Ethena Introduces Bitcoin as Collateral for USDe Stablecoin

Ethena Labs aims to increase the total supply of USDe to 5 billion USD by allowing Bitcoin to be used as collateral for this stablecoin.

Ethena Introduces Bitcoin as Collateral for USDe Stablecoin

In an announcement on the evening of April 4, decentralized stablecoin project Ethena (ENA) revealed that it has begun accepting Bitcoin (BTC) as collateral for USDe, alongside Ethereum (ETH) and ETH liquid staking tokens.

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

— Ethena Labs (@ethena_labs) April 4, 2024

This is a crucial unlock which will enable USDe to scale significantly from the current $2bn supply pic.twitter.com/FOZRWBrVZV

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

This is a crucial unlock which will enable USDe to scale significantly from the current $2bn supply pic.twitter.com/FOZRWBrVZV— Ethena Labs (@ethena_labs) April 4, 2024

As previously reported by Coin68, Ethena has repeatedly mentioned plans to accept BTC as collateral, aiming to attract more capital inflows and increase the USDe supply from 2 billion USD to 5 billion USD in 2024, and eventually to 10 billion USD.

The project's shard rewards program phase 2 is designed to encourage DeFi users to use Bitcoin to mint more USDe. In early April, Ethena airdropped its governance token ENA to users based on their shard rewards from the phase using ETH as collateral.

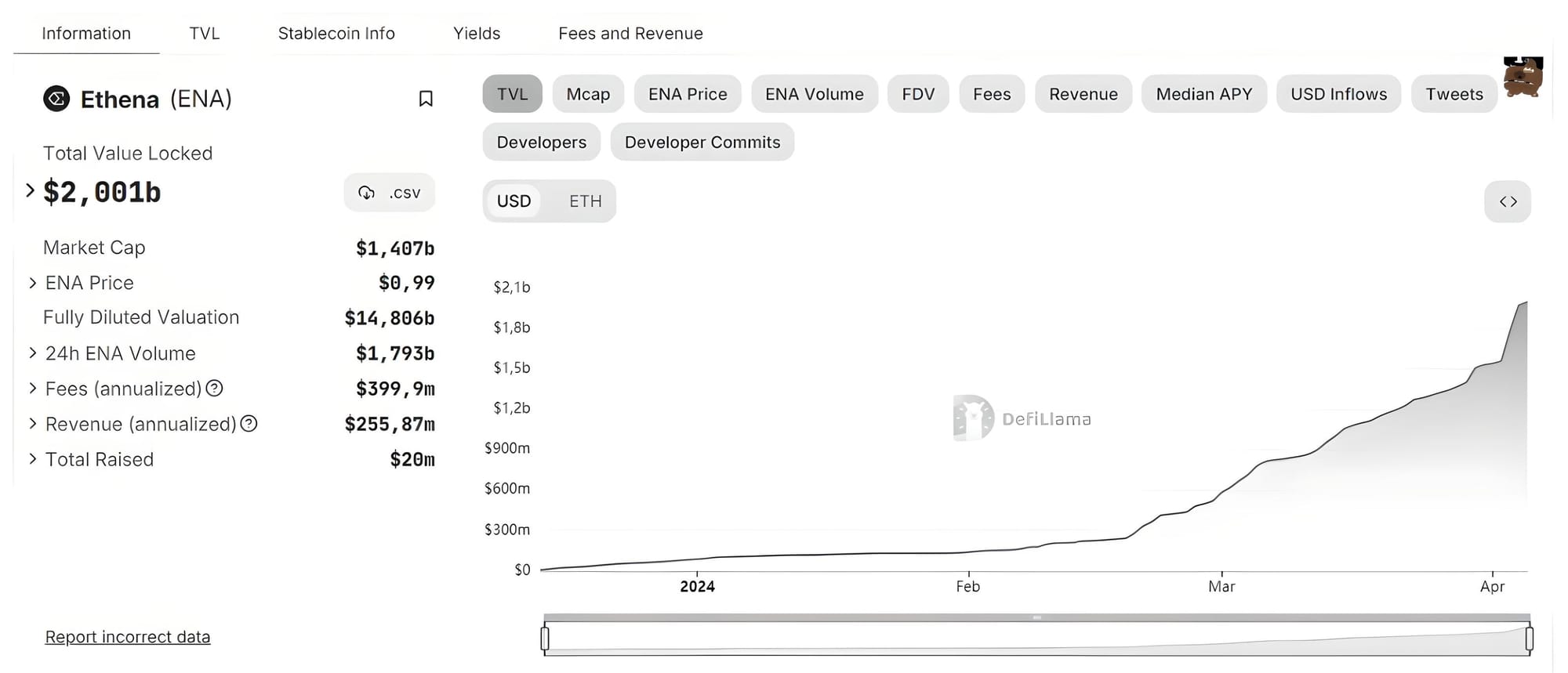

Ethena's TVL Growth. Source: DefiLlama (April 5, 2024)

Ethena claims Bitcoin is one of the most stable and secure assets in the crypto market, thus holding it as collateral brings added security for USDe users.

After the unprecedented growth or USDe since launch, Ethena hedges represent ~20% of ETH open interest as of today

— Ethena Labs (@ethena_labs) April 4, 2024

With $25bn of BTC open interest readily available for Ethena to delta hedge, the capacity for USDe to scale has increased >2.5x pic.twitter.com/glyvBQFEwj

Similar to Ethereum, Ethena will establish short BTC futures positions on major CEXs to minimize depeg risks for USDe in the event of a Bitcoin price drop, implementing a delta hedging strategy. According to Ethena, the open interest for Bitcoin contracts in March reached 24.3 billion USD, 2.4 times that of Ethereum, with Ethena accounting for nearly 20% of it. Ethena believes Bitcoin's open interest is growing faster than Ethereum, facilitating liquidity and sustaining delta-hedging.

BTC funding has also mirrored ETH since 2021

— Ethena Labs (@ethena_labs) April 4, 2024

Interestingly, BTC funding outperformed ETH during the 2022 bear market, where BTC yields were ~2% vs ETH yields of ~0%

In bull markets, ETH funding tends to outperform BTC pic.twitter.com/Kp5TBMnlBE

In just 1 year, BTC open interest on major exchanges (exc. CME) has grown from $10bn to $25bn, while ETH OI has grown from $5 to $10bn

However, Bitcoin's main drawback compared to Ethereum is the lack of staking yields. Thus, USDe holders backed by Bitcoin will only receive funding rate yields from short futures positions. Ethena notes that in a bull market, funding rates for BTC and ETH are attractive enough for investors, averaging over 25%-27% in March, with a general range of 18%-19.7% in the first quarter of 2024.BTC funding has also mirrored ETH since 2021Interestingly, BTC funding outperformed ETH during the 2022 bear market, where BTC yields were ~2% vs ETH yields of ~0%

Ethena's rapid growth has not been universally welcomed by the crypto investment community.

How do they maintain a delta-neutral strategy for $BTC in bear markets? In bull markets, they hold spot BTC and short BTC.

— Ki Young Ju (@ki_young_ju) April 5, 2024

If there's a method to short BTC by holding some DeFi-wrapped BTC, the market size would be smaller than its TVL.

This is a CeFi stablecoin run by a hedge…

Some have compared the project's model to the failed LUNA-UST, pointing out risks associated with relying heavily on futures funding rates, which are favorable only during uptrends. Some critics argue that USDe is essentially a stablecoin issued by a CeFi hedge fund, rather than a true DeFi project.