Despite Market Turmoil, Whales Bought an Additional $5.4 Billion in Bitcoin in July

According to recent data, addresses holding more than 0.1% of Bitcoin’s supply were actively purchasing Bitcoin, adding up to $5.4 billion in July.

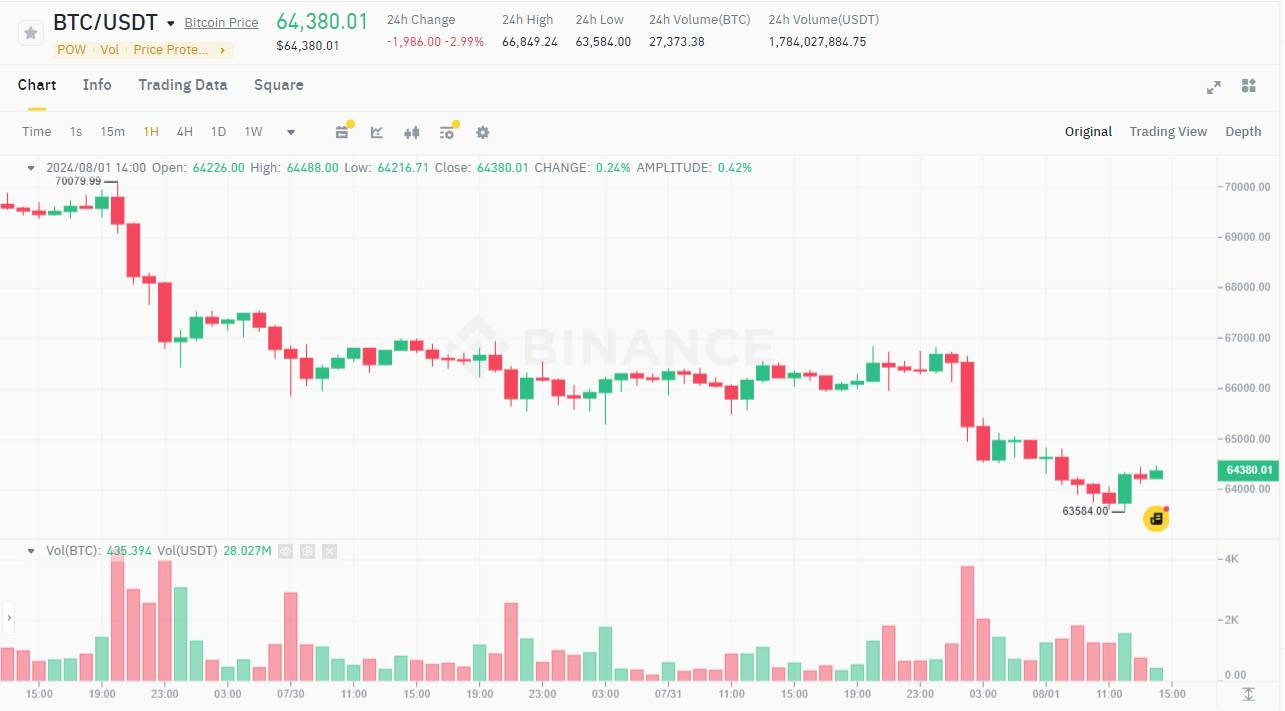

The first day of August saw a dramatic drop in Bitcoin’s price to $63,600 amid news of escalating Middle Eastern conflicts. However, data at the end of July reveals a different story regarding the sentiment of large investors.

