Cash Flow into Solend Surges Post SolBlaze-Marginfi Drama

In the wake of the recent dispute between SolBlaze and marginfi, rival lending protocol Solend has emerged as the biggest beneficiary.

Cash Flow into Solend Surges Post SolBlaze-Marginfi Drama

Recently, the anonymous founder 0xRooter of Solend took to X to highlight the increased inflow of funds into the platform following the 24-hour drama involving SolBlaze and competitor marginfi.

saw a big surge in activity on solend yesterday pic.twitter.com/QEMqkxitU3

— R🐽ter (@0xrooter) April 11, 2024

0xRooter stated:

"Solend experienced significant growth yesterday. The influx of funds into the protocol increased by over $18.6 million on April 11, marking the highest inflow since 2022."

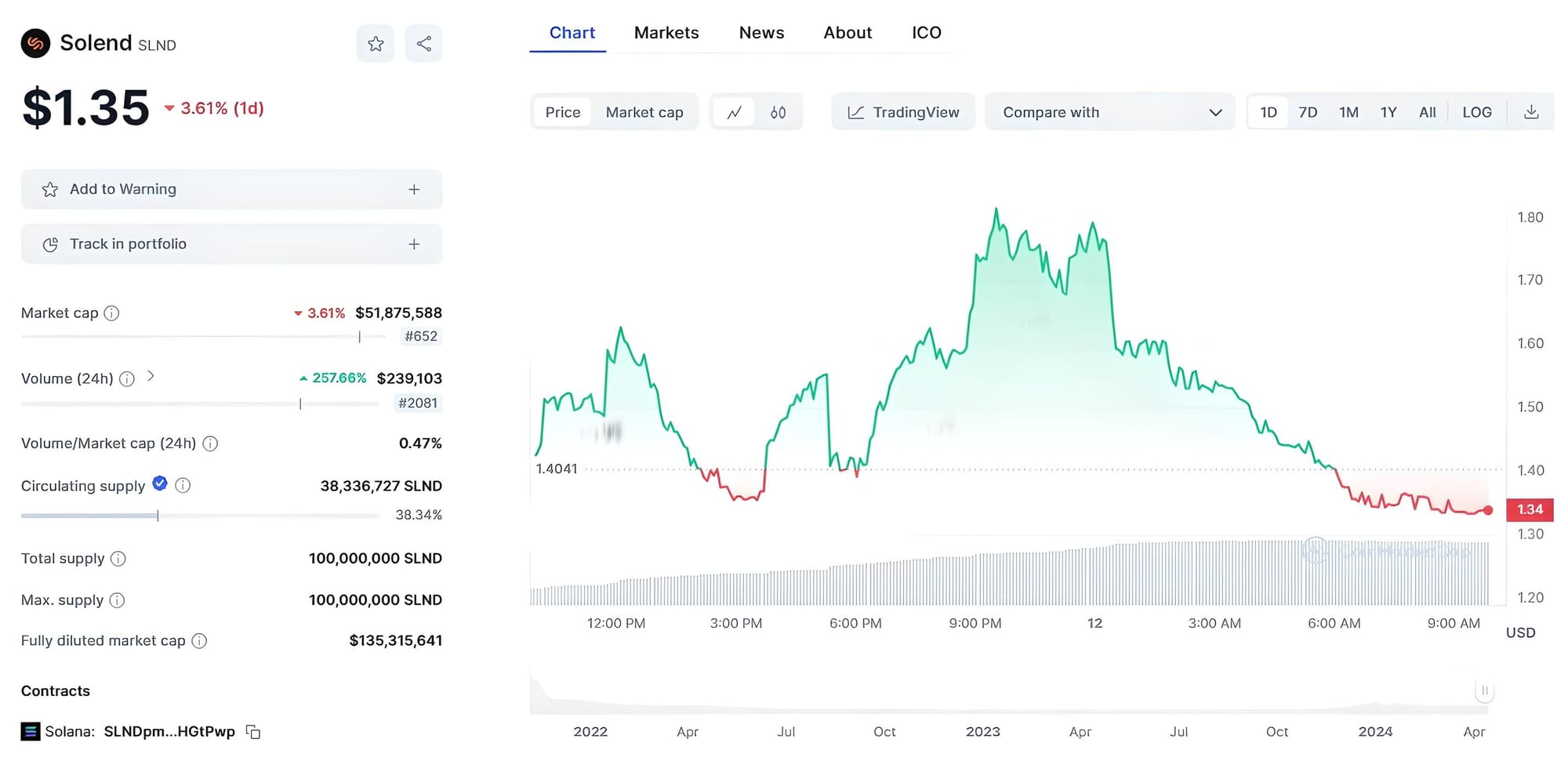

During this period, Solend’s token, SLND, surged by over 44% before slightly retreating to $1.35 at the time of writing.

