dYdX Users Traded $466 Billion in 2022

dYdX, one of the leading derivatives exchanges, had a notably successful year in 2022. But what were the driving factors?

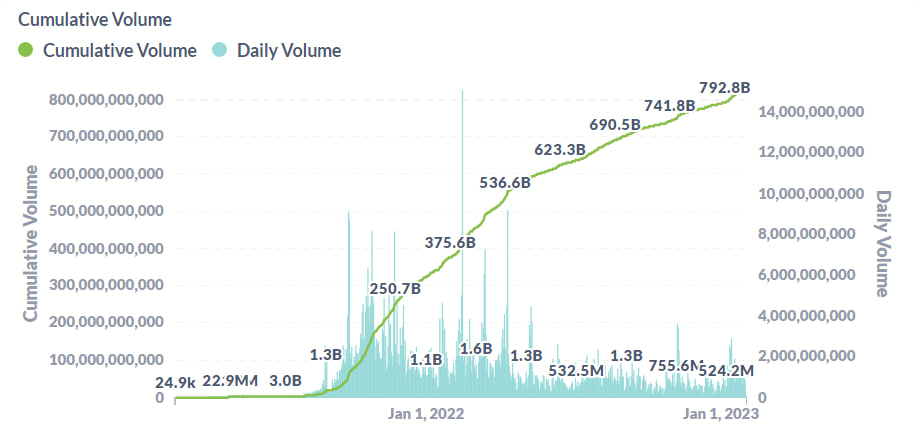

According to the annual report released by the dYdX Foundation on January 31, the platform saw a cumulative trading volume of $466.3 billion and fee revenue of $137.8 million in 2022. This represents a 140% increase in cumulative volume compared to the previous year, which was around $322 billion.

dYdX Foundation is excited to share the inaugural ecosystem annual report 🔥

— dYdX Foundation 🦔 (@dydxfoundation) January 30, 2023

Despite the challenging market conditions in 2022, stakeholders in the dYdX ecosystem persevered and continued to build toward the future of finance - one block at a time 💪🏾https://t.co/NPKPOdEpeG pic.twitter.com/hwz8mgOQOW

Cumulative Trading Volume Increased by 140% Year-over-Year

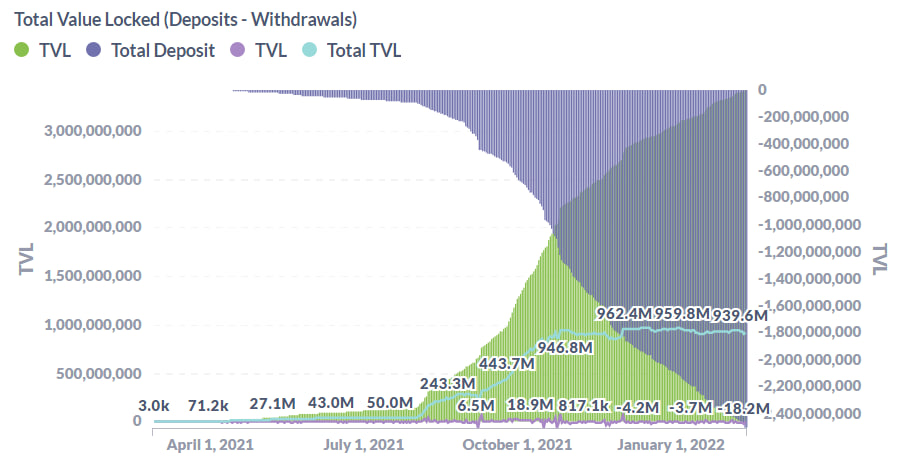

Despite this success, the total value locked (TVL) on the platform has decreased to approximately $400 million from a peak of $1.1 billion in October 2021. These figures indicate that while the TVL has diminished, dYdX users continue to actively engage with the platform.

