Ethena Captures 5.5% of Global Ethereum Perpetual Futures Open Interest

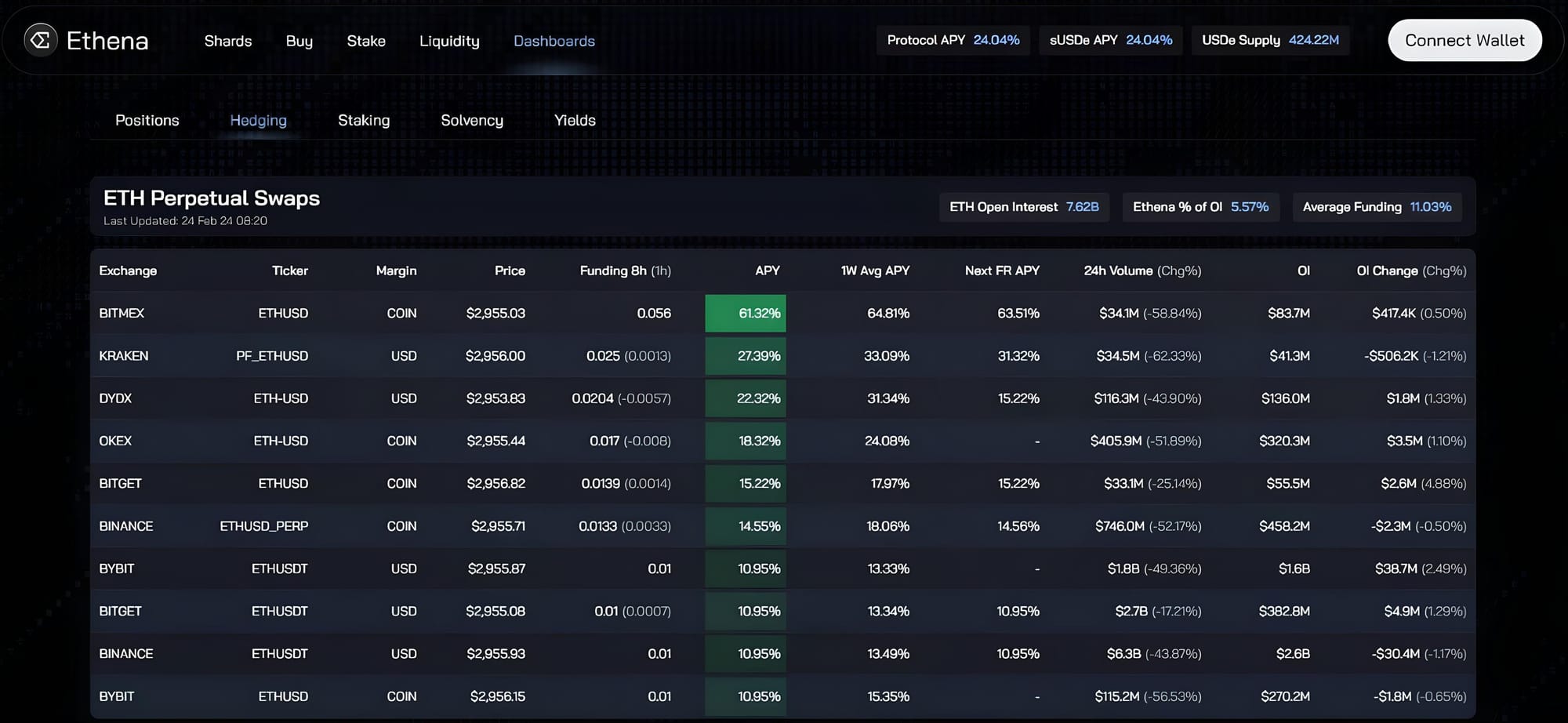

Despite being launched less than three months ago, Ethena, the protocol behind the digital dollar USDe, now holds over 5.5% of the global open interest (OI) in Ethereum perpetual futures contracts.

Understanding Open Interest (OI)

Open interest (OI) measures the total value of all outstanding or "unsettled" futures contracts on exchanges. It is a key indicator of market bullishness and trader sentiment around a specific asset, in this case, Ethereum (ETH).

Ethena's Market Impact

According to data from Ethena, the protocol for issuing the decentralized stablecoin USDe on Ethereum, it currently accounts for more than 5.5% of the global open interest in ETH perpetual futures.

