Crypto Market Sees Green After Bitcoin ETF Approval - Ethereum (ETH) System Surges

Leading cryptocurrencies have all risen following the SEC approval of Bitcoin spot ETFs, with Ethereum (ETH) and its ecosystem tokens showing the strongest gains.

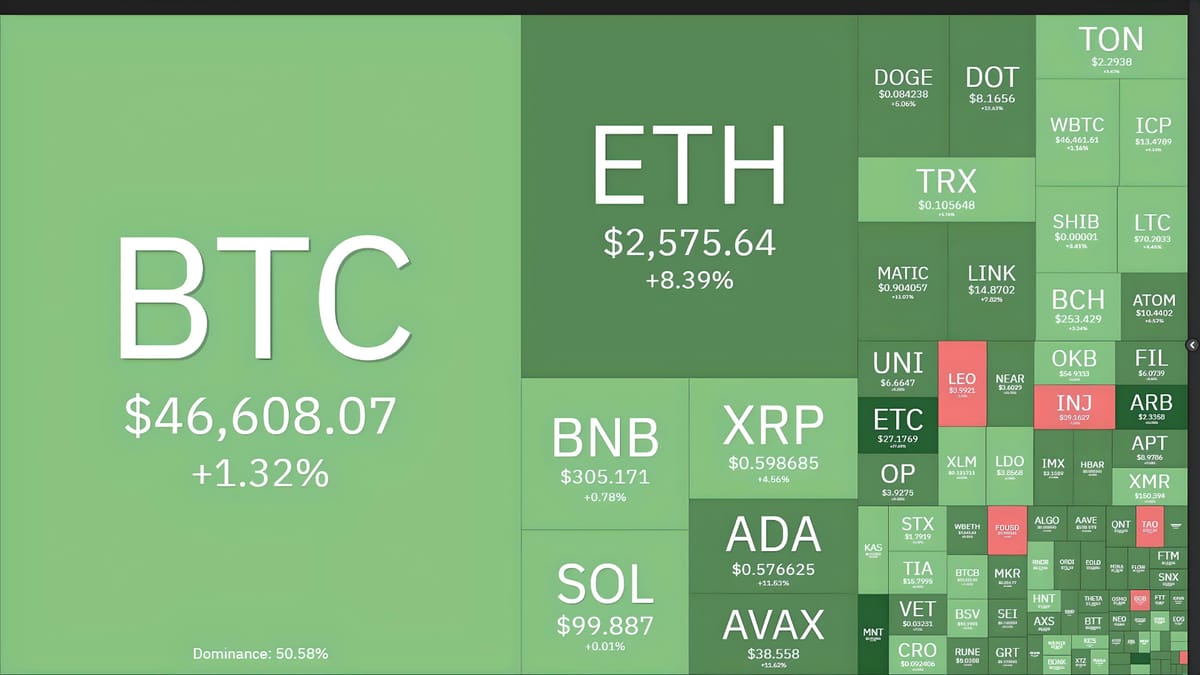

Cryptocurrency Price Movements as of 09:15 AM on 11/01/2024. Source: Coin360

As reported by Coin68, in the early hours of January 11, the U.S. Securities and Exchange Commission (SEC) approved 11 proposals for Bitcoin spot ETFs from major Wall Street players such as BlackRock, Fidelity, VanEck, and Franklin Templeton. This long-awaited event was expected to usher traditional financial flows into the cryptocurrency space.

Over the past six months, Bitcoin has seen significant growth, rising from $25,000 to nearly $48,000, largely driven by ETF expectations.

However, despite the official confirmation of the SEC's approval of Bitcoin spot ETFs, BTC prices did not react strongly, hovering around $46,000 - $47,500, suggesting forecasts of a "sell the news" event were justified.

1-hour chart of BTC/USDT pair on Binance at 09:15 AM on 11/01/2024

Instead, market attention shifted to Ethereum (ETH) and tokens within its ecosystem. ETH surged by 10% over the past 24 hours as investors shifted their ETF expectations to the world's second-largest cryptocurrency. ETH briefly touched $2,643 on January 11, the highest since the LUNA - UST crash in early May 2022.

1-hour chart of ETH/USDT pair on Binance at 09:15 AM on 11/01/2024

In addition to Bitcoin spot ETFs, major Wall Street firms have also been leveraging opportunities to propose Ethereum spot ETFs to the SEC. Organizations pursuing these proposals include BlackRock, VanEck, ARK Invest, Grayscale, Hashdex, Invesco, and Fidelity.

Proposals for Ethereum spot ETFs awaiting SEC approval. Source: Bloomberg (30/11/2023)

Moreover, several core tokens within the Ethereum ecosystem have benefited from the reallocation of Bitcoin funds as investors rebalance their portfolios.

Tokens have recorded growth of over 20% in the past 24 hours, including Arbitrum (ARB) and Mantle (MNT) - leading layer-2 solutions; ENS - a pioneering Web3 domain project praised by Vitalik Buterin; Rocket Pool (RPL) and Lido (LDO) - dominant players in Liquid Staking; Pendle (PENDLE) - a leader in yield farming, among others.

Another standout performer is Ethereum Classic (ETC), the original Ethereum version before the 2016 DAO hack.

Tokens experiencing growth alongside Ethereum, screenshot from CoinMarketCap at 09:20 AM on 11/01/2024

The cryptocurrency market cap returned to $1.77 trillion on January 11, equivalent to levels seen in May 2022.

In the past 12 hours, nearly $185 million in derivative orders were liquidated, with 61% being short orders.

Statistics on derivative liquidations in the past 12 hours, screenshot from CoinGlass at 09:20 AM on 11/01/2024