Total Value Locked (TVL) Reduced to Around $400 Million

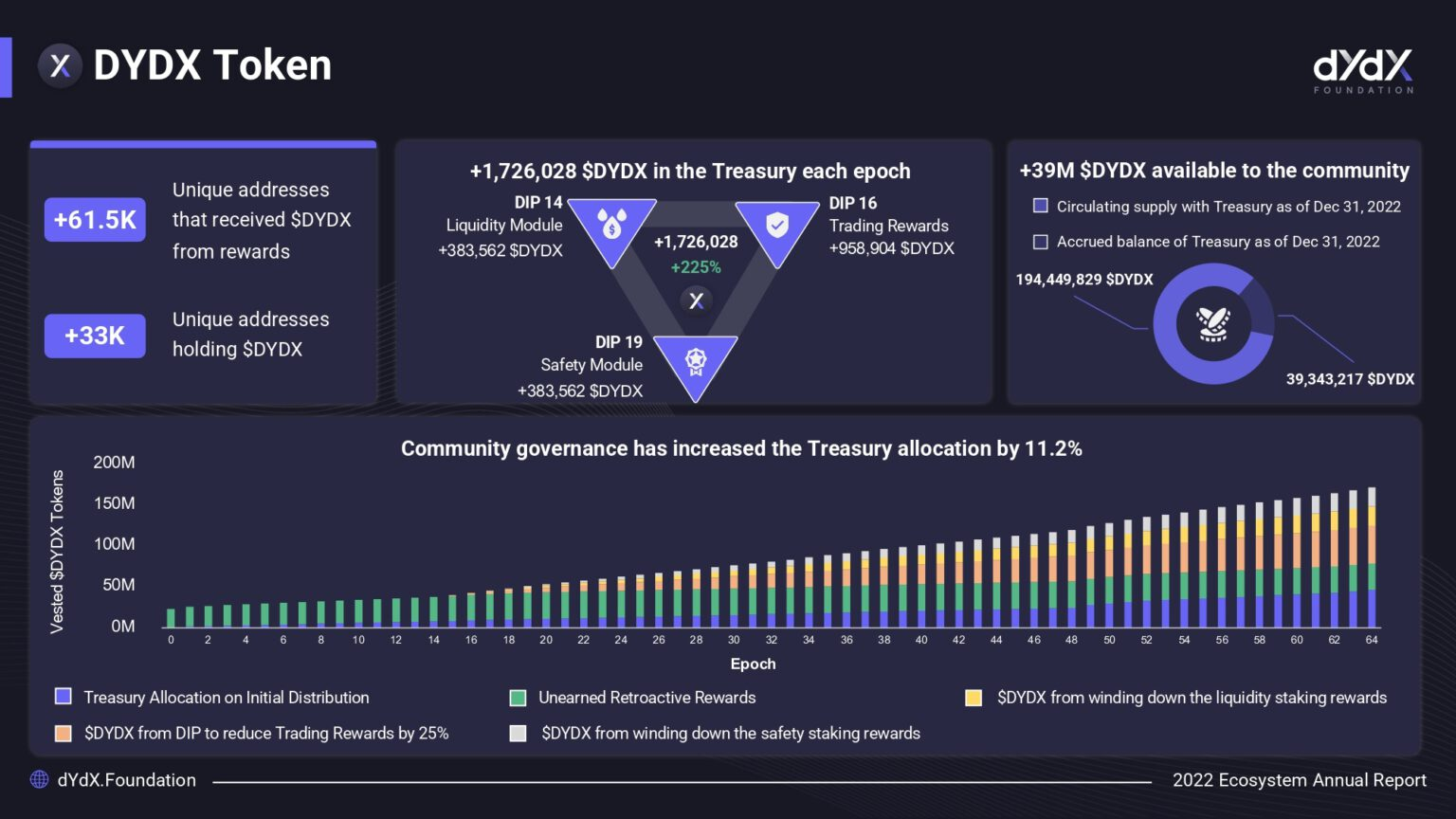

By the end of 2022, over 33,000 unique addresses held DYDX tokens, and the project distributed tokens to more than 61,500 wallets through retroactive rewards, trading, staking, and liquidity mining.

Over 33,000 Unique Addresses Held DYDX Tokens by Year-End

Overall, 2022 was a successful year for not only the parent organization but also for stakeholders such as DAO members, market makers, infrastructure providers, security and audit firms, and research and analysis teams.

In 2022, DeFi proved its resilience and demonstrated clear advantages over CeFi 👊🏾

— dYdX Foundation 🦔 (@dydxfoundation) January 30, 2023

We believe that the following principles are key to the dYdX protocol’s success in the future:

👉🏾 trustless technology,

👉🏾 self-custody, and

👉🏾 decentralization pic.twitter.com/q1nD3gPlZc

However, the inflation of DYDX tokens has raised concerns among speculators. This is due to the planned release of 150 million tokens, valued at over $280 million, to early investors, employees, and project advisors on February 3, 2023.

If this occurs, the circulating supply of DYDX will double from the current 156 million, making early 2023 a particularly “sensitive” period for the token. Additionally, the project plans to unlock more tokens in the following months.

As noted by Coin68, this prominent derivatives platform may announce more significant updates to help stabilize the DYDX price.

Read More: Tokenomics Research #5: DYDX – Necessary Changes to Avoid “Boredom”

Until last week, the dYdX team decided to delay the token unlock schedule until December 2023. By then, the amount of unlocked tokens will reach 400 million DYDX, according to the project.

The token price has surged recently. DYDX experienced rapid growth, temporarily peaking at $3.55 – a level not seen since May 2022. DYDX has risen nearly 35% from the previous day and 104% on a weekly basis.

1D Chart of DYDX/USDT on Binance as of 10:45 AM, February 1, 2023

Currently, dYdX operates on Layer 2 StarkEx but will soon transition to its own blockchain within the Cosmos ecosystem.