CryptoQuant Warns USDe Holders to Monitor ETH Reserves to Mitigate Risks

According to a report by CryptoQuant, Ethena must maintain a stable amount of Ethereum reserves to "survive" during periods of negative funding rates. Users holding USDe should also exercise caution.

CryptoQuant Warns USDe Holders to Monitor ETH Reserves to Mitigate Risks

The stablecoin issuance project Ethena continues to spark debates regarding its unique model. While some support Ethena for its innovative approach, a segment of the community criticizes the project and urges users to exercise caution.

CryptoQuant's latest report advises USDe holders to closely monitor the project's treasury to avoid risks associated with negative funding rates.

Dive into Ethena’s USDe risks, analysis, and key metrics to monitor ⬇️ https://t.co/8guDSUNeKi

— CryptoQuant.com (@cryptoquant_com) April 16, 2024

Key Insights from the Report

Ethena Labs currently offers an APY of 17.2% (variable) for users staking USDe or other stablecoins on the platform. This yield is generated from staking rewards of Liquid Staking Tokens (LSTs) and the funding rate of short positions.

Funding Rate measures the difference between the asset's price in the futures and spot markets. When the futures price is higher than the spot price, the funding rate is positive, and long positions pay short positions. Conversely, when the futures price is lower than the spot price, the funding rate is negative, and short positions pay long positions.

In a bullish market, this isn't an issue. However, during bearish periods like the current one, many traders open short positions, driving the funding rate into negative territory. This means Ethena, maintaining short positions, has to pay for the funding rate.

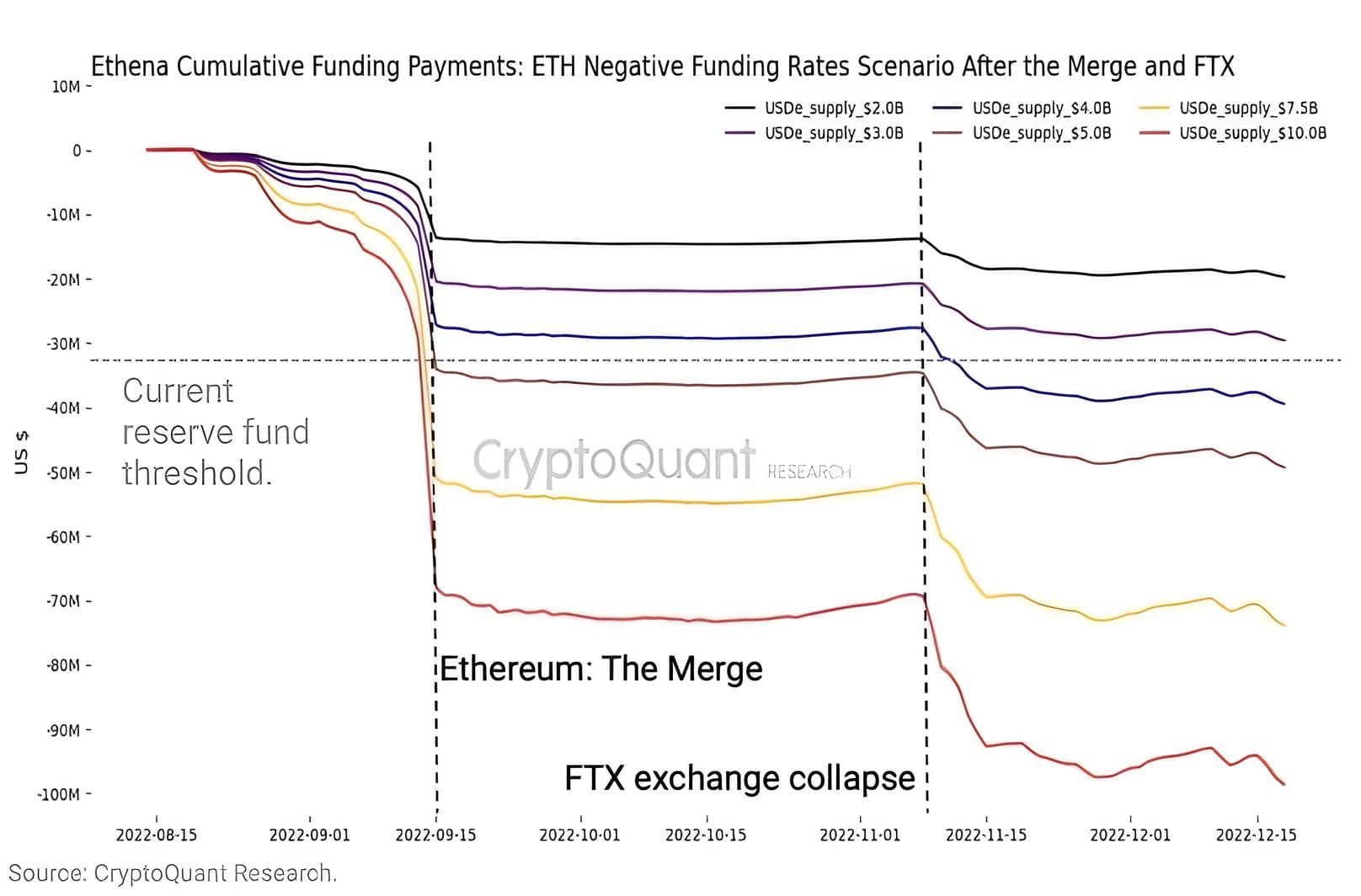

Ethena's ETH reserves are meant to cover such scenarios. However, as USDe's market cap increases, the value of the short positions Ethena holds also rises, leading to higher funding rate payments.