Global Open Interest (OI) in ETH Perpetual Futures by Ethena, February 24, 2024

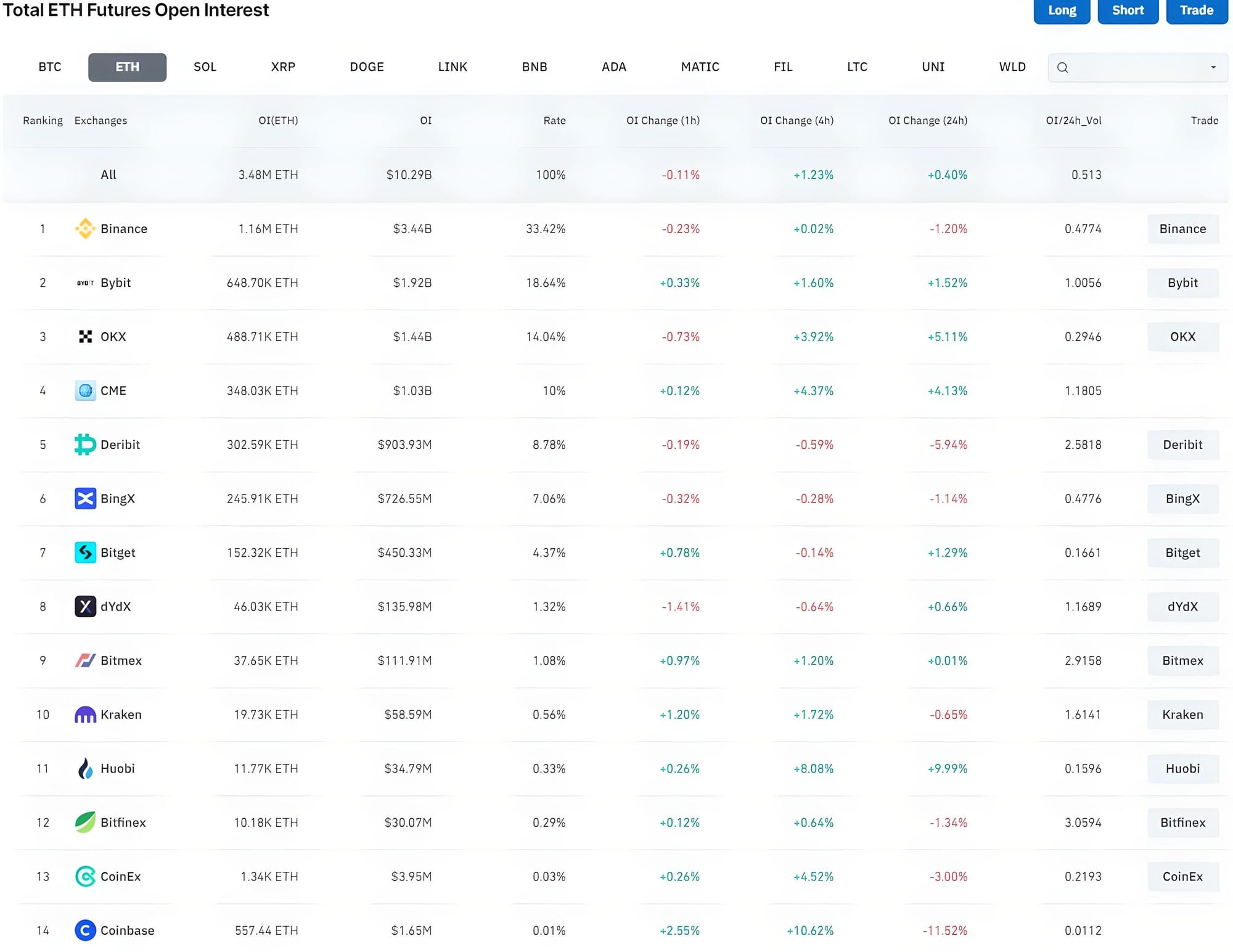

Remarkably, Ethena's OI surpasses that of long-established exchanges offering ETH perpetual futures, such as Bitget (4.37%), dYdX (1.32%), and Bitmex (1.08%).

Open Interest (OI) in ETH Futures Across Global Exchanges, February 24, 2024, by CoinGlass

High Yield Attracts Users

Not only does Ethena command a significant market share, but its yield of up to 24% has also drawn users to mint approximately 424 million USDe tokens to date. Initially, the project planned to offer a 15% yield for the first week to holders, but due to strong community feedback, they increased the yield to 24%, leveraging the assets generated by the protocol instead of allocating a portion for the core team.

