BTC and ETH Prices Plummet Following Fed Rate Hike Announcement

On the morning of September 22, 2022, the cryptocurrency market experienced a significant downturn following the Fed's announcement of its latest interest rate hike.

Price Movements of Leading Cryptocurrencies at 08:25 AM on September 22, 2022

Source: Coin360

As highlighted in Coin68's article on key events to watch in September 2022, the Fed announced a rate adjustment in the early hours of September 22. This rate pertains to the overnight lending between banks, ensuring they meet the Fed’s reserve requirements.

The Fed has consecutively raised the federal funds rate by 0.75% in its last two meetings, bringing it to 2.25% – 2.5%. This represents the most rapid short-term rate hike by the Fed since it adopted the federal funds rate as a benchmark in the early 1990s.

Fed Chair Jerome Powell had previously stated that the Fed would maintain a “hawkish” stance, continuing to raise rates to achieve its 2% inflation target by the end of the year. Consequently, market expectations and analysts anticipated a 0.75% hike in this adjustment.

The latest data confirms that the Fed increased the rate by 0.75% to 3.25%, aligning with financial analysts' forecasts. This move responds to August’s inflation in the US, where while the overall inflation rate has decreased, consumer prices continue to rise, indicating the Fed has not yet fully curbed rising costs. The Fed still plans two more rate hikes this year, scheduled for November and December.

Despite the expected nature of the announcement, it had a negative impact on the cryptocurrency market, influenced by the broader US stock market. Additionally, macroeconomic factors such as Russia’s recent partial mobilization to escalate tensions with Ukraine have also played a role.

In recent hours, Bitcoin (BTC) has suffered a severe drop from a peak of $19,556 at the time of the Fed’s announcement to just $18,125 – the lowest level since the $17,622 low in mid-June.

15-minute Chart of BTC/USDT on Binance at 08:25 AM on September 22, 2022

Ethereum (ETH) has also seen a significant decline, adjusting to $1,220, a level not seen since mid-July.

15-minute Chart of ETH/USDT on Binance at 08:25 AM on September 22, 2022

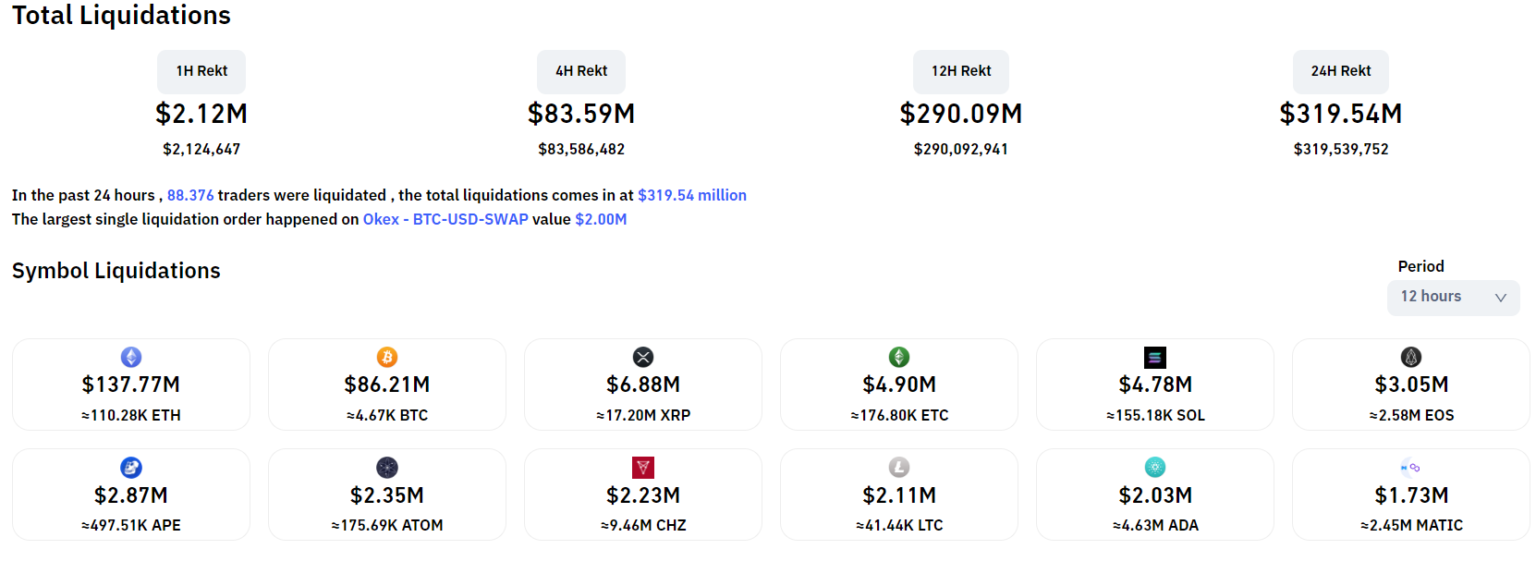

In the past 12 hours, over $290 million in derivatives have been liquidated, with the majority concentrated in ETH and BTC.

Recent Crypto Liquidations in the Past 12 Hours, Data from Coinglass at 08:25 AM on September 22, 2022

Earlier, on September 13, following less-than-ideal US inflation data for August 2022, the crypto market also witnessed a significant price dump.