mining ban in 2021. This record drop in difficulty indicates that a significant number of mining rigs have been turned off, driven by mining revenue hitting its lowest point in two years.