Update on sUSDe Payment:

— Ethena Labs (@ethena_labs) February 23, 2024

The team has taken onboard the understandable feedback from the community to correct for it immediately as well as detailing our rational

The full protocol APY attributable to the assets backing USDe in the sUSDe staking contract has been sent

Community Concerns and Clarifications

However, the ease of changing the yield has raised concerns among investors, drawing comparisons to the infamous algorithmic stablecoin LUNA. Ethena's founder, Guy Young, quickly addressed these concerns on Twitter, explaining the rationale behind the yield adjustments and the mechanics ensuring stability and security following the mainnet launch and the introduction of the "Shard" reward program.

Strategic Partnerships and Funding

Ethena Labs, the developer behind Ethena, raised $14 million in a strategic funding round led by Dragonfly and Arthur Hayes' Maelstrom fund, valuing the protocol at $300 million. Ethena also enjoys support from major CEXs like Binance, Bybit, OKX, Deribit, Kraken, and Gemini.

Innovative Stablecoin Approach

Unlike traditional stablecoins such as USDC and USDT, which are backed by USD, USDe is collateralized by Ethereum (ETH) and liquid staking tokens like Lido's stETH. Ethena aims to maintain price stability through a "delta-neutral strategy" on centralized exchanges (CEXs).

To hedge the ETH and derivative tokens held, Ethena takes short positions on ETH futures on CEXs and earns funding fees. This method ensures that any losses or gains from these positions are offset, securing the stablecoin's value. This strategy also explains why Ethena collaborates with CEXs to establish these derivative hedges.

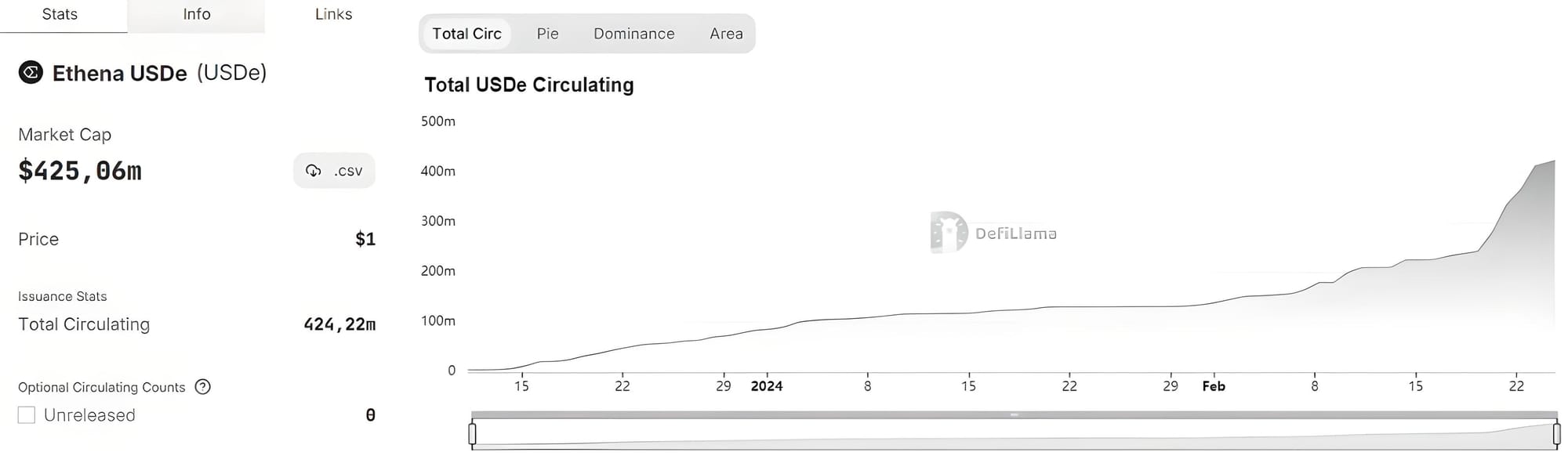

Current TVL

As of this writing, the total value locked (TVL) in USDe has reached an all-time high (ATH) of $425 million, nearly doubling from the previous ATH of $244 million recorded just a week earlier.

Total Value Locked (TVL) in Ethena's USDe Reaches New ATH of $425.06 Million, by DefiLlama

Ethena's rapid growth and substantial market share in Ethereum perpetual futures highlight its innovative approach and the increasing interest in decentralized finance (DeFi) solutions.