Do Ethereum Forks Have the Potential the Community Thinks They Do? What Miners Really Want

Ethereum remains a hot topic in the crypto community after The Merge, as this historic upgrade has inadvertently sparked an intriguing chain-split battle.

Do Ethereum Forks Have Staying Power in the Market – What Are Miners Really After?

Despite a surge in coins that share Ethereum’s mining algorithm following The Merge, miners are still struggling to find a profitable project to transition their operations and cover their mining rig costs.

However, hope for miners was rekindled on the evening of September 15, when the Ethereum Proof-of-Work fork successfully launched, kicking off a race for market share among these blockchains to attract users and miners.

Before diving into the current status of Ethereum forks, it’s essential to understand why miners seem to prefer Ethereum forks over other PoW projects.

Aside from the profit aspect, Ethereum has been a major brand for miners for over seven years, significantly contributing to the ETH network’s power. As a result, miners are keen to find a viable alternative on the Ethereum chain, despite ETH's shift to PoS.

Hashrate and Market Share of Ethereum Forks

The largest and most well-known Ethereum fork is Ethereum Classic (ETC), which currently boasts a hashrate of 263.67 TH/s, the highest in ETC’s history.

Hashrate of Ethereum Classic (ETC) as of 11:54 AM, September 16, 2022. Source: 2Miner

With this hashrate, ETC is trading at around $33.97 at the time of writing, with a market cap of $4.6 billion.

4H Chart of ETC/USDT as of 11:54 AM, September 16, 2022. Source: Binance

Next is EthereumPoW (ETHW) – a fork initiated by the project of the same name to maintain Ethereum’s traditional PoW consensus mechanism. Despite being launched less than 24 hours ago, ETHW’s hashrate is already at a high 73.72 TH/s.

Hashrate of EthereumPoW (ETHW) as of 11:54 AM, September 16, 2022. Source: 2Miner

ETHW’s trading price is around $13.

Price of EthereumPoW (ETHW) as of 11:54 AM, September 16, 2022. Source: CoinMarketCap

Poloniex has renamed #ETHW as @EthereumFair #ETF and resumed the trading of ETF markets (USDT, USDD, ETH) on Sep 15, at 13:15 (UTC).

— Poloniex Exchange (@Poloniex) September 15, 2022

The trading history of ETHW markets is inherited by the corresponding ETF markets.

Details: https://t.co/CobIKrUnfK pic.twitter.com/aTAGWpSqus

Lastly, EthereumFair (ETF) – another PoW fork of Ethereum supported and rebranded by Poloniex.

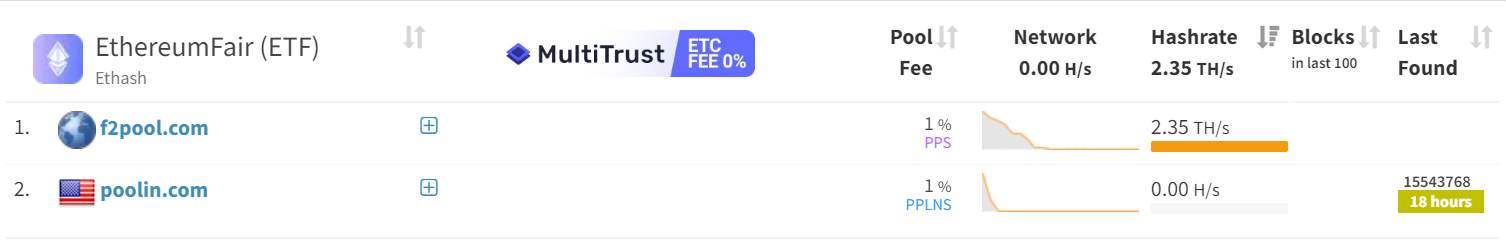

Currently, only two major pools, f2pool and Poolin, are mining EthereumFair, with a hashrate of 3.35 TH/s. However, as of noon on September 16, Poolin withdrew from the mining pool, reducing ETF’s hashrate to 2.35 TH/s.

Hashrate of EthereumFair (ETF) as of 11:54 AM, September 16, 2022. Source: Mining Pool Stats

Despite the decrease in hashrate, ETF’s price has surprisingly risen from a low of $17 to $18.53 over the past 24 hours.

Price of EthereumFair (ETF) as of 11:54 AM, September 16, 2022. Source: CoinMarketCap

What’s Next for Ethereum Forks?

Before Ethereum successfully completed The Merge and fully transitioned away from mining, ETH’s hashrate was at 740.88 TH/s.

Hashrate of Ethereum (ETH) as of 11:54 AM, September 16, 2022. Source: 2Miner

This means that the combined hashrate of the mentioned forks accounts for about 45.8% of Ethereum’s total hashrate. However, in terms of market capitalization, these forks still represent a relatively small portion, around 5% of ETH’s current market cap of $180.7 billion.

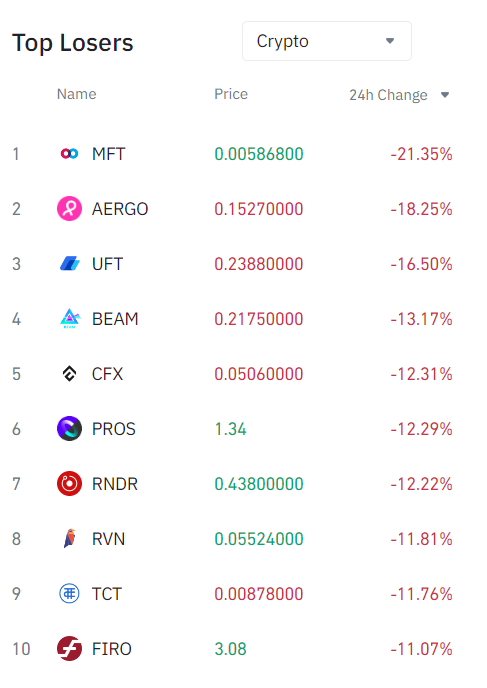

Overall, in terms of hashrate, these ETH forks currently have an edge over coins using the same algorithm as ETH or other PoW consensus mechanisms, such as Ravencoin (RVN), Firo (FIRO), or Conflux (CFX).

This is why, after an initial surge at The Merge, these projects quickly fell in the Binance rankings, giving way to EthereumPoW (ETHW) and EthereumFair (ETF).

Top Gainers and Losers on Binance in the Past 24 Hours. Source: Binance

However, it remains to be seen whether EthereumPoW and EthereumFair will have long-term staying power. A historical parallel can be drawn to Bitcoin, where numerous forks, such as Bitcoin Cash (BCH), initially created a splash but quickly faded.

In another view, the current Ethereum forks might be seen as an opportunity exploited by major organizations, exchanges, and some miners to profit from Ethereum’s Merge. As the market matures, these forks might experience a decline.

Even Ethereum Classic (ETC), the most successful “twin” of Ethereum, faces skepticism regarding its long-term stability due to its limited use cases on the blockchain, potentially becoming a temporary trend or a “safe haven” for miners looking to recoup costs and offload their assets.