Ethena Earns $4 Million for USDe Treasury in Just Two Weeks

The decentralized stablecoin project Ethena (USDe) has generated significant profits by shorting ETH futures and leveraging the rising funding rates over the past two weeks.

Just two weeks after launching its mainnet, Ethena, which issues the decentralized stablecoin USDe on Ethereum, has amassed over $4 million for its treasury. This marks an early milestone for a model that has sparked considerable debate within the crypto community regarding yield generation.

According to @macromate8, Growth Director at Ethena Labs, the treasury has grown from nearly $12 million a week ago to over $16 million, allowing the project to retain $4 million after distributing payouts to users.

Ethena just made $4 MILLION DOLLARS for its treasury in JUST 1 WEEK

— Seraphim (@MacroMate8) March 7, 2024

Tell me, which DeFi product that’s been live for 2 weeks can do that https://t.co/qJQEWJe91K

How USDe Works

USDe is a stablecoin backed by Ethereum (ETH) and liquid staking tokens like Lido's stETH. It maintains its peg to USD by establishing short ETH positions on centralized exchanges (CEX) and earning funding fees through a Delta Neutral model.

Users who stake USDe receive sUSDe, a certified token that provides high yields generated by the protocol. Users can also deposit various stablecoins such as USDT, FRAX, DAI, crvUSD, and mkUSD to receive Ethena's USDe, which can then be staked. The unstaking period is 7 days. Staked USDe can be supplied to other DeFi platforms for additional returns.

Yield Generation Strategy

Ethena Labs ensures that losses or profits from any position can be offset. This strategy is why they partnered with CEXs from the start to facilitate the establishment of derivative hedge positions for ETH.