Price movement of SLND on the daily timeframe, screenshot from CoinMarketCap at 09:55 AM on April 12, 2024

As reported by Coin68, late on the night of April 10, SolBlaze posted a lengthy thread accusing the lending protocol marginfi of "withholding" user funds, not distributing the BLZE tokens that SolBlaze had sent to marginfi as customer rewards. SolBlaze also alleged that marginfi had sold off all received BLZE tokens, with daily sales amounting to millions of tokens, citing "fund management" as the reason.

The tension escalated further when marginfi blocked all messages from the community, and founder edgar announced his resignation on X.

some of you may have seen the drama with marginfi, but don't know the backstory of solend vs marginfi.

— R🐽ter (@0xrooter) April 11, 2024

let me catch you up...

starting during the bear market, we were on the receiving end of multiple attacks. there's no shortage of examples, so I'll highlight just a few.

0xRooter subtly hinted that marginfi had previously "slandered" and spread false information about Solend on forums or social media.

About half a day later, it appeared that the two projects had reconciled and reached a mutual understanding. SolBlaze announced that both sides had discussed the issue openly and resolved it. The user rewards, halted for 8 days (not 3 weeks), were due to an on-chain error, and marginfi is working on restoring them and compensating those affected.

Marginfi confirmed that edgar’s resignation was for "personal reasons" and assured that the platform would continue its operations normally.

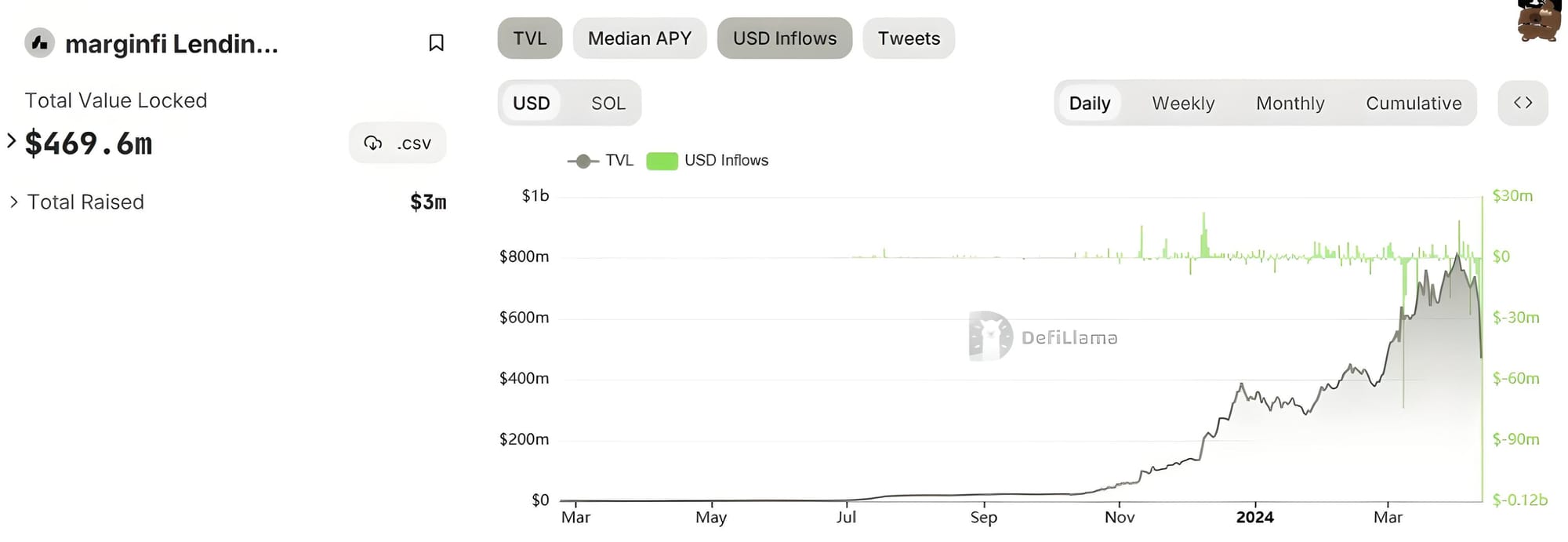

Following this intense drama, marginfi has suffered significant losses. The platform witnessed an outflow of $194 million. The total value locked (TVL) on the protocol has dropped to $469.6 million, down from $811.1 million on April 1.

Season 2 is live!

— Solend (@solendprotocol) April 11, 2024

Here's what you need to know:

- 7 figures of SLND + partner rewards

- All collateral-enabled deposits are incentivized

- Ends in 3 months

Read on for more details (including information about the vampire bonus).

1/7 pic.twitter.com/PfgAthFT5k

In a related development, Solend recently launched Season 2, a three-month liquidity incentive program. Under this program, all deposits used as collateral will accrue reward points, potentially redeemable for platform tokens in the future.