Blast Raises $20 Million to Increase Yields for ETH and Stablecoin Holders

Blast, the latest layer-2 solution on Ethereum, has received investments from major funds and notable KOLs in the crypto community, aiming to boost yields for ETH and stablecoin holders.

According to an announcement on the morning of 21/11, the layer-2 solution Blast on Ethereum has officially launched and declared that it raised $20 million from investors such as Paradigm, Standard Crypto, and eGirl Capital.

Many other prominent figures in the crypto community on X (Twitter) also participated in the funding round.

Additional investors include @bywassies @evan_ss6 @manifoldtrading @gainzy222 @KeyboardMonkey3 @DoveyWan @JandX_ @0xLawliette @Brentsketit @icebergy_ @naniXBT @cole0x

— Blast (@blast) November 20, 2023

Image: Blast Raises $20 Million to Increase Yields for ETH and Stablecoin Holders.

Image Source: Coin68

Blast is built on Optimistic Rollups technology, similar to Arbitrum and Optimism, and is EVM-compatible, allowing investors and dApps on Ethereum to easily connect. The team behind Blast includes Pacman, founder of the NFT platform Blur, and other members who are former MakerDAO employees, MIT graduates, and Seoul University graduates.

Blast aims to promote interest-bearing staking activities on the Ethereum network. While Ethereum offers a basic staking yield of 3-4%, no layer-2 solutions have yet provided additional yields to incentivize holding ETH on them instead of on layer-1.

By holding assets on Blast, users' balances will accumulate interest. The ETH deposited by users on Blast will be used to directly stake ETH through Lido, and the block rewards will be redistributed to users.

The baseline interest rate on existing L2s is 0%, so by default the value of your assets depreciate over time.

— Blast (@blast) November 20, 2023

Blast is the first L2 with native yield. On Blast, your balance compounds automatically, and earns Blast rewards on top. pic.twitter.com/donh7jsxUL

Image: Overview of Blast's Staking and Yield Strategy.

Image Source: Coin68

Moreover, Blast supports deposits of popular stablecoins such as USDT, USDC, and DAI. The received stablecoins will be invested in protocols that hold US Treasury bonds like MakerDAO, generating interest which is then shared with users through a proprietary stablecoin called USDB.

In the future, Blast may replace Lido and MakerDAO with projects developed directly on its layer-2 network, depending on community vote results.

Blast has announced a limited trial for users with invitation codes. Currently, investors can earn 4% interest on ETH and 5% on stablecoins, along with Blast Point rewards.

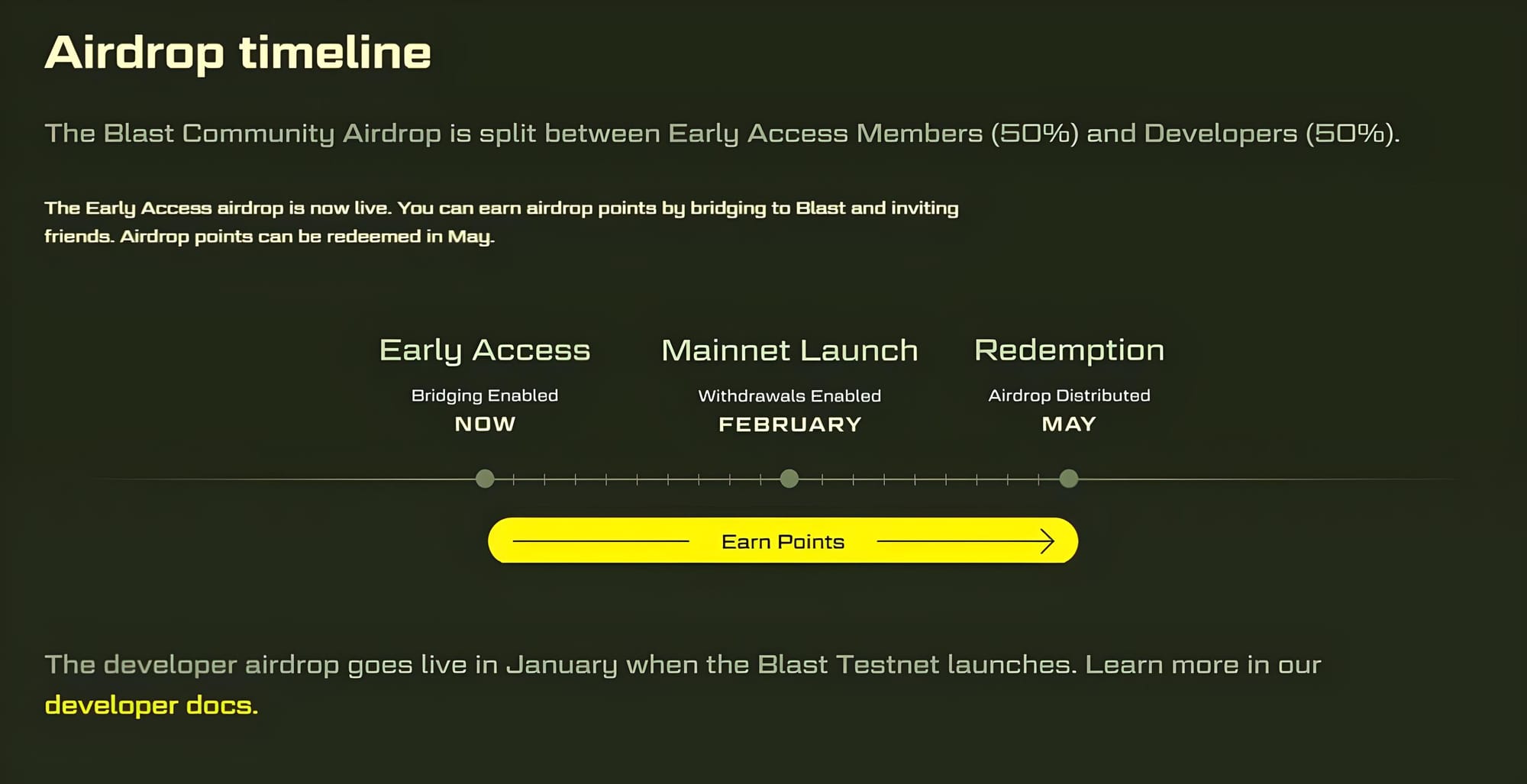

Blast's testnet is scheduled for January 2024, with the mainnet launch planned for February 2024.

Note that assets bridged to Blast cannot be withdrawn until the layer-2 network launches its mainnet in February next year. Blast Points will be used to determine eligibility for the token airdrop. These points can be collected based on the amount bridged from Ethereum to Blast and the number of people invited to experience the layer-2 solution.

The airdrop will consist of 50% for early users and 50% for dApps developing products on the network. While dApps will receive airdrops immediately upon the testnet launch in January, users will have to wait until May 2024 to convert their points into tokens.

Blast's Development Roadmap for 2024

As of 09:30 AM on 21/11, nearly $5 million in ETH and stablecoins have been bridged from Ethereum to Blast.

Image: Overview of Blast's Development Roadmap.

Image Source: Coin68

$5m in deposits already https://t.co/WuD8XkvpBG pic.twitter.com/HVmom2jCFE

— Karl (@karl_0x) November 21, 2023