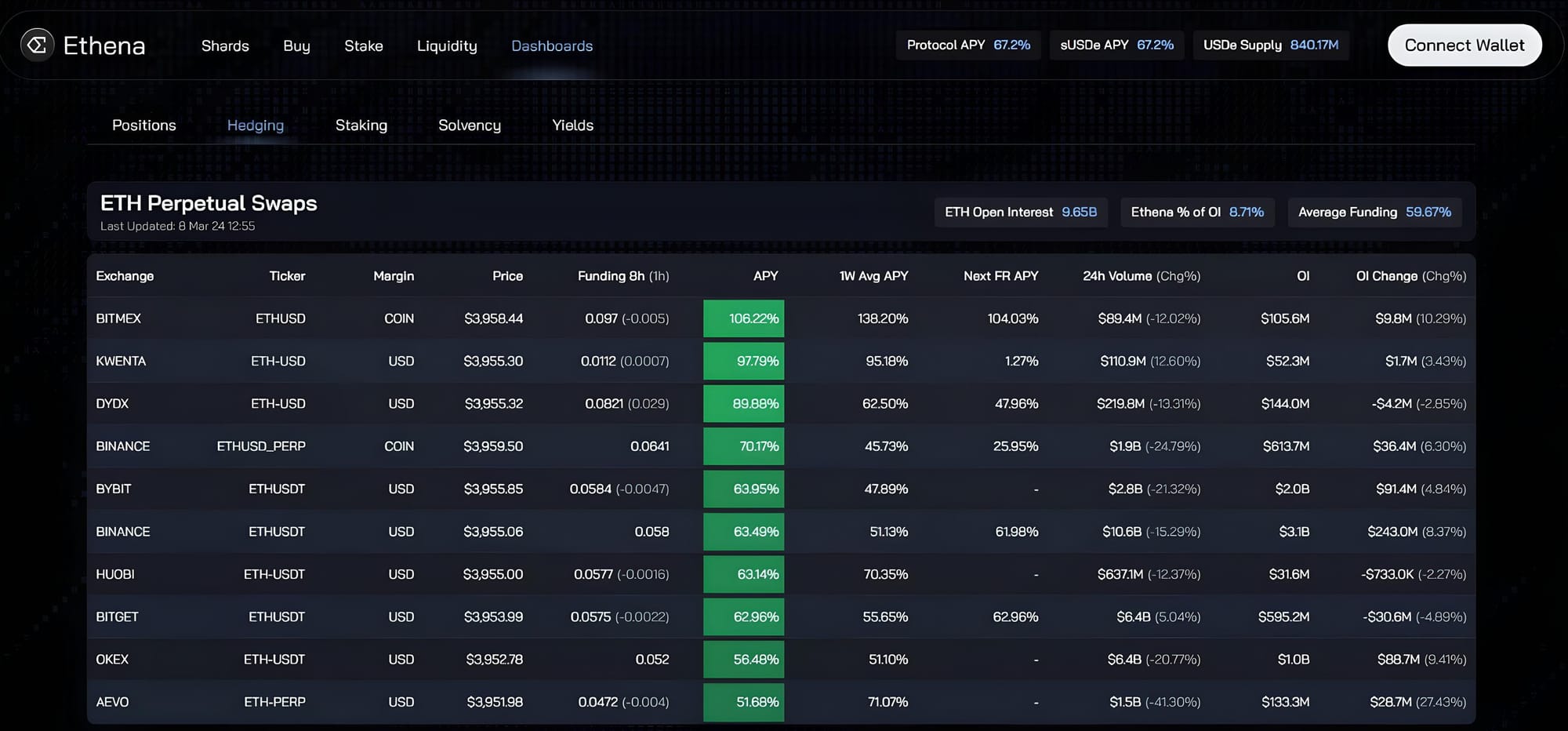

The high yields offered by Ethena primarily stem from funding rates—payments made to traders holding long or short positions in futures contracts. When prices rise, longs pay shorts as they borrow from the market to place larger bets, and vice versa. Investors also earn staking interest on ETH, which is currently around 4% per annum.

Additionally, Ethena's perpetual futures open interest (OI) for ETH represents 8.71% of the global total, up from 5.5% just two weeks ago.

Market Impact and Future Prospects

Defi_Maestro, a prominent DeFi investor, noted that Ethena's revenue ranks among the top 3 DeFi dApps in its first two weeks. He believes that USDe and sUSDe have significant potential for integration into various layer-1 and layer-2 blockchains.

@ethena_labs absolutely chadding

— Defi_Maestro ✺ (@Defi_Maestro) March 8, 2024

+ 2 weeks from launch

+ 3rd highest revenue in Crypto

+ Highest revenue among DeFi Dapps

+ TVL continues to increase

+ Insurance Fund growing as well

+ DeFi Dapps integration on the horizons

+ Various L1 and L2s will be adopting $USDe and $sUSDe… pic.twitter.com/g5gs0XbQnZ

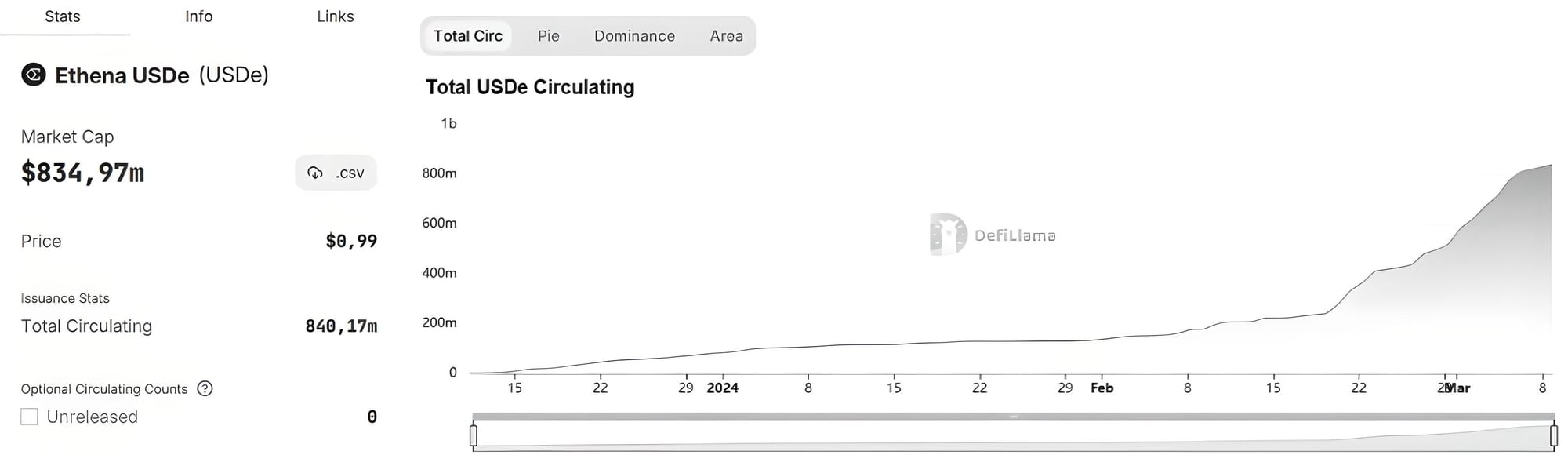

As of this writing, the total value locked (TVL) of the USDe stablecoin has reached a new all-time high (ATH) of $834.97 million, almost doubling the previous ATH of $425 million on February 24, 2024, representing over 300% growth since its launch.

Conclusion

Ethena's innovative approach and strategic partnerships have positioned it as a leading player in the DeFi space, with its USDe stablecoin showing substantial growth and profitability in a short period. As it continues to expand and integrate with other blockchain platforms, Ethena's model could set a new standard for decentralized finance.