Client Diversity and Its Crucial Role for Ethereum's Ecosystem

In recent days, the Ethereum community has been abuzz with the keyword "Client Diversity" and the potential risks it poses to the network's future. So, what exactly is "Client Diversity," and why is it so crucial for the Ethereum ecosystem? Let's delve into this issue and explore its significance.

What is a Client?

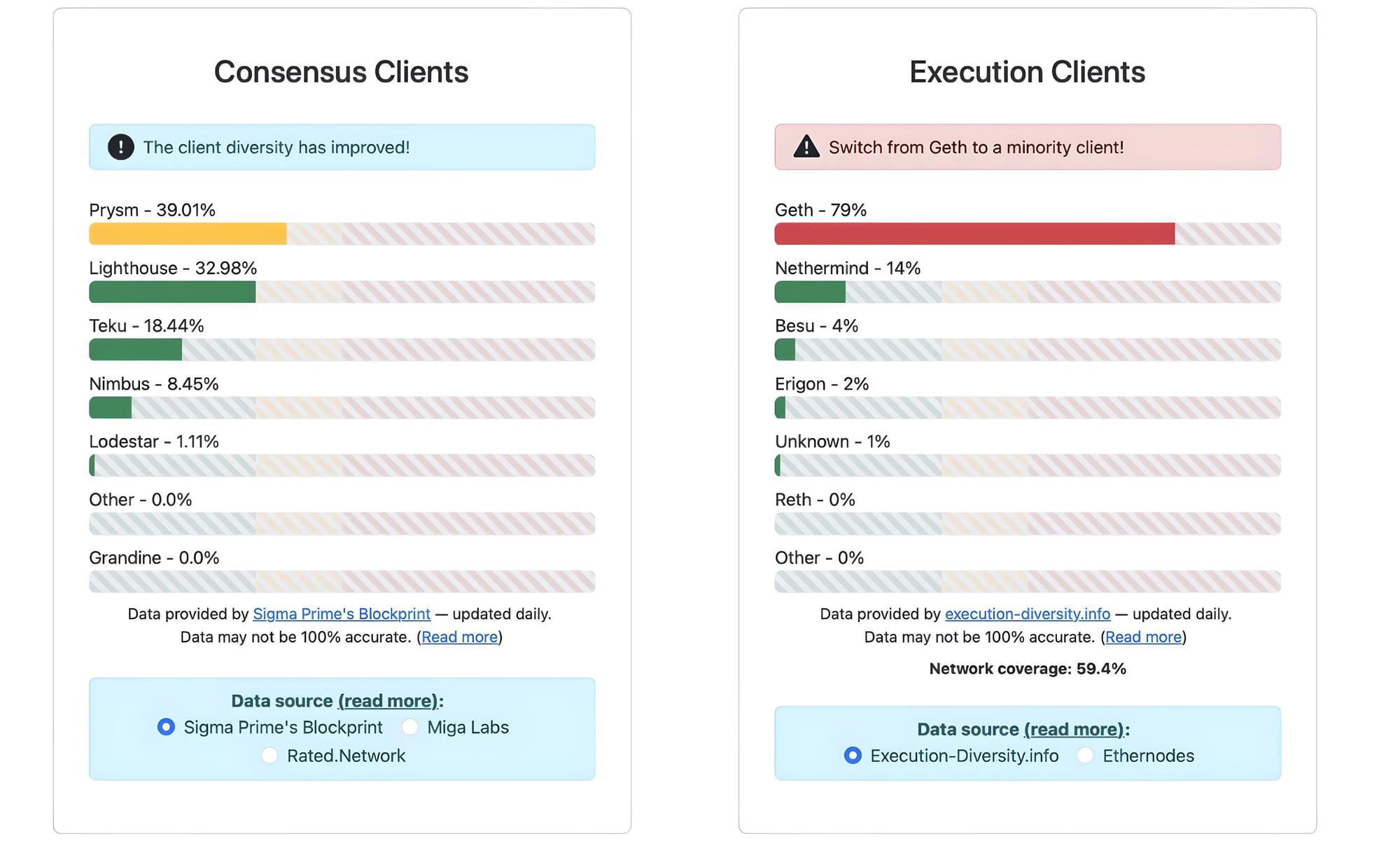

To understand "Client Diversity," we first need to grasp the concept of a "Client" in the context of blockchain technology. On Ethereum, validators participating in network validation using the Proof-of-Stake consensus mechanism rely on two main types of software:

- Consensus Client: This software handles the consensus process, determining the past data of the blockchain.

