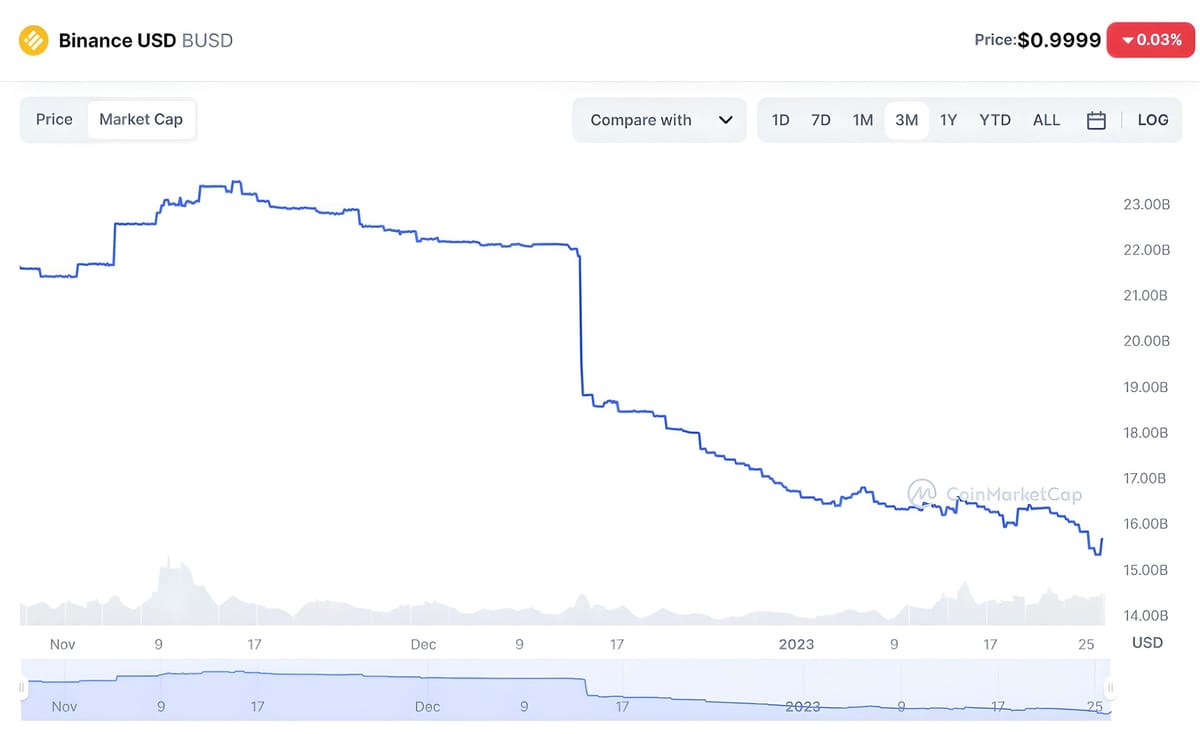

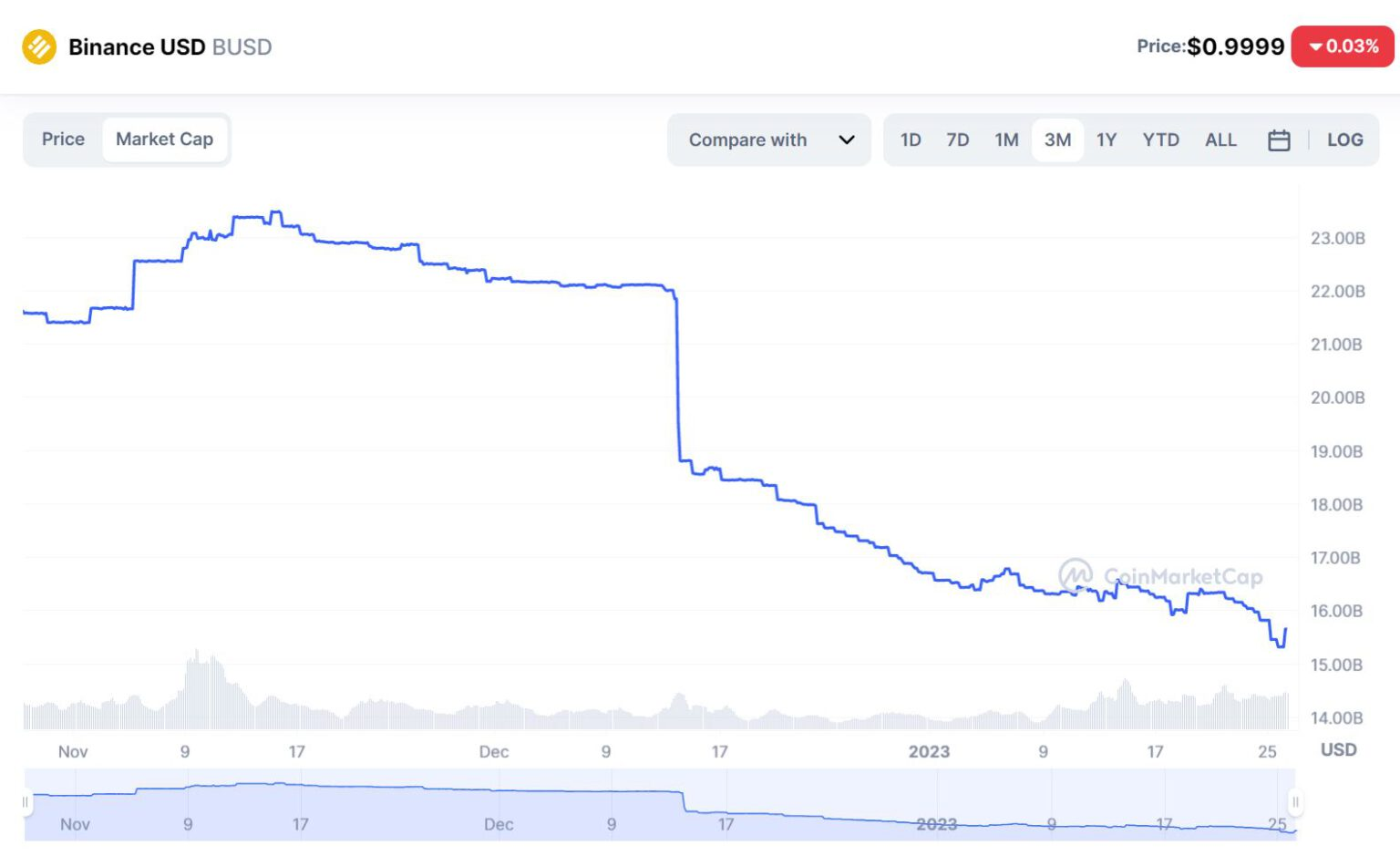

BUSD Supply Continues to Decline in January

The Binance stablecoin BUSD has seen its circulating supply drop by over $8 billion since mid-November 2022.

According to data from CoinMarketCap, BUSD’s circulating supply hit a low of $15.3 billion on January 25, 2023, showing a continuous decline throughout January.

This decline is a direct result of Binance facing a wave of negative news in December 2022, which severely undermined trust in the exchange and its branded products.

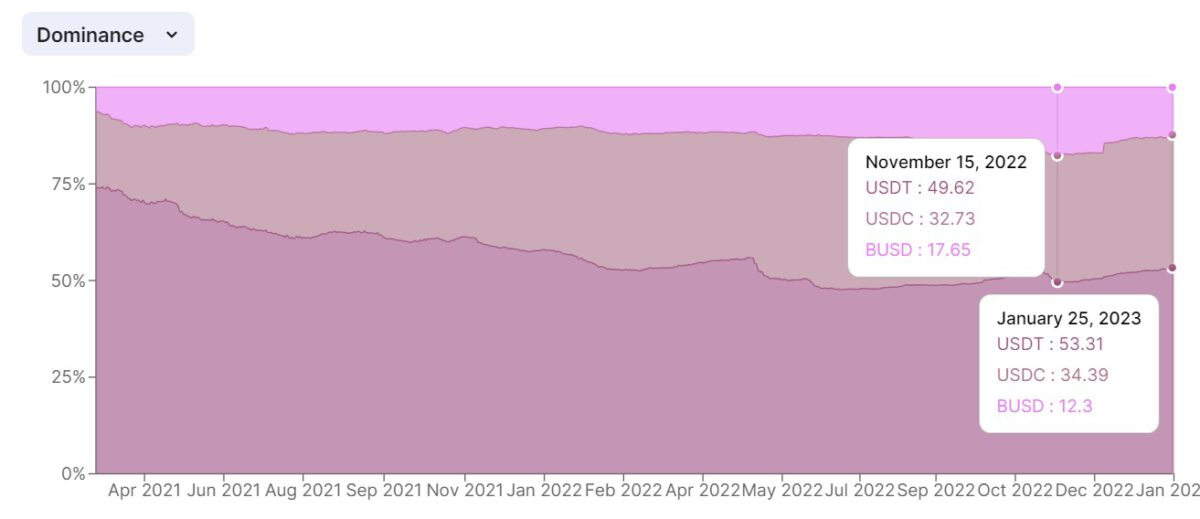

BUSD’s supply peaked at $23.4 billion in mid-November 2022, during the crypto market turmoil following the catastrophic collapse of FTX. At that time, BUSD's market share among stablecoins reached an all-time high of 17.55%.

However, after losing $8.1 billion in market cap, BUSD’s market share has now fallen to 12.43%, with the lost ground being reclaimed by USDT and USDC.

Market Share Dynamics Among USDT, USDC, and BUSD

By January 2023, BUSD faced additional scrutiny over past issues with its collateral assets from mid-2021, although Binance has claimed these issues have been resolved. Moreover, the exchange admitted to co-mingling user funds with collateral for B-Tokens, raising questions about these “missteps” of the platform.

As of the morning of January 26, 2023, the total market cap of the stablecoin sector stands at $137.3 billion, continuing its downward trend since the May 2022 collapse of LUNA-UST.