Cryptocurrency Market Faces Major Sell-off as Bitcoin Plunges to $65,000, Altcoins Drop 25%

The cryptocurrency market endured a severe blow as Bitcoin plummeted overnight, resulting in over $810 million worth of derivative liquidations.

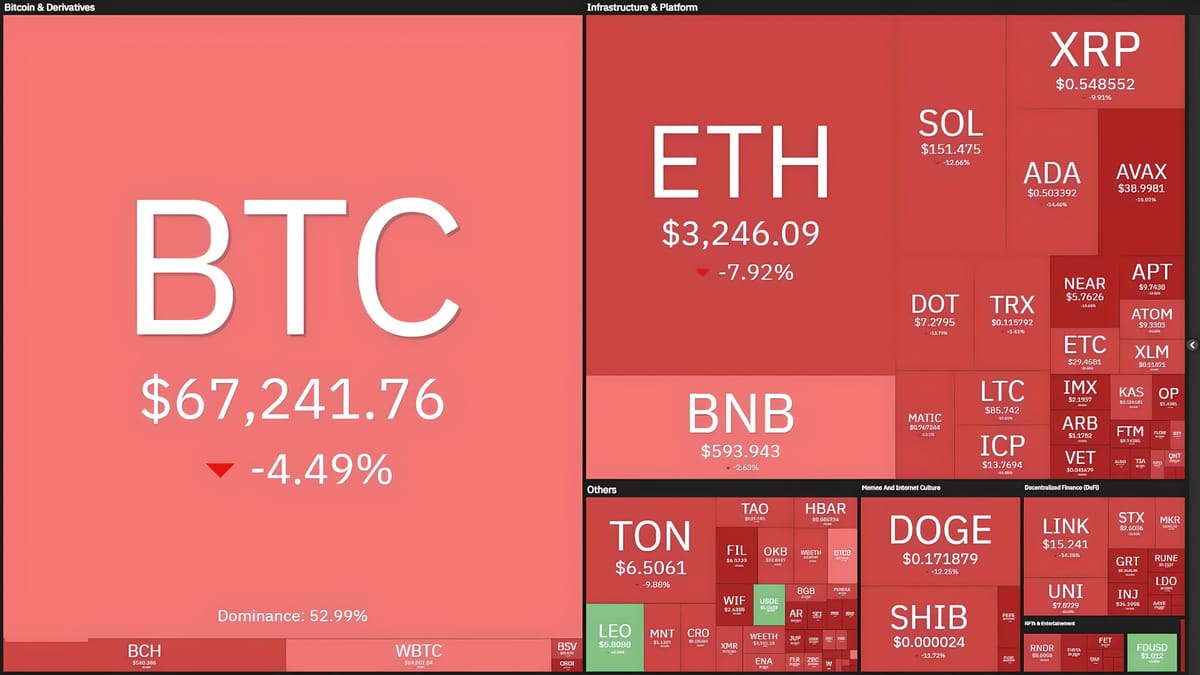

Fluctuations of Top Cryptocurrencies at 08:20 AM on April 13, 2024

Early on April 13, Bitcoin unexpectedly underwent a sharp correction from $70,800 to $65,000, marking its lowest point since early March when BTC crashed $10,000 in just one hour after setting a new all-time high.

1-hour chart of BTC/USDT pair on Binance at 08:20 AM on April 13, 2024

There's currently no clear reason behind the dump, except for reports of U.S. inflation slightly exceeding earlier predictions for the week. This news has financial analysts worried that the Fed may postpone interest rate cuts.

Additionally, some opinions suggest that the global geopolitical situation may be affecting the cryptocurrency market, as U.S. President Biden warned of potential Iranian attacks on Israel.

[Tree] BlackRock (IBIT) Daily BTC Flows: +111.4m

— Tree News (@News_Of_Alpha) April 13, 2024

Preliminary statistics indicate that Bitcoin ETFs are experiencing nearly balanced inflows and outflows, with BlackRock's IBIT continuing to attract significant inflows, while Grayscale's GBTC maintains consistent outflows in the hundreds of millions. However, April 12 (U.S. time) trading sessions for Bitcoin ETFs may have seen a day of net outflows due to GBTC's larger outflow compared to IBIT's inflow.

The sudden dump and significant selling pressure somewhat spread panic throughout the market, causing many other major altcoins to lose between 10-30% of their value.

[Tree] Grayscale (GBTC) Daily BTC Flows: -166.1m

— Tree News (@News_Of_Alpha) April 12, 2024

The ETH/BTC exchange rate even dropped to its lowest level in three years, with a general pattern pushing the BTC Dominance index up to 55.7% - its highest since May 2021.

According to CoinGlass statistics, the cryptocurrency market witnessed $810 million in asset liquidations over the past 12 hours, predominantly affecting altcoins, followed by Bitcoin and Ethereum. The long liquidation ratio reached up to 90%.

TODAY: ETH/BTC drops to a level not seen in nearly 3 years 😮 pic.twitter.com/75nt0SNDQ4

— Bitcoin News (@BitcoinNewsCom) April 12, 2024

This marks the largest liquidation since Bitcoin's dump to $59,000 on March 6, when $1.1 billion was liquidated in the derivatives market.

Statistics on liquidation ratios in the cryptocurrency market over the last 12 hours, screenshot from CoinGlass at 08:25 AM on April 13, 2024