- Execution Client: Used to execute transaction requests from users, ensuring smooth operation of the Ethereum network.

Understanding Client Diversity

Client Diversity essentially advocates for diversifying the use of Client software within the Ethereum network. Currently, the concentration of Client usage presents significant challenges such as:

2/ Coinbase Cloud prioritizes the security of customer assets, and the underlying blockchain, above all else. When launching Ethereum staking and evaluating execution layer clients to maximize these traits, Geth was the only client that met our technical requirements.

— Coinbase Developer Platform🛡️ (@CoinbaseDev) January 23, 2024

- Network disruption risks: If a heavily used Client encounters issues, it could disrupt the Ethereum network. For instance, in May 2023, Ethereum faced issues with Prysm's Consensus Client, preventing the network from achieving timely validation for 24 consecutive hours.

- Security risks and economic incentives: Validators using a dominant Client face penalties if the Client malfunctions. This not only jeopardizes network security but also threatens validators' economic interests, especially in Staking activities.

- Impact on network development: Diversifying Clients improves resilience against network attacks and enhances the long-term sustainability of the Ethereum ecosystem.

Why the skewed distribution of Clients?

The imbalance in Client usage, particularly with clients like Geth and Prysm, can be attributed to several factors:

If you are staking on Ethereum and currently running Prysm, this is for you: Run the majority client at your own peril!https://t.co/6XWfSTJWqS

— Dankrad Feist (@dankrad) March 24, 2022

In this post I detail the enormous risks that staking with the majority client incurs.

- Performance and stability: Clients with better development and performance tend to dominate due to validators' preference for stable and efficient software.

- Staking profitability: Economic incentives, especially in Liquid Staking, may drive validators to choose certain Clients over others.

- Lack of strong community encouragement: Insufficient advocacy for Client diversity within the community also contributes to this imbalance.

Implications of centralized Client usage

Over-reliance on a single Client can lead to severe consequences, including:

So what actually happens if there’s a bug in Geth?

— Labrys (@Labrys_io) January 23, 2024

Well, it depends on the bug.

Because more than ⅔ of the validators on Ethereum run Geth, any critical bug in Geth will instantly stop the chain from finalising. This doesn’t actually mean that the chain stops or halts. So long… pic.twitter.com/XI3tiQF1J1

- Network disruptions: Malfunctions in a dominant Client could disrupt Ethereum's operations.

Why is geth 80% of the stake?

— Mark (ethDreamer.eth) 🦇🔊 (@EthDreamer) January 24, 2024

People think it's because geth is the most reliable. It's actually because of the 2017 parity wallet bug.

I'm 💯 serious.

Back in the day we used to have 2 clients: geth & parity. They were roughly equal in their usage.

But then an exploit in the…

Security vulnerabilities: High concentration in a single Client increases the risk of network exploitation.

Ethereum @ Home!

— punk5736.stark (@punk5736) January 24, 2024

Protocols:

=> @NethermindEth + Lighthouse (Primary)

=> Geth + Prsym (Secondary)

=> Papyrus @starknet full node

.. with space for future L2 or @eigenlayer protocols that catch my interest. Being onchain is sublime when the computer upstairs signs off on it 🤠 pic.twitter.com/rUqTIqUbhq

- Validator validation and economic risks: Validators may face significant economic penalties if their Client fails, affecting their financial interests.

Knock-knock @binance 👋 https://t.co/VrTH9XnRsD pic.twitter.com/9rL1bm8F3o

— Mark (ethDreamer.eth) 🦇🔊 (@EthDreamer) January 23, 2024

Hitler is not happy with the state of Ethereum client diversity... pic.twitter.com/G1oiUIR93e

— Doug Colkitt (@0xdoug) January 24, 2024

Conclusion

Diversifying Clients on the Ethereum network is not just a technical consideration but a critical factor for its sustainability and security. The Ethereum community must collaborate to promote Client diversity, thereby mitigating risks and improving network performance for the future.