Monthly Bitcoin Price Volatility. Source: CoinGlass

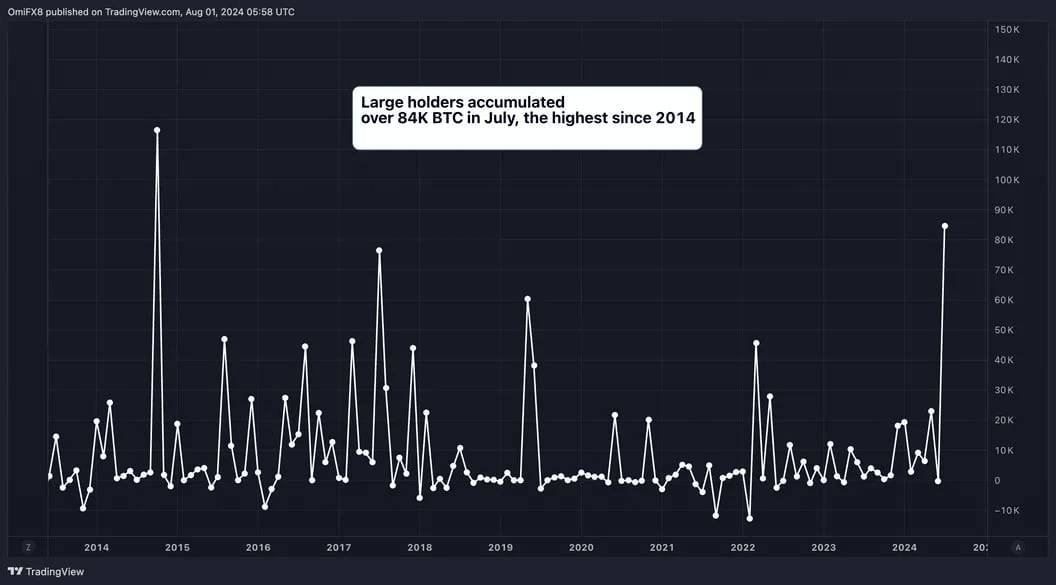

CoinDesk cites data from IntoTheBlock and TradingView showing that addresses owning at least 0.1% of BTC’s circulating supply bought over 84,000 BTC in July. This means whales accumulated a staggering $5.4 billion worth of Bitcoin within just 30 days.

Savvy #BTC traders capitalized on two-way price volatility in July, boosting their coin stash at the fastest pace since 2014. reports @godbole17.https://t.co/XfcPbWCrzB

— CoinDesk (@CoinDesk) August 1, 2024

This represents the largest monthly BTC purchase since October 2014.

Net Inflow in July for Large Wallets. Source: IntoTheBlock, TradingView

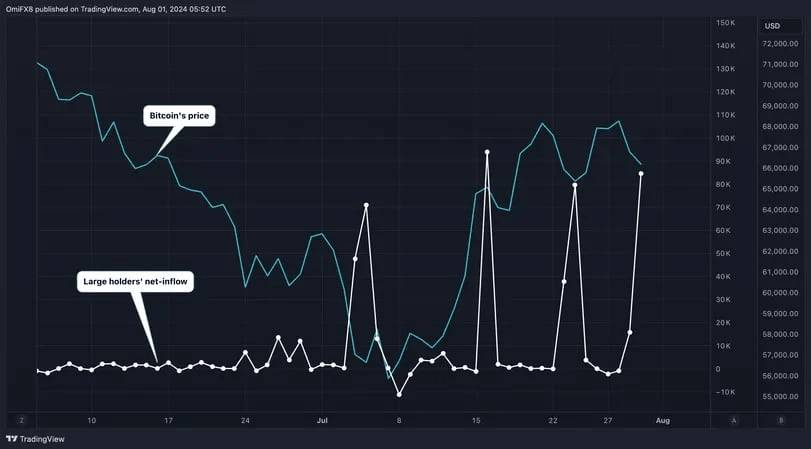

Specifically, large wallets were active in buying during the early July dip below $55,000, triggered by news of the German government selling coins. They ceased accumulation and held their positions as Bitcoin began its recovery, nearing $70,000 by the end of the month.

Whales’ Accumulation Strategy: Buying at Low Prices in July. Source: IntoTheBlock, TradingView

This indicates that these seasoned traders accurately identified the lower price range to buy in, then watched their portfolios grow.

Not only are new holders confident in Bitcoin’s future, but analysts also remain optimistic about price movements going forward.

Jag Kooner, Head of Derivatives at Bitfinex, notes:

“Expectations for a potential interest rate cut in September create a sense of optimism and may increase liquidity in the market, which is beneficial for Bitcoin and other cryptocurrencies. Additionally, this could put upward pressure on BTC and boost ETF inflows as investors seek to capitalize on favorable market conditions.”

Optimism also stems from new capital entering the market through stablecoins pegged to fiat currencies like the USD. As reported by Coin68, the market capitalization of stablecoins has risen to $164 billion, the highest since May 2022.

“This is the highest monthly increase in stablecoin market capitalization since April, indicating new capital inflows into the market, which helps drive up BTC and altcoin prices.”

Furthermore, Kooner emphasizes that the diminishing impact of negative news reinforces investor confidence. Previously, news such as the German and U.S. governments selling coins or Mt. Gox repaying debt caused market upheavals, but subsequent price movements have become much more stable.

“This indicates that the market has partly 'absorbed' the negative news, and such news is no longer causing panic among investors.”

“Currently, the market is very confident, especially as even seemingly negative news like Mt. Gox repayments or German government BTC sales are no longer having a significant impact on BTC prices.”

Meanwhile, BTC’s price slightly recovered to $64,400 by the afternoon of August 1st, after dipping to $63,600 earlier that morning.

1-hour Chart of BTC/USDT on Binance at 02:50 PM on August 1, 2024