The Financial Strain on Ethena

According to CryptoQuant, with ETH reserves valued at approximately $32.7 million, Ethena can only sustain paying the funding rate if USDe's market cap remains below $4 billion.

Source: CryptoQuant

Currently, USDe's market cap has surged to $2.3 billion just two months after its launch.

Ethena Reserve Fund Fluctuation. Source: Ethena Dashboard (18/04/2024)

“To survive a prolonged bearish market, Ethena needs to maintain a retention ratio above 32%. This ensures the reserve fund is sufficiently large to withstand periods of extremely negative funding rates.”

Critical Retention Ratio

The retention ratio of ETH is the portion of revenue allocated back to the reserve fund. CryptoQuant emphasizes that this ratio must be sustainable to help Ethena survive the "bear season."

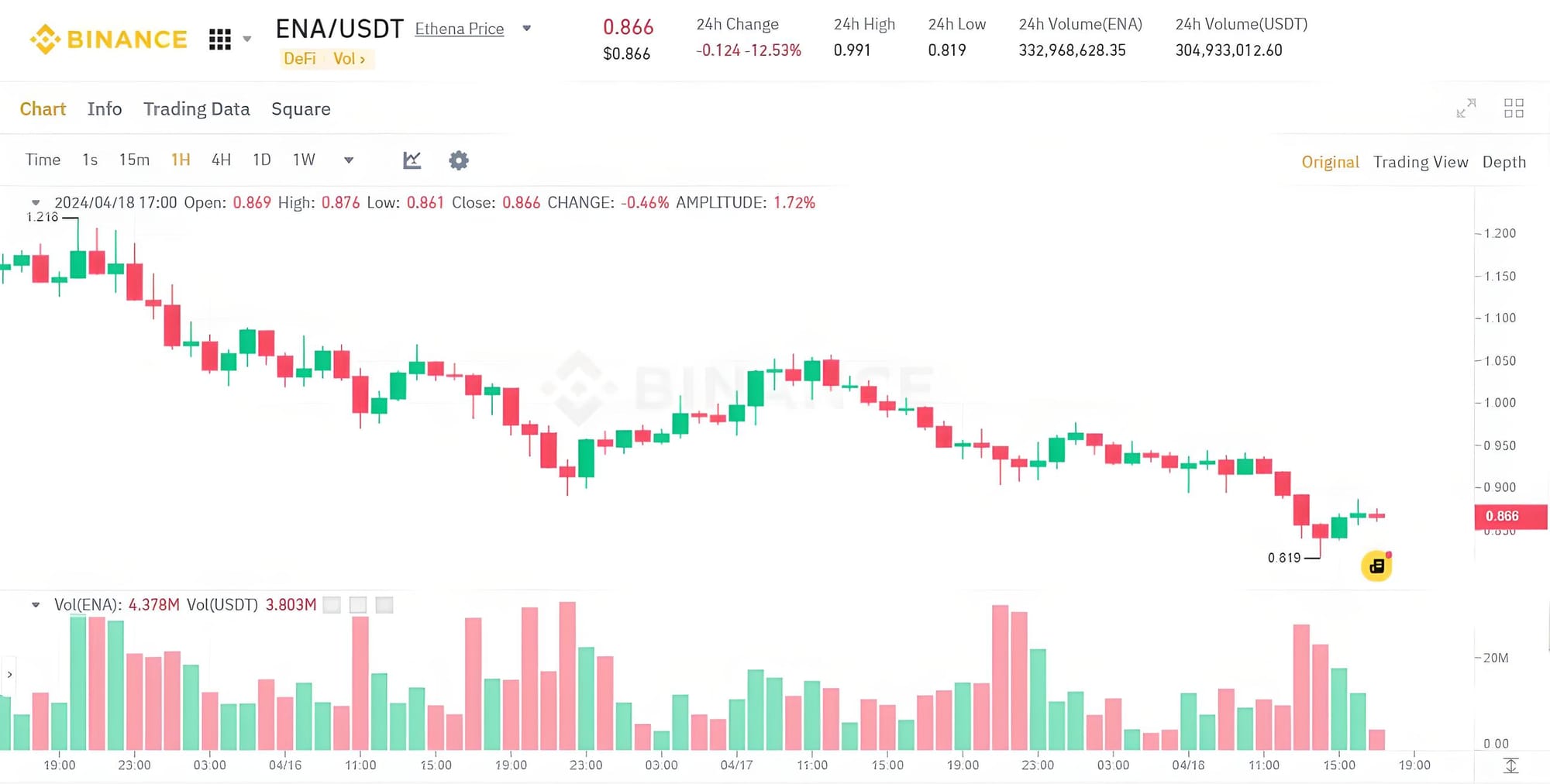

ENA's price is currently around $0.86, having dropped 12% in the past 24 hours.

1-Hour Chart of ENA/USDT on Binance at 05:10 PM on 18/04/2024